Table of Contents

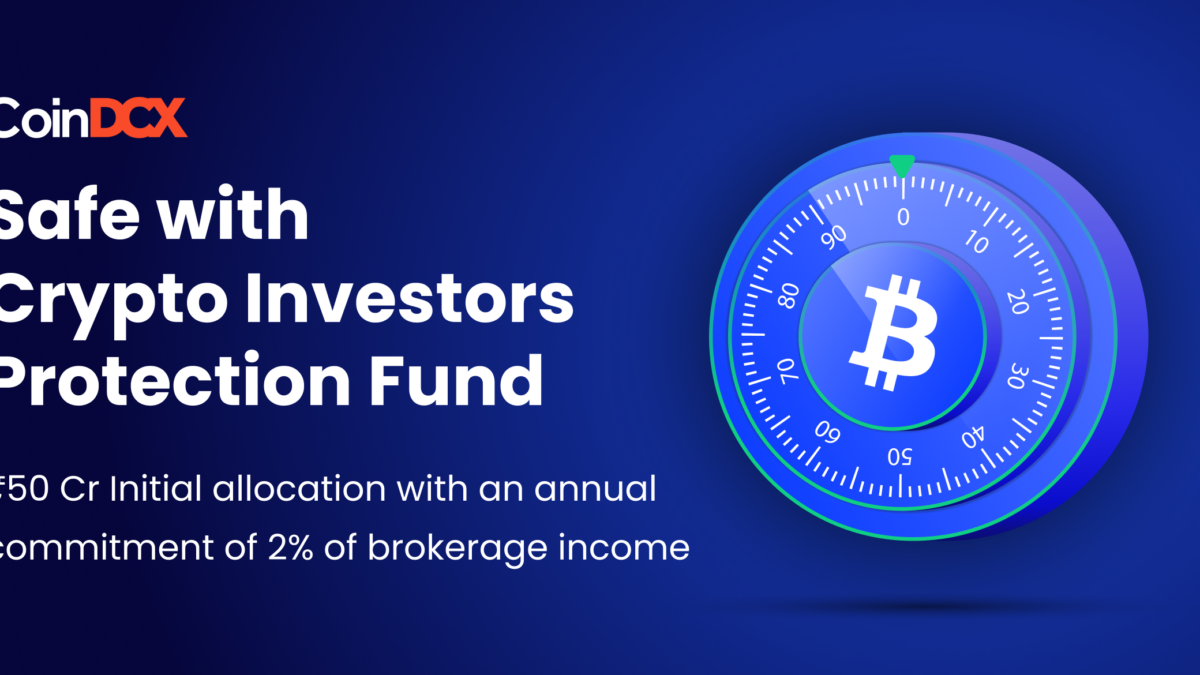

ToggleCoinDCX, India’s largest crypto exchange, is proud to announce the Crypto Investors Protection Fund (CIPF). This fund, with an initial allocation of INR 50 crore, is set up to compensate users for losses incurred in extremely rare scenarios such as security breaches or other adverse events. This fund underscores CoinDCX’s commitment to upholding trust within the crypto ecosystem.

At CoinDCX, we prioritize robust security measures and invest heavily in top notch security practices to ensure our customers’ assets are always protected. In the extremely rare event of a security breach or adverse event, our dedicated fund will provide an additional layer of protection, ensuring that our customers’ assets remain secure and intact.

CoinDCX is committed to contributing 2% of brokerage income to the corpus, with annual revisions to increase the fund size over time.

“At CoinDCX, security is our top priority. We invest heavily in top notch security practices and follow robust security measures to ensure our customers’ assets are protected at all times. The CIPF will be one of its kind and a significant step towards building long-term trust in the Indian crypto ecosystem.” Sumit Gupta, Co-Founder of CoinDCX

CoinDCX is safe

Security is our top priority, and we have best in industry security measures to protect and maintain the integrity of users’ assets on our platform. CoinDCX, the first FIU-registered exchange in India, is ISO 27001:2022 certified with latest security standards and takes information security seriously, implementing industry-leading security measures, including multi-party computation (MPC), two-factor authentication (2FA), and other advanced encryptions.

To ensure safety of customers’ assets, the assets under management at CoinDCX are diversified across multiple vaults, ensuring an added layer of security.

We have transparent proof of reserves, which is publicly visible in real-time. Users can see our proof of reserves anytime.

We adhere to all regulatory standards and guidelines, conducting regular security audits and compliance checks to meet safety and security.

The detailed framework of CIPF will follow soon. Stay tuned!

Building a Safer Crypto Ecosystem

The Indian crypto market is steadily maturing and expanding. The enthusiasm for this promising asset class is incredibly high among Indians. With over 3 crore investors, India ranks among the top countries globally in this sector. With the launch of the CIPF, CoinDCX aims to further build trust in the ecosystem among the community.

FAQs

The CIPF is a newly established fund of ₹50 Crore aimed at protecting CoinDCX users’ assets. It sets a new standard for trust and security in the Indian crypto ecosystem. CoinDCX has a strong security posture, but the CIPF is a precautionary measure to protect users’ assets in the unlikely event of a security breach or adverse event. This fund enhances security and fosters long-term trust in the platform. The CIPF was established as a proactive measure to build long-term trust and assure our users that CoinDCX is fully committed to protecting their assets. It aims to safeguard investor’s assets in the event of a security breach or adverse event, reflecting CoinDCX's dedication to maintaining a secure and trustworthy platform. The CIPF ensures that in the unlikely scenario of a security breach or other adverse event, CoinDCX users’ assets will be protected against losses due to such breaches. CoinDCX commits to contributing 2% of its brokerage income to the CIPF corpus. The fund size will be revised annually and increased over time to ensure its adequacy. In the unfortunate and rare event of a hack or security breach, the CIPF will be utilized to protect the assets of affected CoinDCX users. This fund provides compensation and ensures that their investments remain safeguarded. The assets under management at CoinDCX are diversified across multiple vaults, adding an extra layer of security. CoinDCX employs stringent security measures, including multi-party computation (MPC) and two-factor authentication (2FA). Yes, the CoinDCX CIPF currently holds a fund-to-assets ratio of around 1%, which is comparable to the protection levels offered by many international exchanges. This ratio indicates that the CIPF is designed to provide a similar level of security and trust as seen in global standards. Yes, the CIPF is an integral part of CoinDCX’s commitment to ensuring the safety and security of all users’ assets. Information about the CIPF will be available on CoinDCX's official website and through regular updates communicated to users via email and other channels. Details regarding eligibility criteria for compensation will be outlined in CoinDCX's official CIPF document, which will be made available to users. No, the CIPF is designed to cover losses resulting from security breaches or adverse events, not from normal trading activities or market fluctuations. CoinDCX will regularly review the fund’s status and make contributions based on 2% of brokerage income. Additionally, the fund size will be adjusted annually to ensure its sufficiency. No, the CIPF is funded solely by CoinDCX’s contributions. Customers are not required to contribute to the fund.What is the CoinDCX Crypto Investors Protection Fund (CIPF)?

Why has CoinDCX created this fund?

Is the new fund being created in response to the recent WazirX hack?

How does the CIPF benefit CoinDCX users?

How is the CIPF funded?

What happens if a security breach or adverse event occurs?

How will CoinDCX ensure the safety and security of the users’ assets?

Does the CoinDCX CIPF offer protection comparable to that of funds provided by international crypto exchanges?

Is the CIPF applied to all CoinDCX users?

How can CoinDCX users access information about the CIPF?

Are there any specific eligibility criteria for compensation from the CIPF?

Will the CIPF cover losses from trading activities?

How does CoinDCX ensure that the CIPF is adequately funded?

Are customers required to contribute to the CIPF?

Related posts

Standing Tall: Ensuring High Standard of Security & Strong Risk Management at CoinDCX

Our Mission to Safeguard Your Funds: Key Updates from Co-Founder…

Read more

Buy, Sell & Deposit Hamster Kombat ($HMSTR) On CoinDCX: A Complete Guide

Transfer your $HMSTR to CoinDCX and trade in INR from September 26!

Read more