Table of Contents

ToggleKey Takeaways:

- Potential Price Surge: GSR Markets predicts that the approval of a Spot Solana ETF in the US could increase the price of SOL by up to 9 times, from its current price of $149 to over $1,320.

- Market Cap Increase: In the “blue sky scenario,” Solana’s market cap would rise to $614 billion, based on the assumption that Solana ETFs would capture 14% of the flow seen by Bitcoin ETFs.

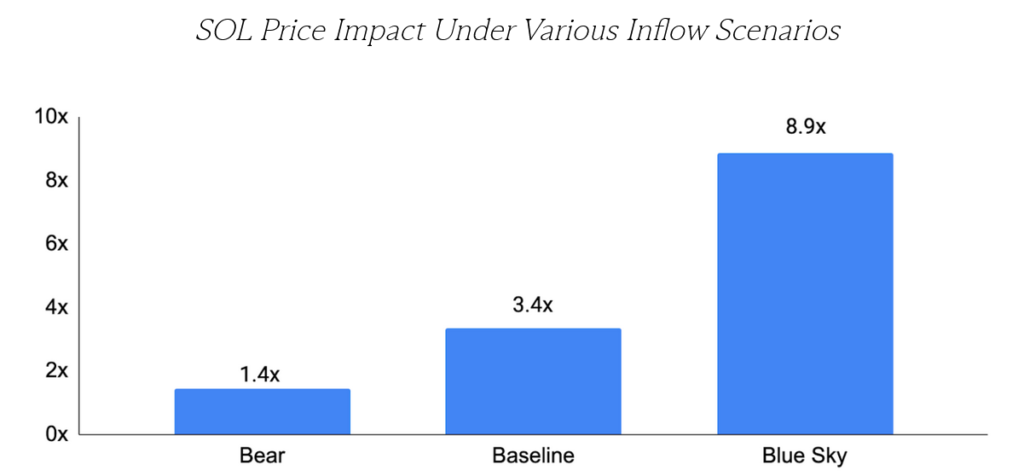

- Various Scenarios: GSR outlined multiple scenarios, with the “bear” scenario predicting a 1.4x increase and the “baseline” scenario predicting a 3.4x increase in Solana price.

- Staking Rewards Impact: The firm notes that the potential price surge could be even higher if the Spot Solana ETFs include income from staking rewards, although staking wasn’t allowed in approved Spot Ether ETFs.

- Regulatory Challenges: Despite the optimistic forecasts, significant regulatory hurdles remain, as the SEC has labeled SOL as a security, complicating the approval pathway for a Spot Solana ETF.

In a recent report dated June 27, crypto market maker GSR Markets has projected a substantial surge in Solana price, contingent upon the approval of spot Solana ETFs in the United States. According to GSR’s analysis, the price of Solana could potentially increase by a factor of nine in a “blue sky” scenario.

GSR Markets’ Predictions and Scenarios

GSR Markets identified Solana as a key player in “crypto’s big three,” alongside Bitcoin and Ethereum, and evaluated its potential for being the next crypto to secure US regulatory approval for a spot Solana ETF. On the same day GSR’s report was released, VanEck made headlines by filing for a spot Solana ETF, catching many in the industry by surprise.

GSR’s bullish forecast is based on the assumption that spot Solana ETFs could capture 14% of the flows that spot Bitcoin ETFs have received since their launch in January, adjusted for the relative market cap sizes. This optimistic “blue sky” scenario suggests that Solana’s current price of approximately $149 could skyrocket to over $1,320, pushing its market cap to a staggering $614 billion.

In contrast, GSR also presented “bear” and “baseline” scenarios. The bear scenario anticipates a more modest 2% of Bitcoin’s ETF flows, potentially increasing Solana price by 1.4 times. The baseline scenario envisions a 5% share, translating to a 3.4 times price rise for Solana.

Read More: Solana Price Prediction

Impact of Staking Rewards on ETF Estimates

GSR Markets highlighted that the projected estimates might be even higher if spot Solana ETFs incorporate income from staking rewards. However, it remains uncertain if staking will be permitted, as it was not included in the approved spot Ether (ETH) ETFs.

“Solana is poised for a spot ETF if and when additional spot digital asset ETFs are allowed in the US, and the impact on price may just be the largest yet,” GSR noted in its report.

Regulatory Hurdles and SEC Stance

Despite GSR’s optimistic outlook, there are significant regulatory hurdles to overcome. Bloomberg ETF analyst Eric Balchunas and others have pointed out that a change in the US President and the Chair of the Securities and Exchange Commission (SEC) would likely be necessary for a spot Solana ETF to gain serious consideration. The SEC, under Chair Gary Gensler, has classified the SOL token as a security in its lawsuits against Binance and Coinbase, complicating the approval process compared to Bitcoin and Ether ETFs.

Broader Context and Market Developments

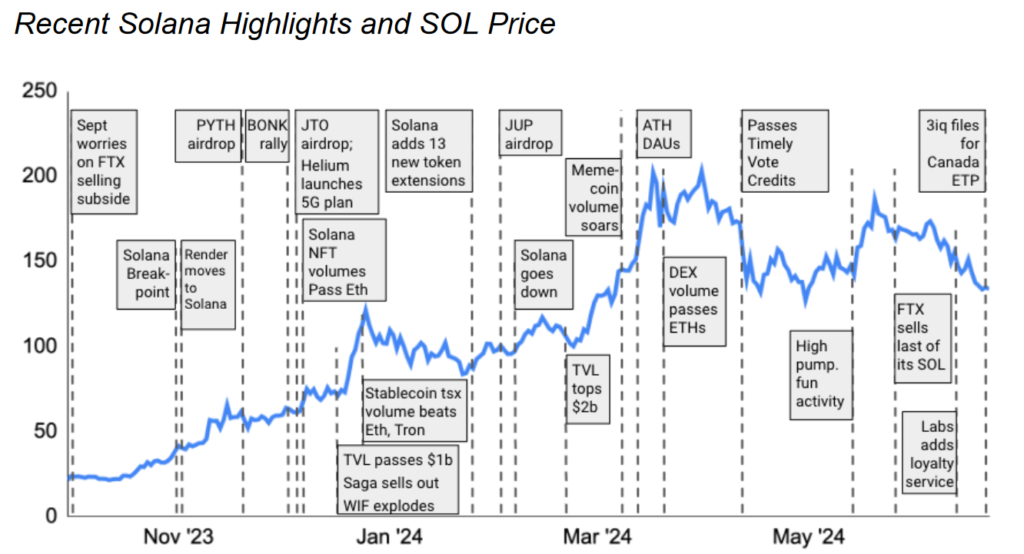

VanEck’s application for a spot Solana ETF comes just a week after crypto asset manager 3iQ filed for a similar product in Canada, marking a North American first. Meanwhile, the Solana ecosystem has garnered attention and praise from significant players such as Franklin Templeton, a $1.5 trillion asset manager, though they have not yet confirmed any plans to pursue a spot Solana ETF.

Additionally, over $1 billion worth of Solana exchange-traded products are already being offered globally, demonstrating substantial existing interest and investment in Solana-related financial products.

Conclusion

The potential approval of a spot Solana ETF in the US represents a significant opportunity for both the crypto market and investors. If GSR Markets’ “blue sky” scenario materializes, Solana could experience unprecedented growth, elevating its market cap to new heights. However, the road to approval is fraught with regulatory challenges, and the SEC’s current stance on Solana as a security adds a layer of complexity to the approval process.

Investors and stakeholders in the crypto space will be closely monitoring developments related to Solana ETFs, particularly any shifts in regulatory attitudes or significant endorsements from major financial institutions. The future of Solana price and market presence hinges on these critical factors, making it a focal point for market watchers and potential investors alike.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more