Key Takeaways:

- Bitcoin’s Resurgence Beyond $50K: Bitcoin price’s recent climb above $50,000 marks a significant turning point in its trajectory, distinct from the previous surge in December 2021.

- Diverse Market Factors: Unlike the challenging conditions of 2021, the current surge is attributed to increased institutional interest, shifting interest rates, and the upcoming Bitcoin halving.

- Anticipation Surrounding Bitcoin Halving: The imminent Bitcoin halving in April is seen as a bullish catalyst, with mining rewards set to be halved, enhancing Bitcoin’s scarcity and long-term appeal.

- Institutional Confidence: Robust institutional interest is evidenced by the remarkable $1.1 billion influx into spot Bitcoin ETFs within a week, signaling growing confidence in Bitcoin price potential.

- Retail vs. Institutional Dynamics: While retail interest remains relatively low, institutional participation is thriving, possibly indicating a more stable foundation for market growth and a shift in Bitcoin price influence.

Read More: Bitcoin Price Prediction

Bitcoin’s recent ascent beyond $50,000 marks a pivotal moment in the crypto landscape, distinctly different from its previous surge in December 2021. This time, a confluence of factors, including heightened institutional interest, shifting interest rates, and the impending Bitcoin halving, sets the stage for a unique trajectory.

In December 2021, Bitcoin price journey to $50,000 coincided with an unsuspecting plunge into a prolonged bear market. Eleven consecutive interest rate hikes in the United States, coupled with the collapse of prominent crypto institutions and a mass exodus of retail investors, defined this challenging period.

Contrastingly, eToro market analyst Josh Gilbert highlights the current macro conditions as increasingly favorable for risk assets like Bitcoin. Anticipating four or five Federal Reserve cuts in 2024, the upcoming fourth Bitcoin halving, and substantial inflows into Bitcoin ETFs, Gilbert underscores the positive sentiment shaping the market.

The imminent Bitcoin halving scheduled for April is a crucial catalyst on the horizon. This event, where mining rewards are halved for Bitcoin miners, is widely perceived as a bullish driver for BTC’s long-term price. Gilbert emphasizes the significance of this halving in enhancing Bitcoin’s scarcity and contributing to its overall appeal.

The performance of Bitcoin ETFs is another notable factor boosting market confidence. A recent report from CoinShares reveals a remarkable $1.1 billion influx into spot Bitcoin ETFs within a week, marking the most substantial seven-day period of inflows since their launch on January 11.

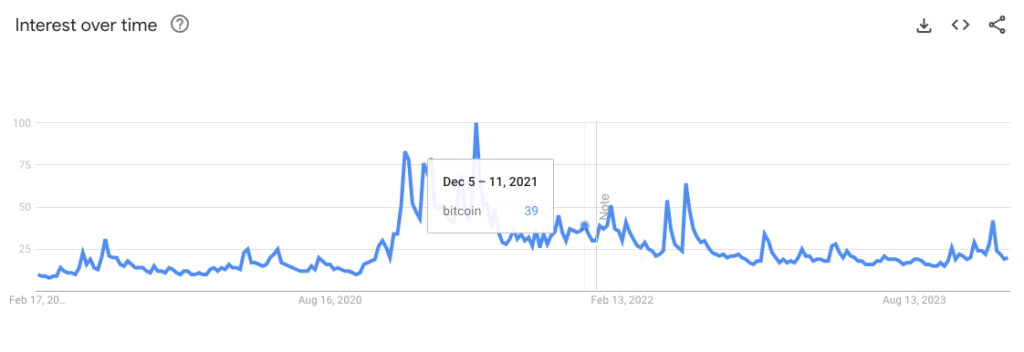

While institutional interest flourishes, retail participation remains subdued, as indicated by Google Trends data. The search term “Bitcoin” garnered a score of 39 in December 2021 but has since dropped to 19, suggesting a relatively low level of retail interest in the asset. Crypto analyst Will Clemente sees this as a potential indication of a more sustainable foundation for market growth.

Looking ahead, Ki Young Ju, CEO of CryptoQuant, anticipates Bitcoin’s price soaring to $112,000 per coin in 2024. He attributes this bullish forecast to the performance of spot Bitcoin ETFs, further emphasizing the growing influence of institutional participation in shaping Bitcoin’s future trajectory.

In conclusion, Bitcoin’s resurgence above $50,000 signals a new era, characterized by institutional strength, evolving market dynamics, and optimistic forecasts. As macroeconomic conditions align with crypto’s favor, the stage is set for Bitcoin to navigate a path distinct from its previous milestones.

Additional Read: Bitcoin Halving History & Outlook 2024

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more