Table of Contents

ToggleKey Takeaways:

- Bitcoin Price Drop: Bitcoin price fell below $65,000 after the US Federal Reserve decided to maintain current interest rates and amid escalating tensions in the Middle East.

- Fed’s Interest Rates Decision: The Federal Open Market Committee left interest rates unchanged at 5.25% to 5.5%, with Fed Chair Jerome Powell noting a solid economic pace and significant reduction in inflation.

- Market Reactions: Following the Fed’s announcement, Bitcoin price briefly dipped to $64,200 as of writing and continued to hover around that, marking its lowest level since July 25.

- Middle East Conflict Impact: Reports of the assassination of Hamas leader Ismail Haniyeh in Tehran contributed to the market’s volatility, similar to previous Bitcoin price drops linked to Middle East tensions.

- September Rate Cut Speculation: Market observers remain optimistic about a potential rate cut in September, contingent on upcoming inflation data, which could positively impact Bitcoin price and other cryptos.

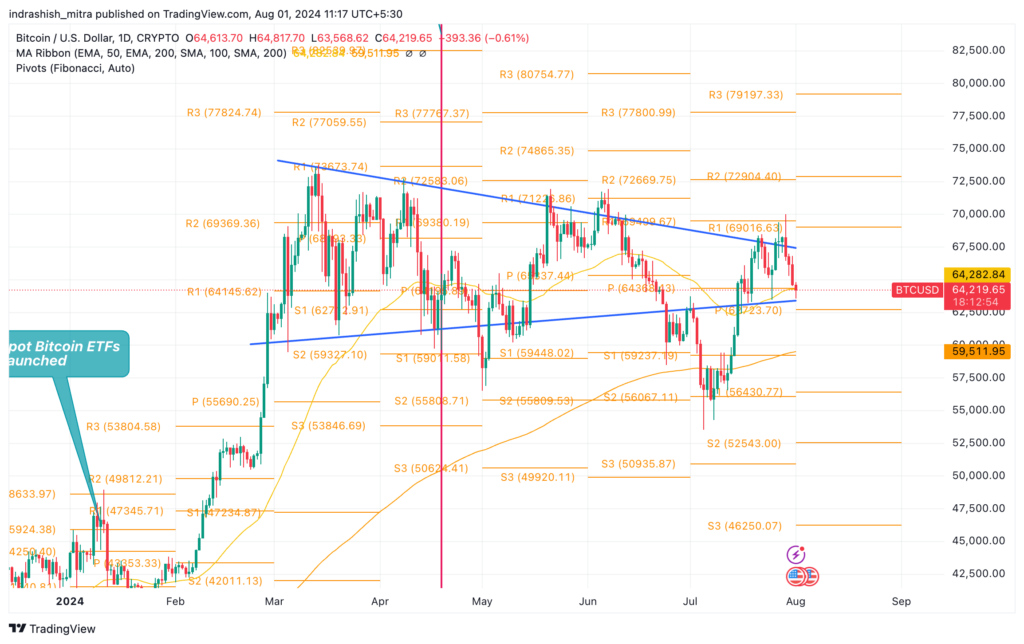

Bitcoin price has slipped below the critical $65,000 mark following the US Federal Reserve’s decision to maintain interest rates and rising geopolitical tensions in the Middle East. On July 31, Bitcoin fell to $63,500, marking the first time it dropped below $65,000 since July 25. Despite a brief recovery to $65,075, the crypto quickly dipped again, stabilizing around $64,200.

Impact of Federal Reserve’s Decision

The Federal Open Market Committee (FOMC) announced its decision to keep interest rates steady at 5.25% to 5.5%. This move was widely anticipated by the market. Federal Reserve Chair Jerome Powell commented on the economy’s solid pace of growth and positive indicators for GDP and Private Domestic Final Purchases (PDFP). However, he noted that consumer spending growth has slowed, aligning with the Fed’s strategy to manage inflation.

“Inflation has eased substantially from a rate of 7% to 2.5%. We are strongly committed to returning inflation to our 2% target to support a strong economy that benefits everyone,” Powell stated in his July 31 speech.

Prior to the FOMC announcement, market expectations were that rates would remain unchanged until September. Powell’s remarks hinted at the possibility of a rate cut in September, contingent on further declines in inflation over the next two months.

Market Reaction and Analysis

Bitcoin price drop coincided with broader market reactions to the Fed’s policy stance. The relative strength index (RSI) for Bitcoin indicates that it is now in an oversold position, which some analysts see as a potential buy signal. A pseudonymous crypto commentator, Seth, pointed out, “The FOMC is used to liquidate Degen Retails that don’t know how to trade and use way too high leverage,” in a July 31 post on X.

Geopolitical Tensions

The decline in Bitcoin price also follows reports of escalating tensions in the Middle East. According to a Reuters report on July 31, Hamas leader Ismail Haniyeh was assassinated in Tehran, Iran. Historical data suggests that Bitcoin prices often react negatively to rising geopolitical tensions. For instance, on April 19, reports of explosions at Isfahan airport in central Iran led to a 5.44% drop in Bitcoin price within two hours.

Future Outlook for Bitcoin Price

Observers remain optimistic about a potential rate cut in September. The Kobeissi Letter noted, “While Fed Chair Powell has not confirmed a September rate cut, he sounds more optimistic. Ultimately, the Fed awaits the next two months of inflation data. Further declines in inflation open the door for a September cut.”

Mark Zandi, Moody’s Analytics chief economist, expects the inflation data to align with the Fed’s forecasts, making a rate cut in September likely. “The inflation data must cooperate for the Fed to follow through, but all indications are that it will. Global investors are cheered by this – stocks are up a lot and bond yields are down,” Zandi wrote.

Market Sentiment On Bitcoin Price

Michael van de Poppe, founder of MN Trading, believes Powell’s dovish tone is positive for Bitcoin price and altcoins. Despite the current dip, the market sentiment is cautiously optimistic, driven by the potential for a September rate cut and the overall easing of inflation.

In conclusion, Bitcoin price’s recent slip below $65,000 can be attributed to the Federal Reserve’s decision to hold rates steady and geopolitical tensions. However, with signs pointing to a potential rate cut in September and ongoing positive economic indicators, the outlook for Bitcoin and the broader crypto market remains cautiously optimistic.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more