Table of Contents

ToggleKey Takeaways:

- High Bitcoin Profitability: Over 94% of Bitcoin holders are currently in profit, indicating that most of the BTC supply was acquired at lower price levels. This milestone often signals potential market corrections due to profit-taking.

- Historical Patterns Suggest Profit-Taking: Historically, high profitability in Bitcoin has been a precursor to significant BTC price drops. Past market behavior shows that when Bitcoin supply in profit reaches these levels, a pullback usually follows, as seen in previous cycles like 2017 and 2021.

- Resistance at $69K: Bitcoin is facing strong resistance around $69,000, which marks a significant liquidity zone. This price point has acted as a major barrier, preventing further upward movement, and may result in short-term price corrections.

- Potential Short Liquidations: If Bitcoin breaks above the $68,000 mark, it could trigger the liquidation of over $1.6 billion in leveraged short positions. This might propel the price higher, possibly leading to a rally past $69,000.

- Bitcoin ETF Inflows as a Catalyst: Growing inflows into US-based Bitcoin ETFs are adding bullish momentum to the market. With over $21 billion in cumulative investments as of late October 2024, these inflows could fuel further price growth and help BTC break through key resistance levels.

As Bitcoin price surpasses $69,000, a striking 93% of all Bitcoin supply is now in profit. This data, provided by CryptoQuant and analyzed by independent experts like Axel Adler Jr., signals a major market milestone. However, this surge raises questions about the sustainability of the rally and whether a significant price correction is imminent.

Bitcoin Percent Supply in Profit. Source: Axel Adler Jr / CoinTelegraph

Bitcoin’s Profitability at 94%: A Key Marker

Bitcoin price rally has pushed nearly 94% of its total supply into profit, a level that often precedes market sell-offs. According to Checkmate, an analyst at Checkonchain, short-term holders (STHs) have benefited the most from recent dips, allowing many to re-enter the green. This reinforces the “buy-the-dip” mentality that drives market sentiment during bullish phases.

Bitcoin short-term holder supply in profit/loss ratio. Source: Checkmate / CoinTelegraph

Yet, historical trends suggest caution. The last time Bitcoin reached similar profitability levels, significant corrections followed. For instance, when Bitcoin’s profit supply reached this point in September 2023, the price dropped by 8.7% shortly after. This pattern echoes past bull markets in 2017 and 2021 when large profit-taking events led to bear market cycles.

Read: Top on-chain analytical tools

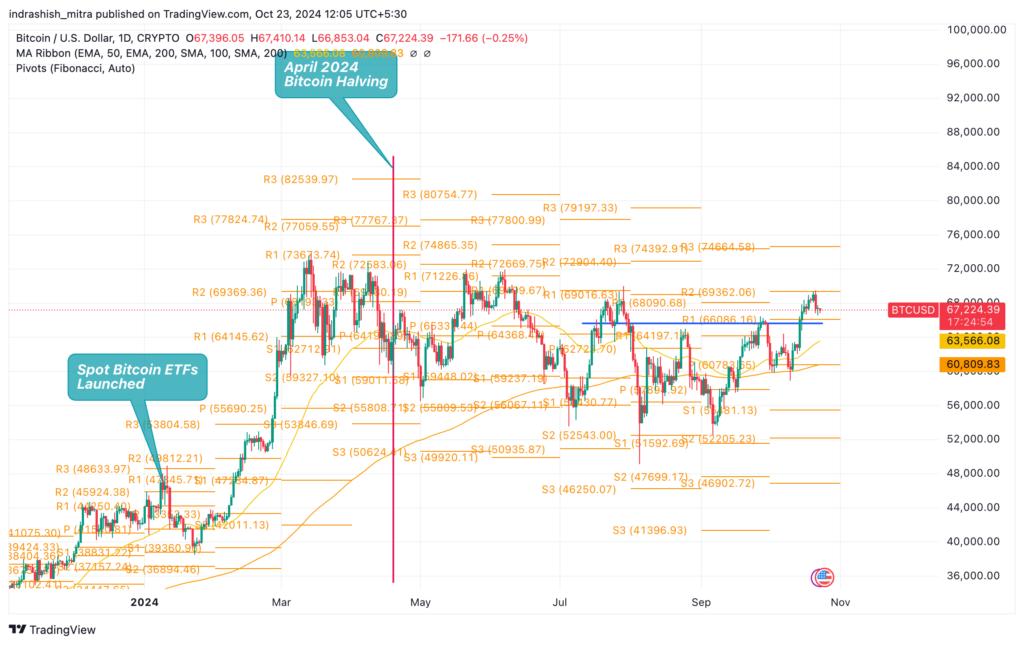

$69,000 Resistance: A Barrier for Bitcoin

Despite the bullish momentum, Bitcoin faced resistance around the $69,000 level. Traders, including Jusko Trader, noted this as a key liquidity zone that has proven to be a challenge for Bitcoin in recent months. Breaking through this zone would require significant inflows of capital, and traders are closely watching this level to assess whether BTC price can sustain its upward trajectory.

Currently, Bitcoin price is trading just below this resistance at $67,200. However, some analysts argue that this pullback is healthy, as it helps bring new cash flow into the market. Moreover, $1.65 billion in leveraged short positions could face liquidation if Bitcoin breaks above $68,000, potentially igniting a further rally.

Read: Bitcoin hashrate crosses 700 EH/s

Inflows into Bitcoin ETFs Could Fuel a Breakout

A key factor that might help Bitcoin breach the $69,000 resistance is the increasing inflows into U.S.-based spot Bitcoin ETFs. Since October 11, these inflows have gathered momentum, with cumulative investments reaching $21.2 billion as of October 22, 2024. If this trend continues, it could provide the fuel needed for Bitcoin to break through the major resistance and continue its upward trajectory.

Conclusion: Is $69K a Local Top?

While Bitcoin’s current rally has been impressive, the question remains whether $69,000 is the local top or if BTC will break through this resistance level. With 94% of Bitcoin supply in profit, there’s a strong case for profit-taking at this point. Yet, the continued inflow of capital into Bitcoin ETFs and the liquidation of short positions could drive the price higher.

In summary, Bitcoin is at a critical juncture. If it manages to sustain its momentum and break through the $69,000 resistance, a further rally could be on the horizon. However, traders should remain cautious, as historical trends suggest that periods of high profitability often lead to market corrections.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more