Table of Contents

ToggleKey Takeaways:

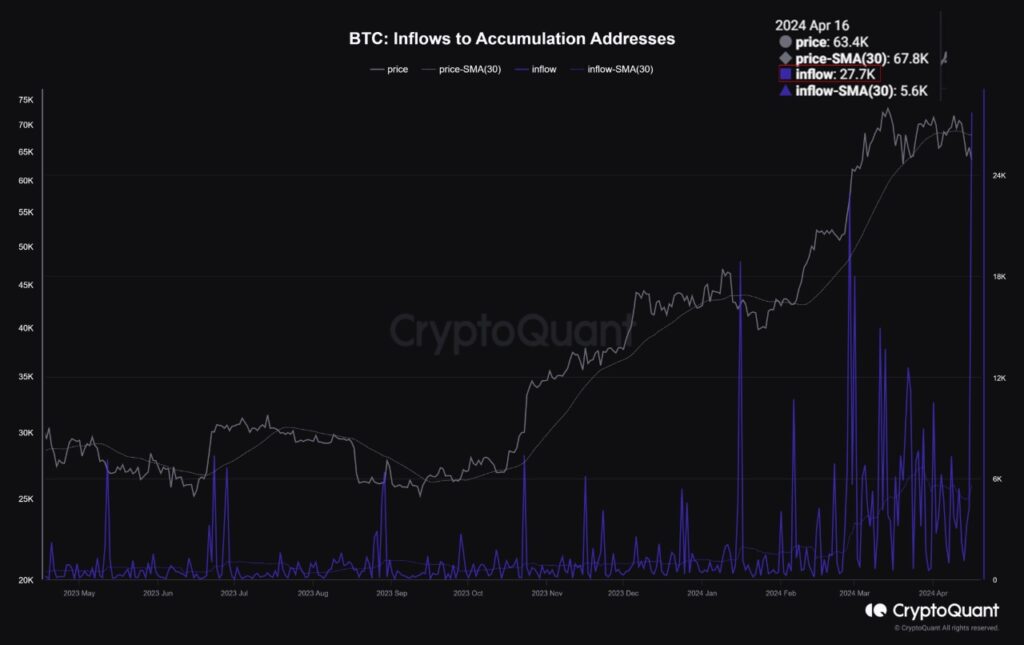

- Confidence Amid Volatility: Despite recent Bitcoin price dips, hodlers demonstrated confidence by accumulating $1.7 billion worth of BTC, signaling strong belief in its long-term potential.

- Record Accumulation Activity: A record-breaking 27,700 BTC was added to ‘accumulation’ wallets in a single day, indicating a surge in motivated buying during the price dip.

- Strategic Buying at $63,000: The influx of BTC into accumulation addresses around the $63,000 price range, suggesting that large investors view this level as an opportunity to accumulate Bitcoin.

- Preparing for Post-Halving Rally: Market analysts anticipate that the current market dynamics may represent the last chance to acquire Bitcoin at lower prices before a potential post-halving rally.

- Potential for Accelerated Cycle: With Bitcoin expected to enter a re-accumulation phase post-halving, there is speculation about the possibility of an accelerated market cycle, highlighting the dynamic nature of cryptomarkets.

In a remarkable display of confidence, dedicated Bitcoin (BTC) holders seized the opportunity during a recent price dip to accumulate a staggering $1.7 billion worth of BTC. Amidst a turbulent market, these hodlers demonstrated unwavering belief in the long-term potential of the leading crypto.

Read More: Bitcoin Price Prediction

Record Accumulation: $1.7 Billion Added in a Day

On April 16, as Bitcoin’s price dipped below $63,000, a record-breaking 27,700 BTC found its way into ‘accumulation’ wallet addresses. This influx, totaling $1.75 billion at current prices, marked an unprecedented surge in accumulation activity within a single 24-hour period. This data, sourced from CryptoQuant, highlights a significant trend among committed investors.

Elevated Motivated Buying at $63,000 Range

The surge in accumulation addresses indicates a heightened level of motivated buying, particularly around the $63,000 price range. This suggests that large investors remain steadfast in their commitment to accumulating and holding Bitcoin for the long term. Accumulation addresses, characterized by a balance of over 10 BTC and no previous withdrawals, serve as a testament to this confidence.

Market analysts, including Rekt Capital, have pointed to the current market dynamics as potentially signaling the last opportunity to acquire Bitcoin at “bargain prices” before an anticipated post-halving rally. Comparing Bitcoin’s price action to previous halving cycles, Rekt Capital suggests that the recent dip is part of a pre-halving retracement, with a re-accumulation phase likely to follow the upcoming Bitcoin Halving event.

Anticipating Accelerated Cycle

Rekt Capital predicts that Bitcoin may enter a re-accumulation phase post-halving, potentially leading to a parabolic uptrend. Historically, this phase has lasted over a year, but with the possibility of an accelerated cycle in the current market, the timeline could be shortened. This projection underscores the dynamic nature of the crypto market and the potential for rapid shifts in sentiment and price action.

In conclusion, the surge in accumulation activity amidst market volatility reflects the unwavering confidence of Bitcoin hodlers in the digital asset’s long-term prospects. As investors brace for potential market cycles and anticipate future rallies, the resilience of Bitcoin as a store of value remains a cornerstone of the crypto ecosystem.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more