Table of Contents

ToggleKey Takeaways:

- Bullish Weekly and Technical Patterns: Bitcoin price’s recent surge past $70,000 has formed a “golden cross” on its daily chart, a bullish signal that historically aligns with significant upward trends.

- Whale Accumulation Points to Strong Market Confidence: On-chain data reveals major Bitcoin holders, or “whales,” continue accumulating, with institutional interest growing—a combination that often precedes major price rallies.

- US Macro Events as Price Drivers: Upcoming US economic data and the Fed’s interest rate decision could drive market volatility, with analysts anticipating a possible boost for Bitcoin amid rate cut expectations.

- Record Inflows in Bitcoin ETFs: US-based Bitcoin ETFs have seen unprecedented inflows, underlining growing institutional investment, which strengthens Bitcoin’s support and reinforces its appeal as a mainstream asset.

- Potential for All-Time High: With favorable technical patterns and rising demand, Bitcoin is positioned to retest its $73,000 all-time high, signaling the start of a possible new macro uptrend.

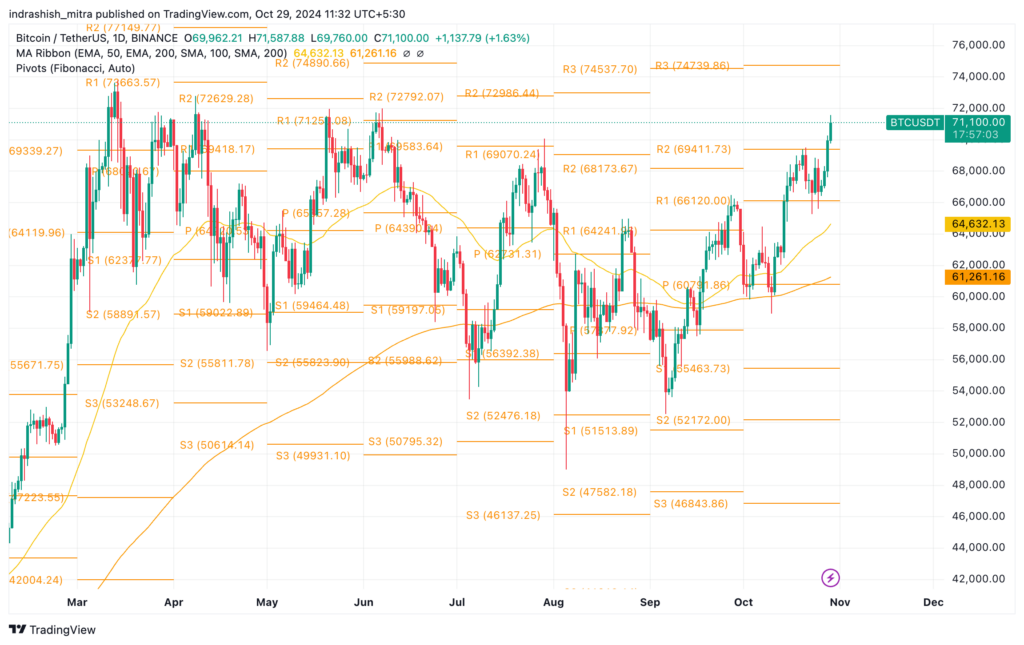

Bitcoin price has exceeded $70,000, reaching a high of $71,000 for the first time in six months. This milestone occurs at a pivotal time as October closes, coinciding with key financial events like the US presidential election and Federal Reserve rate decisions. The market anticipates possible price swings, with $67,000 emerging as a potential retracement level, given its history of acting as a support point. Analysts predict heightened volatility as these events unfold.

Bullish Momentum and Key Technical Patterns

The recent “golden cross” on Bitcoin’s daily chart—a sustained crossing of the 50-day moving average above the 200-day Exponential Moving Averages—signals a possible sustained uptrend. This crossover has previously triggered substantial rallies, raising speculation that Bitcoin might surpass six-figure levels in early 2025 if this pattern continues. A similarly bullish weekly close, locking in a promising level, may further strengthen this upward trajectory.

Institutional Investment and Whale Activity

A rising percentage of Bitcoin holdings among US-based institutions and major wallets is driving further optimism. In recent weeks, wallets holding over 100 BTC have increased, while retail holdings declined slightly. This concentration among larger investors often precedes bullish price action. Additionally, on-chain data indicates “whales” continue accumulating Bitcoin, suggesting a firm belief in its long-term potential. Historically, institutional and whale activity has been a harbinger of price appreciation, with large players taking advantage of market dips for strategic accumulation.

Read more: Bitcoin whale activity hits record high

Macro and Market Influences on Bitcoin Price Trajectory

The US macroeconomic landscape is poised to impact Bitcoin price. Major data releases are expected, including Q3 GDP, job numbers, and inflation indicators like the Personal Consumption Expenditures (PCE) index, seen as critical to the Fed’s interest rate decision. Given that a rate cut is largely anticipated, Bitcoin and other risk assets could respond favorably, with increased investor interest in the asset class as a potential hedge against inflation.

Fed target rate probabilities. Source: CME Group / CoinTelegraph

ETF Inflows and Their Effect on Bitcoin Price

Recent inflows into US-based Bitcoin exchange-traded funds (ETFs) have added another layer of support to Bitcoin price rally. Data reveals that Bitcoin ETFs have attracted more than $22 billion in total net inflows, emphasizing the growing institutional interest in regulated Bitcoin exposure. The increase in Bitcoin ETF demand signals not only heightened institutional engagement but also mainstream acceptance of Bitcoin as a significant investment asset.

Read: Bitcoin price prediction

Volatility Ahead as November Approaches

With the US presidential election and other key events fast approaching, Bitcoin’s market outlook remains mixed. While some anticipate corrections, market sentiment largely leans toward a continued bullish trajectory. The end of October marks a time when traders and investors may seize the opportunity to buy Bitcoin as it approaches critical resistance levels. As volatility rises, the community is watching closely for potential pullbacks to buy Bitcoin at favorable prices, betting on further upward momentum through November and beyond.

Bitcoin’s Growing Appeal and Potential for a New All-Time High

Bitcoin’s recent upward movement has placed it on the edge of a new macro uptrend, one that could see it test all-time highs around $73,000. Many investors view current price levels as a strategic entry point, especially given Bitcoin’s performance history following periods of sustained accumulation by major holders. Should this pattern hold, Bitcoin could break past resistance levels in the near term, supported by institutional demand, ETF growth, and favorable macroeconomic factors.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more