Table of Contents

ToggleKey Takeaways:

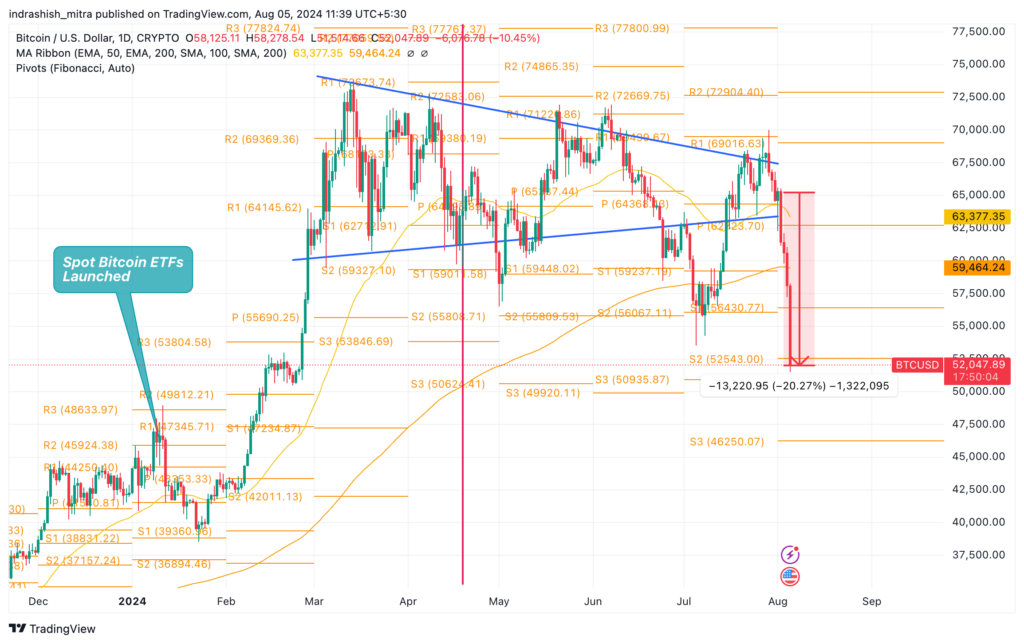

- Largest 3-Day Sell-Off in a Year: The crypto market experienced its most significant three-day sell-off in a year, losing approximately $500 billion from August 2 to August 5, driven by weak employment data and renewed recession fears.

- Impact on Major Cryptos: Bitcoin and Ether saw dramatic price drops, with Bitcoin falling 10% and Ether 18% within two hours. Over the week, Bitcoin fell by 20% and Ether by 28%, reflecting substantial market volatility.

- Role of Jump Crypto: The trading firm Jump Crypto significantly contributed to the market decline by offloading hundreds of millions of dollars in assets, intensifying the sell-off and increasing market instability.

- Leveraged Long Positions Liquidated: The market downturn led to over $600 million in leveraged long positions being wiped out, with Bitcoin and Ethereum longs experiencing significant liquidations, highlighting the risks associated with leveraged trading.

- Broader Market Influence: The sell-off in the crypto market paralleled a significant decline in the Japanese stock market, which dropped 7.1% following an interest rate hike by Japan’s central bank, indicating broader economic factors at play.

The crypto market has experienced its most significant three-day sell-off in the past year, shedding approximately $500 billion since August 2. This steep decline coincided with weak employment data and revived fears of a recession, mirroring a downturn in the equities market. The S&P 500 fell by as much as 4.4% during the same period, influenced by disappointing Q2 results from major companies like Microsoft and Intel and concerns about potential rate cuts in September.

Key Factors Behind the Crypto Market Downturn

Several factors have contributed to the crypto market’s recent turmoil. The poor performance of major tech stocks, combined with the broader economic uncertainty, has driven a significant sell-off. Companies like NVIDIA have faced market pressures due to anticipated rate cuts, leading investors to shift their capital into smaller, less prominent companies. This movement has not spared the crypto market, which has felt the brunt of these economic shifts.

Impact on Major Cryptos: Bitcoin and Ethereum

The leading cryptos, Bitcoin price, and Ethereum price, have been hit hard by the market downturn. As of August 5, Bitcoin price and Ethereum price plummeted by 10% and 18%, respectively, within just two hours. Over the past week, Bitcoin price has dropped by 20%, and Ether by 28%. The last time the market saw such a sharp decline was in mid-August 2023.

Solana (SOL) price, another significant player in the crypto market, has suffered the most among the top ten cryptos, falling by 30.6% since July 30. The Crypto Fear and Greed Index, which gauges market sentiment, has reverted to “fear” with a score of 26, reflecting the growing apprehension among investors.

Jump Crypto’s Role in Bitcoin Crash

Jump Crypto, a prominent trading firm, has been identified as a key player in the recent sell-off. According to data from Arkham Intelligence, Jump Crypto has offloaded hundreds of millions of dollars in assets, exacerbating the market decline. This mass selling has contributed significantly to the market’s volatility, leading to a rapid decline in crypto asset prices.

Read On: Bitcoin Price Prediction

Bitcoin’s CME Gap and Market Sentiment

The recent Bitcoin sell-off has driven Bitcoin into its CME Gap, a term referring to the price difference between Bitcoin futures contracts’ closing price on Friday and the opening price on Monday. Keith Alan, co-founder of Material Indicators, noted that Bitcoin price could only fill this gap during traditional financial trading hours. This technical aspect has added to the market’s uncertainty, with investors closely watching Bitcoin price performance in the coming days.

Know More: Ethereum Price Prediction

Leveraged Long Positions Wiped Out

The sudden nosedive in the crypto market has also led to significant liquidations of leveraged long positions. Over $600 million in leveraged long positions were wiped out, with $231 million in Bitcoin longs and $256 million in Ethereum longs forcibly closed. CoinGlass data reveals that the total liquidations across the crypto market exceeded $740 million in the last 24 hours alone.

Conclusion

The recent $500 billion plunge in the crypto market highlights the sector’s inherent volatility and its sensitivity to broader economic factors. As Bitcoin, Ether, and other major cryptos navigate these turbulent times, investors are urged to stay informed and exercise caution. The upcoming weeks will be crucial in determining whether the market can stabilize and regain its footing amid the prevailing economic uncertainties.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more