Table of Contents

ToggleKey Takeaways:

- Market Recovery: The crypto market has made a significant rebound, increasing by 2% in the past 24 hours and surpassing a $2 trillion market capitalization.

- Bitcoin and Ethereum Gains: Bitcoin price has risen by 2.56%, reaching around $57,000, while Ethereum has reclaimed the $2,500 mark, indicating strong recovery from recent lows.

- Analyst Optimism: Despite recent downturns, analysts like Michaël van de Poppe and Dan Gambardello remain optimistic about the market, suggesting potential for a bear trap and anticipating a scheduled bull market.

- Macroeconomic Influences: The recent market crash was driven by macroeconomic factors, particularly central bank actions in Japan, affecting global markets. However, this also suggests a faster potential recovery for the crypto market compared to traditional assets.

- Future Prospects: Sustaining key levels such as Bitcoin price above $57,000 and Ethereum above $2,500 will be crucial for continued market strength. Analysts are watching these levels as indicators for further bullish trends.

The crypto market has shown remarkable resilience, rebounding with a 2% increase in valuation within the past 24 hours, pushing its market capitalization beyond the $2 trillion mark. This bullish recovery has been driven by significant movements in leading cryptos, particularly Bitcoin price and Ethereum price.

Bitcoin and Ethereum Lead the Charge

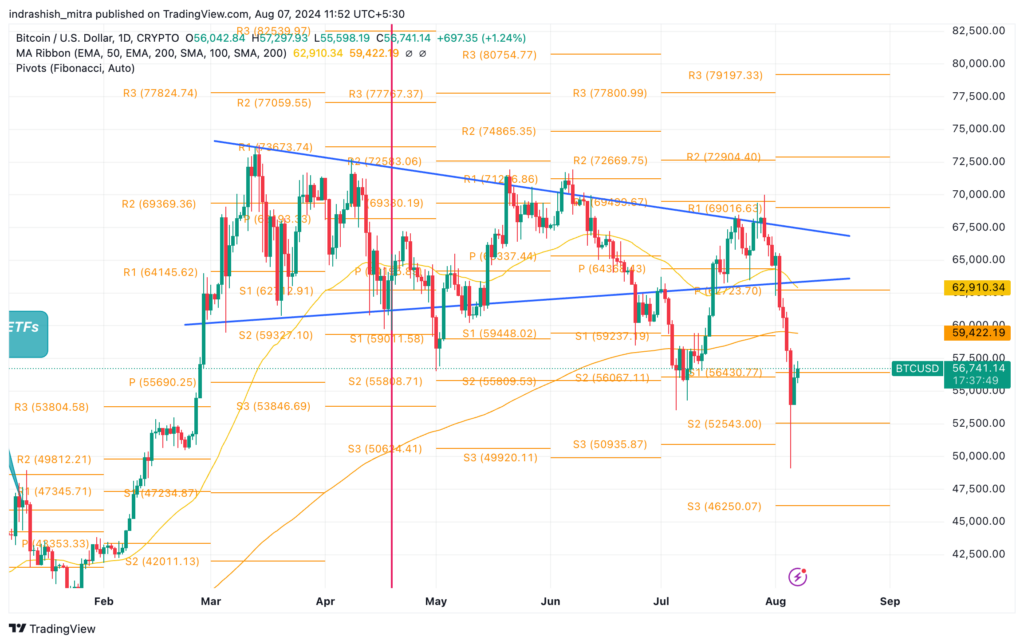

Bitcoin, the market leader, has experienced a 2.56% increase, with its trading volume hitting $47.848 billion, although it still reflects a 49.53% change over a more extended period. Bitcoin price currently is around $57,000, marking a significant recovery from recent lows. Meanwhile, Ethereum price has reclaimed the $2,500 mark, peaking at $2,553.58 in the last 24 hours, showcasing its own strong recovery.

Market Rebounds After Significant Decline

According to CryptoPotato, the total crypto market capitalization recently surpassed $2 trillion once again, after a sharp decline had slashed $500 billion from the market within a week. On August 5, the market cap had plummeted to $1.83 trillion, with Bitcoin price dropping below $50,000 and Ethereum price falling by 23% to below $2,200. However, a recovery of 12% has since been observed, with the market cap reaching $2.06 trillion.

Read More: Bitcoin Price Prediction

Analyst Perspectives on Market Recovery

Despite the recent downturn, analysts maintain a positive outlook. Michaël van de Poppe, founder of MN Consultancy, suggested that the recent correction could result in a bear trap in the current cycle. He pointed out that the massive capitulation event had led to $1.2 billion in leveraged positions being liquidated. Similarly, Dan Gambardello, founder of Crypto Capital Venture, remains patient and optimistic, despite widespread fears of the crypto market’s end, anticipating the bull market to commence as scheduled.

Dovey Wan, founder of Primitive Crypto, compared the recent market dump to the significant corrections seen in March 2020 and May 2021, which were also influenced by macroeconomic factors and leverage flushes. This perspective aligns with that of trader Alex Krüger, who likened the current situation to March 2020. Krüger noted that most altcoins have suffered significantly, suggesting a potential fresh start with a new easing cycle.

Macroeconomic Influences and Market Resilience

The recent crypto market crash wasn’t driven by crypto-specific issues but by broader macroeconomic factors, especially central bank actions in Japan, which had a ripple effect on global traditional markets. Given that cryptos are higher-risk assets, they experienced more pronounced losses. However, this also implies that crypto markets might recover faster than traditional financial markets.

Veteran trader Peter Brandt and ITC Crypto founder Benjamin Cowen have drawn comparisons to previous market cycles. Brandt highlighted that a similar event occurred post-2016 halving when Bitcoin price retraced by 27%, comparable to the 26% correction following the 2024 halving. Cowen drew parallels to the 2019 cycle, where crypto assets surged in the first half of the year but declined in the second half. Despite Bitcoin price correcting by 33% from its all-time high to its 2024 low just below $50,000, this correction is still less severe than past cycle pullbacks, which often exceeded 50%.

Additional Read: Ethereum Price Prediction

Future Prospects and Market Sentiment

Looking ahead, the crypto market’s ability to reclaim the $2 trillion mark and sustain above it will be crucial. For Bitcoin, maintaining its position above $57,000 could set the stage for further gains. Ethereum price’s ability to hold and build upon the $2,500 level will also be a key indicator of market health.

As the market navigates these recovery phases, the sentiment remains cautiously optimistic. Analysts and traders are keeping a close eye on macroeconomic developments and their impacts on the crypto market. The current phase could serve as a foundation for a more robust and sustained bullish trend, provided that critical resistance levels are breached and maintained.

Conclusion

The crypto market’s recent recovery to a $2 trillion market cap, alongside significant gains in Bitcoin price and Ethereum, underscores its resilience amid broader economic challenges. While short-term volatility remains a concern, the long-term outlook appears positive, with potential for further growth as the market continues to stabilize and recover from recent corrections.

Source: CoinPedia

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more