Table of Contents

ToggleKey Takeaways:

- Federal Reserve’s 25-Basis-Point Rate Cut: The Federal Reserve’s recent decision to reduce interest rates by 25 basis points aims to sustain economic stability amid uncertain market conditions, creating a favorable environment for risk assets like Bitcoin.

- Bitcoin Achieves New All-Time High: Following the Fed’s announcement, Bitcoin price surged to nearly $76,900, underscoring its role as a valuable hedge against inflation and economic fluctuations in uncertain times.

- Crypto Market’s Positive Reaction: Major cryptos, including Ethereum and Solana, saw significant price increases, demonstrating investor confidence and a bullish trend across the broader crypto market.

- Real-World Asset Tokens Lead Gains: Tokens related to real-world asset (RWA) protocols outperformed the market, achieving an 11% increase, further highlighting the potential of asset-backed crypto in periods of economic uncertainty.

Read: Top RWA Tokens - Future Rate Decisions Remain Data-Dependent: Fed Chair Jerome Powell emphasized that future rate cuts or hikes will rely on economic data, maintaining a cautious approach that keeps investor interest in Bitcoin strong.

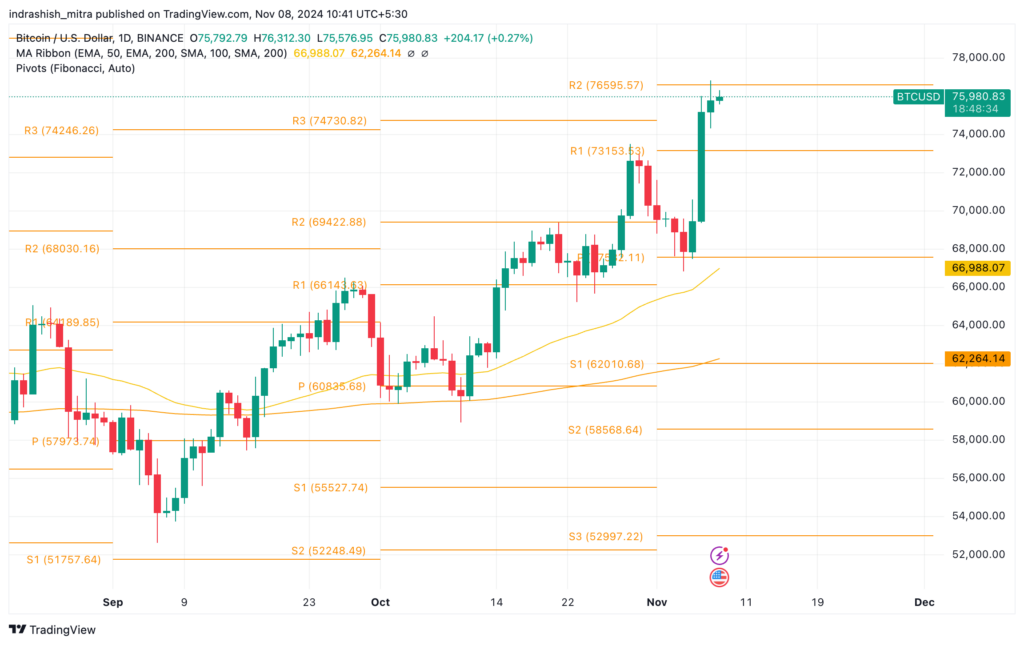

The Federal Reserve’s decision to cut interest rates by 25 basis points on November 7, 2024, has sent ripples across the financial landscape, propelling Bitcoin price to reach a new all-time high (ATH) near $76,900. This latest Federal Open Market Committee (FOMC) move lowers the federal funds rate to a range of 4.5% to 4.75%, aimed at maintaining economic stability amidst an uncertain outlook. The rate reduction reflects the Fed’s ongoing efforts to balance employment and inflation goals, contributing to a bullish sentiment in both the crypto and equities markets.

Fed’s Decision and Its Implications

In their unanimous vote, Federal Reserve officials approved this quarter-point cut following a larger reduction in September. According to the Fed’s statement, the committee acknowledges the current risks in achieving its employment and inflation mandates, with labor market conditions easing moderately and inflation showing gradual progress toward the central bank’s 2% goal. However, Fed Chair Jerome Powell expressed cautious optimism, highlighting that economic activity is expanding, albeit under uncertain conditions.

The crypto community has closely followed the Fed’s actions due to their significant impact on digital assets. Lower interest rates tend to weaken the US dollar, which often drives investors toward assets with inflation-hedging properties, including Bitcoin.

Bitcoin Price Reaction: New ATH Near $76,900

Bitcoin price ascent to nearly $76,900 demonstrates the crypto’s growing appeal as a hedge against inflation and economic uncertainty. Market analysts suggest that this bullish move reflects broader confidence in Bitcoin as the leading digital store of value, rivaling traditional assets like gold. Ethereum (ETH) and Solana (SOL) also showed notable gains following the Fed’s announcement, indicating increased investor interest across the crypto sector.

Read: Bitcoin vs Gold

In addition to Bitcoin price rise, tokens associated with real-world assets (RWA) protocols also outperformed, surging by 11% over the past 24 hours, surpassing the market average of 2.3%. Meanwhile, the total crypto market capitalization is now approaching $2.7 trillion.

Broader Market Reactions: Stocks and Real-World Asset Tokens

The impact of the Fed’s announcement extended to the US equities market, with the S&P 500 and Nasdaq indexes both rising by 0.9% and 1.62%, respectively. Notably, these gains preceded the rate decision, reflecting investor confidence in the Fed’s measured approach to rate adjustments.

This coordinated response from both crypto and traditional financial markets suggests that the rate cut was largely anticipated, contributing to minimal volatility in the immediate aftermath of the announcement. The Fed’s stance on future decisions also highlights a data-dependent approach, with Powell emphasizing that rate policy adjustments will hinge on economic indicators and the evolving labor market landscape.

Outlook for Bitcoin Price and Crypto Markets

With the Fed’s rate cut now official, the crypto market is likely to see continued positive momentum. Bitcoin price’s position near its ATH has strengthened its reputation as a hedge against fiat currency fluctuations, a characteristic that becomes especially appealing during periods of economic uncertainty.

As the Fed remains cautious, the prospect of further rate adjustments could further fuel demand for digital assets. Investors will be watching closely as macroeconomic data unfolds, given that persistent inflation or labor market shifts could prompt additional rate cuts, which might bolster Bitcoin price rally.

In conclusion, the latest Fed decision has catalyzed significant growth across crypto markets, with Bitcoin price’s new ATH capturing global attention. As investors increasingly view Bitcoin as a reliable store of value, its position in the broader financial landscape is poised to grow even stronger in the coming months.

Source: Crypto Slate / CNBC

Related posts

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more

Senator Lummis Pushes for US Strategic Bitcoin Reserve as Trump Wins 2024 US Election

US could lead globally by establishing Bitcoin as a reserve asset.

Read more