Table of Contents

ToggleKey Takeaways:

- Solana’s Metric Surge: Outpacing Ethereum in DEX, NFT volumes, active addresses, and transactions, signaling its growing dominance in crucial crypto metrics.

- Costly Node Operations: Solana’s impressive throughput comes at a cost, with node operations demanding 5X more expense than Ethereum, posing a challenge for decentralization efforts.

- DeFi TVL and On-chain Activity: SOL price surge has significantly amplified DeFi Total Value Locked and transaction counts, indicating heightened on-chain activity and increased adoption.

- Decentralization Metrics: Despite fewer nodes than Ethereum, Solana’s Nakamoto Co-efficient indicates higher decentralization. However, node count disparities pose a notable contrast.

- Firedancer Validator Client: Solana’s solution to bolster its network’s efficiency and scalability involves deploying the Firedancer validator client, promising enhanced block production and increased on-chain transactions without relying on off-chain options.

Recent analysis by Ryan Watkins from Syncracy Capital highlights Solana’s surging performance, surpassing Ethereum across key metrics, yet uncovering the challenge of high node operational costs.

Solana Outperforms in Crucial Metrics

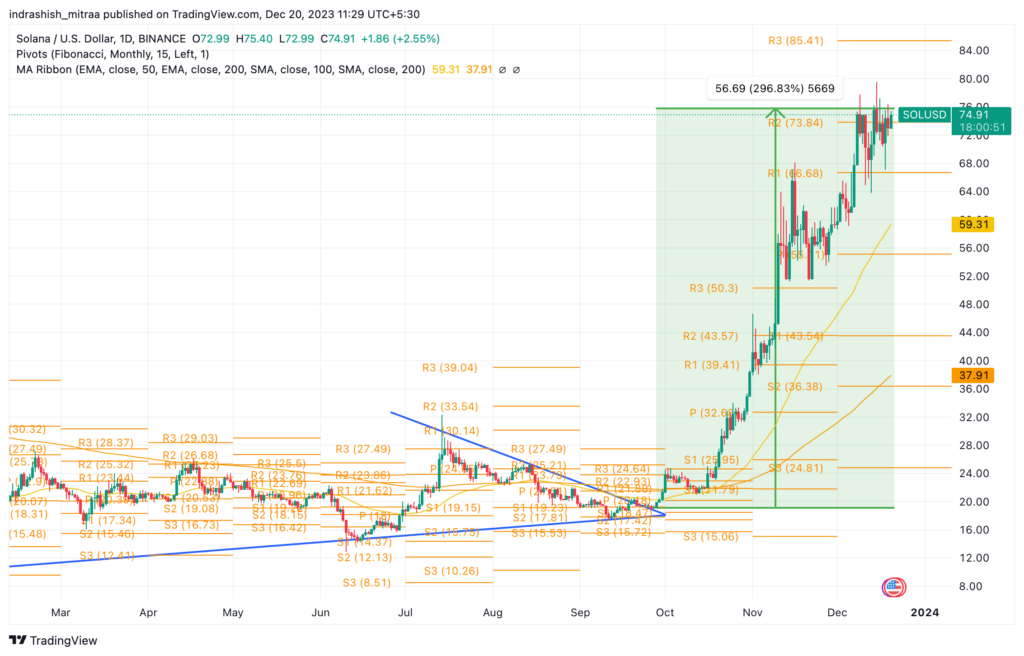

Watkins notes Solana’s ascendancy in decentralized exchange (DEX) and non-fungible token (NFT) volumes, active addresses, transaction counts, and stablecoin transfers, once dominated by Ethereum. This surge coincides with SOL’s robust trading, breaching resistance levels and setting new highs in 2023.

The spike in SOL prices has fueled increased on-chain activity, evidenced by rising transaction counts and a substantial surge in decentralized finance (DeFi) Total Value Locked (TVL). Despite SOL’s over 3X surge since September 2023, the DeFi TVL, according to DeFiLlama data, has similarly multiplied over threefold from around $270 million in July 2023 to now over $1 billion.

Read More: Solana Price Prediction

Solana’s Attraction: Architecture and Scalability

The allure of Solana lies in its architecture and scalability, enabling cost-effective transactions and smart contract launches for deployed protocols. Its structure, leveraging independent nodes rewarded for engagement, promotes decentralization and security.

Cost of Node Operations: The Decentralization Debate

Despite Solana’s promising performance, concerns arise about its decentralization, with Watkins highlighting the network’s 40% fewer nodes compared to Ethereum. The key difference, however, is the stark contrast in operational expenses—Solana nodes demand 5X more in costs compared to Ethereum counterparts. Watkins underscores this cost trade-off for Solana’s high throughput capabilities.

Syncracy data reflects the operational costs, showcasing Ethereum node expenses at around $550, significantly lower than the over $5,100 for a high-end Firedancer-based Solana node. Despite this discrepancy, Solana boasts a TPS (transactions per second) of 55,000 versus Ethereum’s 100, highlighting Solana’s superior throughput.

Decentralization Metrics: Nakamoto Co-efficient and Node Count

Comparing decentralization metrics, as of December 19, the Nakamoto Co-efficient stands at 21 for Solana, unchanged, while Ethereum’s, per Nakaflow data, stands at 2. Although the Nakamoto Co-efficient tends to indicate higher decentralization with a higher reading, there’s a clear disparity in node count—over 1 million Ethereum nodes versus more than 2,900 Solana nodes.

Watkins defends Solana’s decentralization, stressing that it extends beyond node count and geographical distribution. He emphasizes the need for Solana to diversify its developer ecosystem, implement features like light clients, and enhance end-user verification cost-effectively.

Additional Read: Ethereum Price Prediction

Solana’s Path Ahead: Firedancer Validator Client

Solana aims to mitigate these challenges with the Firedancer validator client release, enhancing network robustness, reliability, and scalability. The client’s deployment is set to enable faster block production, facilitating increased on-chain transactions without reliance on off-chain solutions.

Solana’s dominance in key metrics highlights its growth potential, but the cost hurdle for running nodes poses a challenge. The network’s commitment to scalability and decentralization remains pivotal for its sustained success.

Source: bitcoinist.com

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more