Table of Contents

ToggleKey Takeaways:

- Bitcoin Price Near All-Time High: Bitcoin price soared to $71,200, just 4% shy of its record high of $73,700 set in March.

- Significant ETF Inflows: US spot Bitcoin ETFs saw a substantial inflow of $887 million on June 4, marking the second-highest inflow ever recorded.

- Leading ETFs: Fidelity’s Wise Origin Bitcoin Fund led the inflows with $378 million, followed by BlackRock’s iShares Bitcoin Trust with $275 million, and ARK 21Shares Bitcoin ETF with $138 million.

- Positive Market Outlook: The recent price surge indicates a positive turn for Bitcoin after weeks of stagnation, with experts predicting a promising June, partly due to anticipated spot Ethereum ETF developments.

- Growing ETF Popularity: Despite initial skepticism, Bitcoin ETFs have proven popular. They celebrated their 100th trading day with significant demand from retail investors.

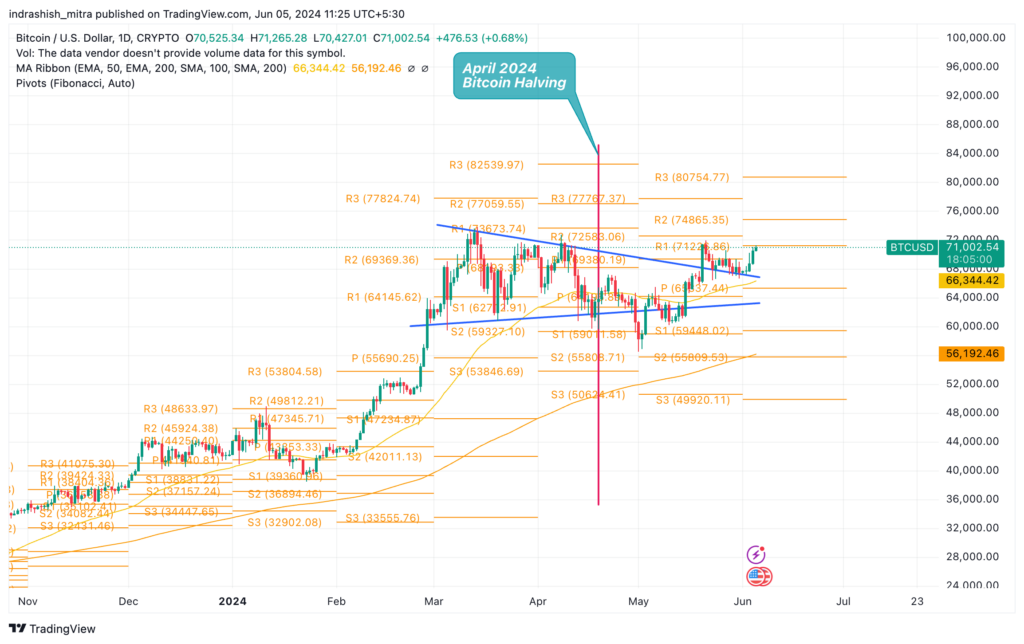

Bitcoin price surged to $71,200 early this week, nearing its all-time high of $73,700 set earlier in March, as massive inflows into US spot Bitcoin exchange-traded funds (ETFs) drive the rally. This recent uptick, captured by TradingView data, reflects a growing bullish sentiment in the crypto market.

Record Inflows into Bitcoin ETFs

On June 4, US Bitcoin funds recorded net inflows of $887 million, the second-highest on record, according to HODL15Capital. This influx was led by the Fidelity Wise Origin Bitcoin Fund, which amassed an impressive $378 million. BlackRock’s iShares Bitcoin Trust followed closely with $275 million, while the ARK 21Shares Bitcoin ETF claimed third place with over $138 million in net inflows.

✅ FINAL 6/4 U.S. Bitcoin ETF inflows of +$887 MILLION.

On the 100th trading day, the ETFs purchased 12,590 #Bitcoin (which is 28 days’ supply) 👇 pic.twitter.com/X8dnnh69ZX

— HODL15Capital 🇺🇸 (@HODL15Capital) June 5, 2024

These substantial inflows marked a notable milestone, the largest since March 12, when a record-setting $1.04 billion flowed into Bitcoin ETFs. The following day, Bitcoin peaked at $73,700, its highest to date.

Read On: Bitcoin Price Prediction

Bitcoin’s Market Performance

At the time of writing, Bitcoin is trading near $71,000, reflecting an almost 3% increase in the past 24 hours. This recent surge indicates a positive shift for Bitcoin after several weeks of stagnation. Industry analysts are optimistic about a “bright June” for the crypto market, largely due to anticipated developments in spot Ethereum ETFs.

Substantial inflows into Bitcoin ETFs come as these funds celebrate their 100th trading day. Nate Geraci, president of ETF Store, highlighted the skepticism surrounding Bitcoin ETFs and their demand, particularly from critics who doubted their appeal to retail investors.

The introduction of Bitcoin ETFs has been a game-changer for the crypto market, providing a regulated and accessible way for investors to gain exposure to Bitcoin without directly holding the asset. This has opened the door for a broader range of investors, including institutions that were previously hesitant to enter the unregulated crypto space.

Bitcoin ETFs have not only increased the liquidity of Bitcoin but also contributed to its price stability. By pooling investor funds, these ETFs can make significant trades without causing large price swings, which is beneficial for the overall health of the Bitcoin market.

As Bitcoin continues to approach its all-time high, the market is abuzz with speculation about whether it will break past the $73,700 mark. The substantial inflows into Bitcoin ETFs suggest strong investor confidence, which could propel Bitcoin to new heights.

The broader crypto market is also poised for growth, with Ethereum ETFs on the horizon. The approval and launch of these ETFs could attract even more investment into the crypto market, driving prices higher.

Conclusion

Bitcoin’s recent price surge to $71,200, fueled by massive inflows into US spot Bitcoin ETFs, highlights the growing acceptance and integration of cryptos into mainstream financial markets. With ETFs like Fidelity’s Wise Origin Bitcoin Fund, BlackRock’s iShares Bitcoin Trust, and ARK 21Shares Bitcoin ETF leading the charge, the market is witnessing unprecedented levels of investment.

With the growing popularity and success of Bitcoin ETFs, it’s clear that cryptos are here to stay, continuing to evolve and integrate into the global financial system. As investors remain bullish, the possibility of Bitcoin reaching new all-time highs seems more likely than ever.

Source: CryptoBriefing

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more