Key Takeaways:

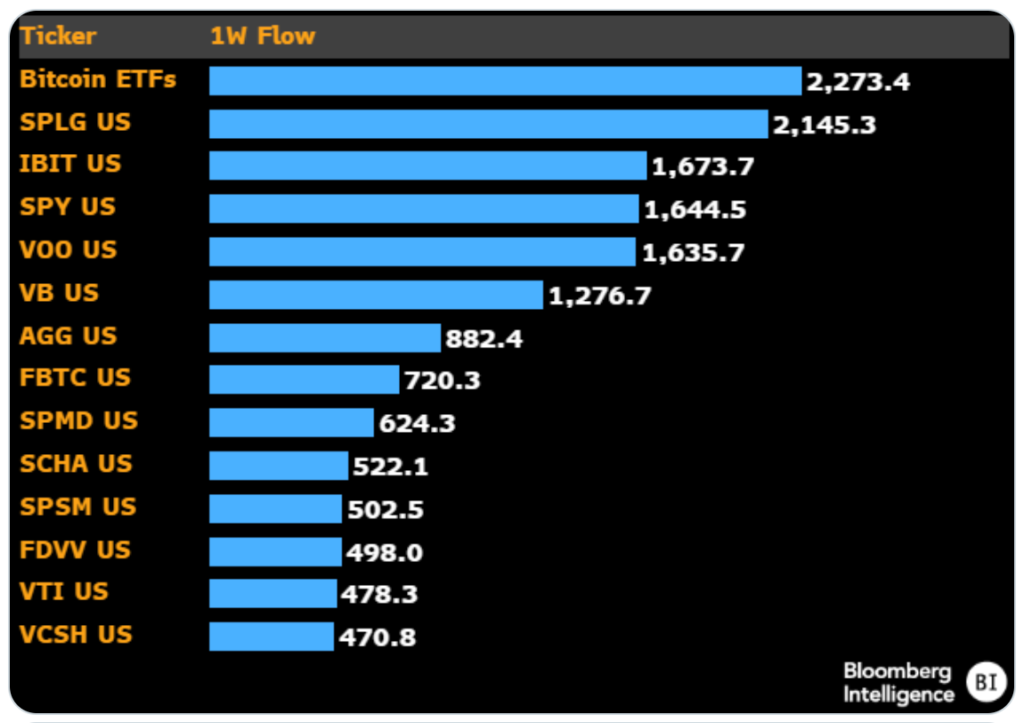

- Record-breaking Inflows: The week of February 12–16 witnessed a historic surge in Bitcoin spot ETFs, with net inflows surpassing $2.2 billion. This remarkable achievement set a record, outpacing the combined volume of inflows for all other ETFs available in the United States.

- BlackRock’s Dominance: BlackRock’s iShares Bitcoin Trust (IBIT) emerged as a key player, attracting the majority of capital inflows with an impressive $1.6 billion over the week. Year-to-date, IBIT has accounted for 50% of BlackRock’s total net ETF flows, signaling the dominance of this fund in the crypto ETF space.

- Spot Bitcoin ETF Performance: Other notable players, such as Fidelity’s Wise Origin Bitcoin Fund, Ark 21Shares Bitcoin ETF, and Bitwise Bitcoin ETF, also experienced substantial gains, collectively accumulating hundreds of millions in capital inflows during the week.

- Challenges for Grayscale Bitcoin Trust: In contrast, the Grayscale Bitcoin Trust faced challenges with significant outflows totaling $624 million from February 12 to 16. Since its conversion to a spot ETF on January 10, Grayscale’s fund has seen over $7 billion in capital outflows, highlighting a contrasting trend among Bitcoin ETFs.

The past week was a remarkable one for Bitcoin ETFs (exchange-traded funds), as the market witnessed an impressive surge, with net inflows exceeding $2.2 billion between February 12 and 16. According to Bloomberg analyst Eric Balchunas, this substantial influx has set a record, surpassing the combined volume of inflows for any other among the 3,400 ETFs available in the United States.

BlackRock’s iShares Bitcoin Trust (IBIT) emerged as the frontrunner, attracting a significant share of the capital flow. Over the course of the week, IBIT secured positive flows amounting to $1.6 billion, contributing substantially to BlackRock’s overall net ETF flows. As highlighted by Balchunas, IBIT has reportedly raked in $5.2 billion year-to-date, representing 50% of BlackRock’s total net ETF flows across 417 ETFs.

Other major players in the spot Bitcoin ETF arena also experienced noteworthy gains. Fidelity’s Wise Origin Bitcoin Fund, holding billions in assets, saw substantial inflows of $648.5 million over the last five trading sessions. The Ark 21Shares Bitcoin ETF and the Bitwise Bitcoin ETF secured $405 million and $232.1 million in capital inflows, respectively.

However, not all ETFs enjoyed a positive trend during this period. The Grayscale Bitcoin Trust faced significant outflows, with withdrawals totaling $624 million from February 12 to 16. Since its transformation from an over-the-counter product to a spot ETF on January 10, Grayscale’s fund has experienced substantial capital outflows exceeding $7 billion.

Additional Read: Bitcoin Price Prediction 2024

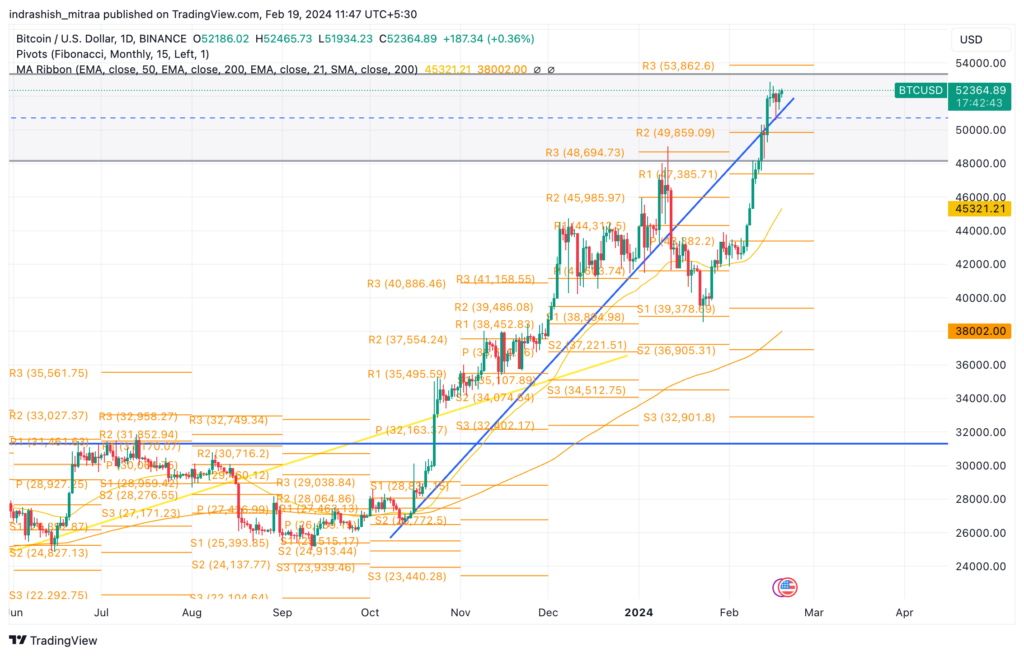

The surge in ETF activity is believed to be a driving force behind Bitcoin’s price gains, with the crypto marking a remarkable 91% increase in the past four months. Market sentiment has been bolstered by the US Securities and Exchange Commission’s (SEC) approval of Spot Bitcoin ETFs on January 10. During the highlighted week, Bitcoin demonstrated resilience and gained nearly 7%, currently trading at $51,434. This surge contributed to an overall climb of 24% in February alone, indicating a positive market trend.

The growing influence of Bitcoin ETFs has also caught the attention of major banks and financial institutions. In a letter dated February 14, a trade group coalition representing Wall Street’s leading firms urged the SEC to consider modifications to the Staff Accounting Bulletin 121. This proposed revision aims to guide accounting for crypto asset custody obligations, potentially allowing banks to act as custodians for BTC funds.

The substantial net inflows into Bitcoin ETFs, particularly the standout performance of BlackRock’s IBIT, underscore the growing significance of these investment vehicles in the crypto market. As institutional interest continues to rise and regulatory support remains firm, the positive impact on Bitcoin’s price and market sentiment is likely to persist, shaping the trajectory of the crypto market in the coming months.

Read More: Impact of Bitcoin ETFs Approval by the SEC

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more