Table of Contents

ToggleKey Takeaways:

- Bitcoin Faces Market Pressure Amid Global Uncertainty: Bitcoin price’s recent drop reflects growing concerns over a potential global recession, driven by weakened economies in Europe and escalating conflicts in the Middle East.

- AI Bubble Speculation Adds to Market Instability: Rising fears around a potential bubble in the AI sector are causing investors to reconsider their positions, as inflated AI subscription costs and declining revenue forecasts could trigger a tech market downturn.

- US Economic Outlook Clouds Investor Confidence: Worries about slowing US economic growth and a tight labor market have dampened stock market performance, directly affecting Bitcoin price’s short-term price due to its correlation with the equity markets.

- European Economic Woes Compound Bitcoin’s Challenges: Major European economies, particularly Germany, are showing signs of stagnation, with significant industries implementing cost-cutting measures, adding to global market fears and reducing risk appetite.

- Rising Geopolitical Tensions Further Unsettle Markets: Escalating tensions in the Middle East and concerns over rising oil prices are pushing inflation fears higher, making it harder for central banks to lower interest rates, contributing to Bitcoin price’s struggle to sustain bullish momentum.

Bitcoin price has recently faced a significant decline, triggered by a convergence of global economic factors, rising concerns over a potential AI market bubble, and escalating geopolitical tensions. As the world grapples with economic uncertainties, investors are shifting focus away from riskier assets like Bitcoin, opting for safer investment options such as government bonds and cash. This trend is not limited to cryptos, as other major markets also display signs of turmoil, driven by weak economic growth in key regions and heightened global conflict.

Global Economic Outlook Adds Pressure on Bitcoin Price

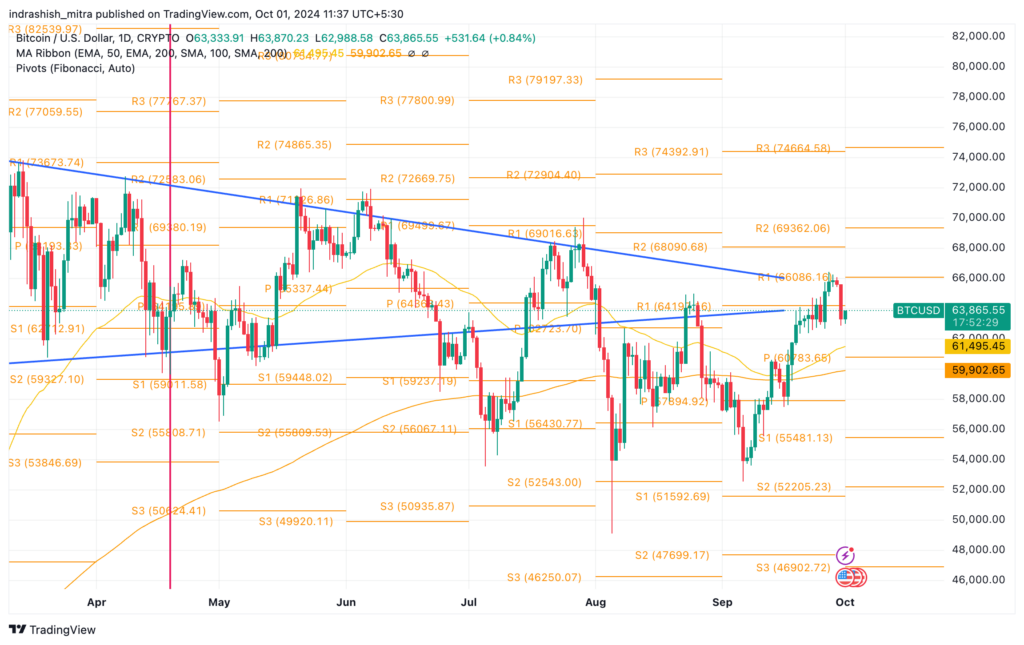

The broader macroeconomic environment plays a significant role in Bitcoin price’s recent correction. Bitcoin price dropped by 4.1% on September 30, retesting the $63,500 support level and erasing the previous five days’ gains. Although the dip caused less than $40 million in liquidations, suggesting some resilience among traders, the market sentiment remains clouded by global economic woes.

In the United States, investors are closely monitoring Federal Reserve Chair Jerome Powell’s comments on the economic outlook, with particular attention to the US labor market, a critical factor influencing broader market conditions. Concerns about slowdowns in the services and manufacturing sectors further contribute to the uncertainty surrounding the economy. Given Bitcoin’s high correlation with traditional markets, any signs of economic weakening in the US are likely to drag BTC price down.

Analysts have also pointed out a potential bubble in the artificial intelligence (AI) sector. With a surge of investment in AI, there is growing speculation that the sector might face a major correction. If such a downturn materializes, panic selling could spill over into other markets, including crypto, where Bitcoin is viewed as a high-risk asset.

Read: Top AI Tokens in 2024

AI Bubble Fears Impact Broader Market Sentiment

A key element driving market anxiety is the potential for an AI bubble to burst. Mike Fishbein, author of the “AI Marketing Brief,” highlights that the cost of utilizing large language models (LLMs) such as ChatGPT, Gemini, and Copilot has significantly dropped. However, companies continue to charge high subscription fees for AI services, leading to fears that customers will eventually push back against inflated pricing. If AI revenues decline, the resulting financial strain could ripple across the tech sector, causing investors to flee to safe-haven assets like cash and government bonds.

This AI bubble speculation, combined with Bitcoin’s sensitivity to broader market shifts, has fueled concern that crypto prices will remain under pressure in the near term. As investors become increasingly wary of high-risk assets, Bitcoin’s status as a “risk-on” investment could lead to further sell-offs if broader market sentiment deteriorates.

Read: When will crypto market bull run begin?

Weakening European Economies and Middle East Tensions Exacerbate Downturn

In addition to US economic concerns, Europe’s economic outlook has also deteriorated, weighing on Bitcoin price movement. Stellantis, a major European automaker, recently revised its profit outlook downward, causing a sharp 14% drop in its stock. Volkswagen has also been grappling with economic challenges, considering factory closures in Germany for the first time in nearly 90 years. With Germany expected to face stagnant or negative economic growth in 2024, alongside weak demand from China, European markets are displaying increasing signs of fragility.

The situation is further complicated by rising tensions in the Middle East, particularly following attacks in Lebanon. Any escalation in the region could lead to higher oil prices, fueling inflation and limiting the US Federal Reserve’s ability to cut interest rates further. In such a scenario, Bitcoin and other risk assets could see reduced demand as investors flock to more stable options.

Bitcoin’s Short-Term Outlook: Uncertainty Prevails

While Bitcoin price’s long-term fundamentals remain strong, the current macroeconomic environment introduces significant uncertainty. The combination of global economic slowdown, fears of an AI market correction, and geopolitical instability presents a challenging backdrop for Bitcoin to regain its bullish momentum.

In the near term, traders are increasingly cautious, moving away from cryptos and toward safer assets. With central banks facing limitations in their ability to lower interest rates and the broader global economy showing signs of strain, Bitcoin’s price may struggle to break out of its current downtrend.

Conclusion: Navigating a Volatile Landscape

Bitcoin price’s recent decline underscores the impact of global economic and geopolitical factors on the crypto market. As recession fears and AI bubble concerns weigh on investor sentiment, risk assets like Bitcoin are seeing reduced demand. While the long-term potential for Bitcoin price remains promising, traders and investors must navigate the volatile short-term environment, characterized by uncertainty and shifting market dynamics.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more