Key Takeaways:

- Massive Burn Event: Binance removed 1,643,698.80 BNB tokens from circulation, worth over $963 million, in its 28th quarterly burn event on July 22.

- Current Price Stability: Despite the significant burn, BNB price remains relatively stable at around $585, showing little immediate impact on its value.

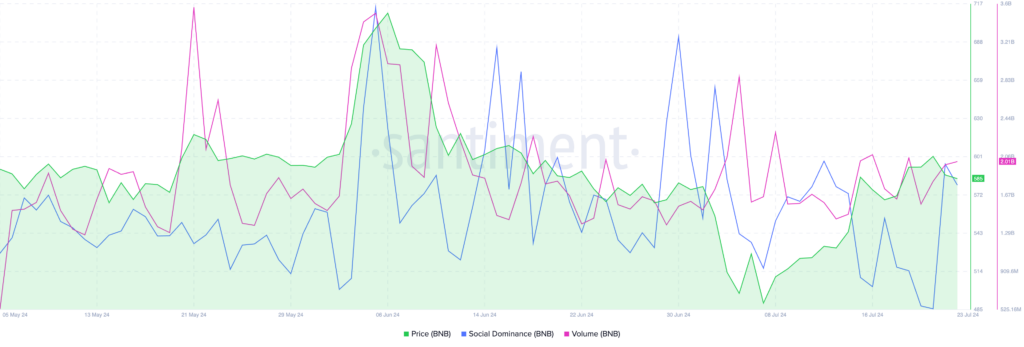

- Increased On-Chain Metrics: BNB’s social dominance and trading volume have risen recently, suggesting growing market interest and potential for future price movement.

- Resistance and Support Levels: Key resistance levels for BNB price are identified at $588, $664, and $677, while support is seen at $554 and $517.80.

- Potential for Price Surge: Analysts project that BNB price could potentially revisit its 2024 peak of $721.80 if it can overcome current resistance levels and maintain positive momentum.

On Monday, July 22, Binance executed a massive burn of 1,643,698.80 BNB tokens, equating to over $963 million. This significant move, part of the 28th quarterly token burn event, permanently removes these tokens from circulation, aiming to reduce supply and mitigate selling pressure on Binance Coin (BNB).

Following the burn, BNB price market performance has been a focal point. As of the latest data, BNB is trading at approximately $585. Despite the burn, which typically has a positive impact on an asset’s price, BNB has yet to see substantial gains. The price has remained relatively stable over the past month, hovering around the $585 mark.

On-chain metrics, however, suggest potential for future gains. According to recent data from Santiment, BNB’s social dominance and trading volume have seen notable increases. Social dominance, which tracks the frequency of mentions across social media platforms, is currently approaching 1%. Meanwhile, trading volume has surged from 1.58 billion on July 20 to 2.01 billion on July 23, signaling growing market interest.

Read More: BNB Price Prediction

Historically, reductions in circulating tokens like the recent burn often lead to price appreciation due to the decreased supply. Although BNB price has yet to respond significantly, there are optimistic projections for the near future. Analysts suggest that BNB price could potentially revisit its 2024 peak of $721.80, which was achieved on June 6. The path to this high might be obstructed by key resistance levels at $588, $664, and $677. These levels correspond to the 50% and 78.6% Fibonacci retracement levels from the decline that followed the June peak and the upper boundary of the Fair Value Gap (FVG).

Technical indicators like the Moving Average Convergence Divergence (MACD) further support the possibility of a recovery in Binance coin price. The MACD shows positive momentum, which could signal an upward trend for BNB price. Potential support levels for BNB are seen at the July 16 low of $554 and the 23.60% Fibonacci retracement level of $517.80.

In summary, while Binance coin has experienced a notable burn and positive on-chain metrics, it remains to be seen if these factors will drive BNB price past $700. Investors and traders should watch key resistance and support levels closely as BNB price navigates its post-burn phase.

Source: FXStreet

Related posts

Pi Network KYC Deadline and Mainnet Launch: What You Need to Know

Complete Pi Network KYC to unlock full Mainnet access.

Read more

Guide to Crypto Tax in India [Updated 2024]

Decoding crypto taxation in India and all you need to know!

Read more