Table of Contents

ToggleKey Takeaways:

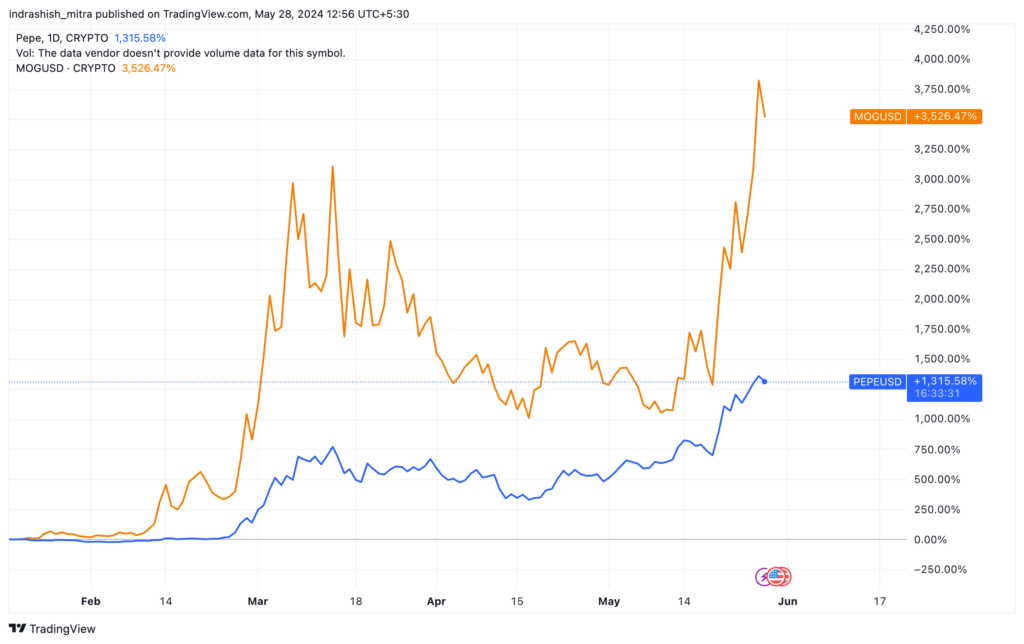

- Meme Tokens Surge: Ethereum-based meme coins PEPE price and MOG price reached all-time highs following the approval of U.S. ether ETF filings.

- Trading Volume Spike: PEPE’s trading volume exceeded $1.8 billion, significantly higher than the usual range of $400 million to $600 million.

- Futures Open Interest: Open interest in futures for PEPE and MOG increased sharply, indicating new money entering the market.

- Bearish Sentiment on PEPE: Despite the price surge, the long-to-short ratio for PEPE shows a bearish trend, with 54% of traders betting against further price rises.

- Beta Bet Narrative: Traders are treating PEPE and MOG as leveraged ways to gain exposure to ether, similar to the behavior seen with other ecosystem meme tokens.

The crypto market has recently witnessed significant movement, particularly within the Ethereum ecosystem. Two prominent meme tokens, PEPE and MOG, have surged to all-time highs, largely driven by the US approval of several spot Ethereum exchange-traded fund (ETF) filings. These approvals have generated a wave of optimism among traders, who see meme tokens as high-beta bets in the broader crypto market.

Surge in PEPE Price & MOG Price

Both PEPE and MOG experienced remarkable price increases. The frog-themed PEPE price rose by 11%, while the cat-themed MOG price saw a dramatic 45% surge within just 24 hours. This significant uptick highlights the growing trend of investors using meme tokens to gain leveraged exposure to major assets like Ether. The trading volume for PEPE skyrocketed to over $1.8 billion, far surpassing its usual range of $400 million to $600 million.

The broader market context also played a crucial role in these developments. While Ethereum price itself rose nearly 5%, Bitcoin price dipped by 1%, showcasing the divergence in performance among major cryptos. The CoinDesk 20 index, which tracks the performance of the largest tokens excluding stablecoins, reported a modest decline of 0.3%. Despite this, the interest in meme tokens remains robust, with their trading volumes and open interest in futures contracts soaring.

Open Interest and Futures Market

Futures data indicate a surge in open interest for PEPE and MOG-tracked instruments. PEPE price‘s open interest increased to $720 million from $550 million the previous week, while MOG’s rose to $8.3 million from $5 million. Rising open interest typically signals new money entering the market, potentially leading to increased price volatility. However, it’s worth noting that the long-to-short ratio for PEPE is skewed towards the bears, with 54% of traders betting against further price rises, according to data from Coinalyze.

The concept of meme tokens as beta bets is gaining traction. Traders view these tokens as a means to leverage their exposure to the primary asset—in this case, Ether—by investing in related networks or protocols. This strategy became particularly evident following the recent increase in the likelihood of Ether ETFs being approved in the US, prompting a rally in PEPE and MOG.

Meme tokens have been on the rise since 2023, often seen as having little intrinsic value but attracting large followings due to their cultural and speculative appeal. The ascent of tokens like PEPE, which briefly entered the top 20 tokens by market capitalization with a value exceeding $6 billion, underscores this trend. Early investors have reaped substantial profits, with some turning modest initial investments into millions.

This phenomenon is not unique to the Ethereum ecosystem. Other networks have seen similar trends, with Solana-based meme coins experiencing significant gains from December to March as SOL tokens appreciated. Similarly, the Avalanche Foundation’s December announcement of investments in meme tokens highlighted the broader acceptance and strategic value seen in these digital assets.

Conclusion

The recent price surge of PEPE and MOG amidst the approval of Ether ETF filings underscores the dynamic and speculative nature of the crypto market. These meme tokens, often seen as high-risk, high-reward investments, continue to capture the imagination of traders and investors looking to capitalize on market trends and regulatory developments. As the crypto landscape evolves, the role of meme tokens as leverage instruments will likely remain a compelling narrative for market participants.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more