Table of Contents

ToggleKey Takeaways

- Recalibration Post-Hype: Transition to Intrinsic Value – 2023 saw a shift from a speculative frenzy to evaluating the true worth of NFTs beyond the hype, leading to a deeper understanding of their utility and value.

- Market Correction and Recovery: Understanding Volatility – Post-April 2022 correction prompted introspection, witnessing a recovery in 2023, reflecting market resilience, profitability for traders, and shorter holding periods for NFTs.

- Liquidity Plunge and Equitable Distribution: Concentration Challenges – A liquidity plunge in April prompted evaluation, emphasizing the need for a more equitable market cap distribution, signaling a pivotal phase in market maturity.

- Major Projects & Events: Record-breaking Sales and Dichotomies – Standout NFT projects like Cryptopunks’ high-value sales, Jack Butcher’s revenue success, and Franke’s collection showcase both triumphs and challenges within the market.

- Future Trends and Insights: Maturation and Innovation – Anticipated trends like utility-driven NFTs, cross-platform integration, DeFi convergence, regulatory developments, and evolved market infrastructure signal a market ripe for innovation and inclusivity in 2024.

Overview of the NFT Market in 2023

Recalibration Post-Hype: Understanding the Transition

The year 2023 served as a pivotal period in the evolution of the Non-Fungible Token (NFT) landscape. Emerging from the fervor and hype of previous years, the market embarked on a recalibration phase. This recalibration was characterized by a shift in sentiment — a move away from speculative frenzy toward a more grounded evaluation of NFTs’ intrinsic value and real-world utility. The market landscape resembled uncharted waters, beckoning enthusiasts to explore beyond the surface and delve deeper into the true essence of digital assets.

Post-April 2022 Correction: Navigating Reality

The correction phase post-April 2022 witnessed a considerable dip in the excitement surrounding NFTs. The hyperinflated expectations collided with reality, prompting a period of introspection within the NFT community. This introspection fostered a shift from the pursuit of quick profits to a focus on long-term sustainability. It was akin to a seasoned sailor adjusting sails in turbulent seas, signifying a maturation phase within the NFT space. As the market adjusted to this new reality, stakeholders began emphasizing the need for intrinsic value and viability beyond speculative allure.

Additional Read: Did the NFT Bubble Burst Yet?

2023 NFT Market Saw New Trends & Liquidity Patterns Emerge!

Liquidity Plunge and Market Evaluation

A significant highlight during this recalibration was the liquidity plunge witnessed in the NFT market. Nearly 70% of NFT projects experienced a floor price of zero in the six months leading up to April 2023, indicating a severe liquidity drought. This scenario propelled an in-depth evaluation of the market’s resilience and highlighted the necessity for a comprehensive market assessment.

However, the narrative took an intriguing turn post-April 2022. The market displayed signs of recovery in the first half of 2023, akin to a phoenix rising from the ashes. This resurgence injected renewed optimism, reflecting the market’s resilience and potential to reclaim its former glory. The recovery was evident in various indicators, such as traders finding profitability, a surge in floor prices among top collections, and a reduced holding period for NFTs, signifying a revitalized market ethos.

Market Concentration and Equitable Distribution

The concentration of market capitalization emerged as a crucial revelation during this recalibration. The realization that the top 1% of NFT projects held over 50% of the total market cap underscored the necessity for a more equitable distribution of value. Stakeholders actively strategized to level the playing field and foster a healthier ecosystem that promotes inclusivity and fair value distribution, akin to a chess player contemplating each strategic move.

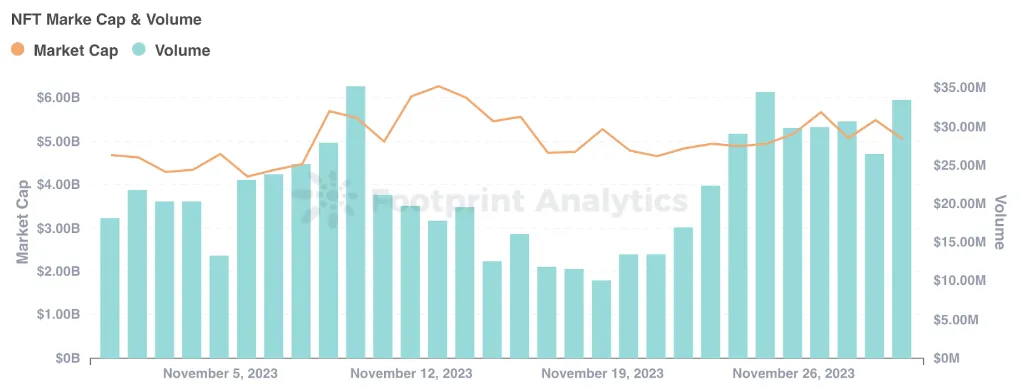

November’s Market Resurgence: Positive Signals Amidst Uncertainty

November brought a breath of fresh air to the NFT market, marking a resurgence that reverberated through key market data and dynamics. Positive signals illuminated the path forward, instilling renewed confidence among traders and enthusiasts. The month witnessed a rebound in trader profitability, surges in floor prices for top collections, and decreased holding periods for NFTs, painting a picture of a market finding stability amidst fluctuating values. Yet, amidst these highs, fluctuations in average prices added layers of complexity to the evolving narrative, prompting closer scrutiny of factors influencing NFT valuations.

The bustling NFT market in November witnessed remarkable sales, including the record-breaking Cryptopunk sale, alongside other notable transactions like the Jack Butcher Trademark collection and Herbert W. Franke’s Zentrum collection. These sales exemplified the allure and challenges within the market, showcasing triumphs alongside rapid price fluctuations on the secondary market. The month also saw the Blur project’s second airdrop and concerns over wash trading, serving as reminders of the need for vigilance and diligence within the NFT landscape.

Future Trends and Insights: Maturation and Evolution

As the NFT market navigates the horizon of the future, promising insights and trends signal maturation and evolution. Utility-driven NFTs are shifting the narrative towards real-world applications, and cross-platform interoperability is bridging digital realms, integration with DeFi is entering new frontiers, enhanced legislation is fostering a mature landscape, and evolving market infrastructure is tailored to meet diverse needs. These trends indicate a market embracing innovation and transformation, ripe for pioneers to shape its future landscape.

Know More: Legal Challenges & Risks Around NFTs

Major Projects & Events That Shaped the NFT Market in 2023

1. Cryptopunks Resurgence: Record-Breaking Sales

Cryptopunks, the iconic NFT collection, continued to dominate headlines with unprecedented sales in 2023. The market witnessed a record-breaking sale of a Cryptopunk masterpiece fetching a staggering $1.1 million, showcasing these digital artifacts’ enduring allure and value. Several other Cryptopunks followed suit, commanding hefty sums in the hundreds of thousands. This resurgence reiterated the sustained interest and investment potential within the NFT market, setting a benchmark for high-value transactions amid market fluctuations.

2. Jack Butcher Trademark: Thriving Sales and Volume

Another standout project that garnered attention was the Jack Butcher Trademark collection, marked by its impressive sales volume and revenue generation. Boasting 10,000 NFTs sold, the collection garnered an impressive 690 ETH in trading volume, reflecting the market’s appetite for diverse and engaging NFT offerings. This project’s success underlined the diversity of interest and the potential for substantial revenue generation within the NFT space beyond established collections.

3. Herbert W. Franke’s Zentrum Collection: Dichotomy in Performance

Herbert W. Franke’s Zentrum collection made waves in the NFT landscape, showcasing both success and challenges within the market. Selling 222 NFTs within a specific price range, the collection amassed a significant 613 ETH in total revenue. However, the price on the secondary market witnessed a rapid descent, dropping by 45% within a week. This dichotomy highlighted the nuanced nature of NFT market dynamics, where success stories and market challenges coexist, offering valuable insights into price volatility and investor behavior.

4. Blur’s Royalty War Victory Over OpenSea: Marketplace Dynamics

The fierce competition between NFT marketplaces, particularly Blur and OpenSea, unfolded as a “Royalty War” reverberating across the NFT ecosystem. Blur’s triumph in claiming a substantial portion of the royalty market share previously dominated by OpenSea showcased the dynamic nature of marketplace competition. This victory impacted marketplace fees and influenced revenue generation, emphasizing the pivotal role of marketplace dynamics in shaping overall NFT market trends and revenue distribution.

Read More: Top NFT Scams to Avoid?

NFT Trader & Whale Analysis in 2023

Trader Profitability and Behavior

The NFT market in 2023 witnessed noteworthy shifts in trader behavior and profitability. November emerged as a month of resurgence, with approximately 41% of traders in profitable territory. This positive wave mirrored the trends reminiscent of May 2022, indicating a market finding its stability after periods of fluctuation. However, these figures also reflect the market’s volatility, showcasing traders’ challenges in navigating price fluctuations and volatility within the NFT space.

Floor Price Surges and Holding Periods

The top 500 collections experienced a substantial surge in floor prices, elevating by an impressive 42% within a single month. This surge illustrated a collective confidence among collectors and investors, underlining the optimistic sentiments prevalent in November. Additionally, the reduction in the holding period for NFTs from an average of 100 days in October to 18 days in November indicated a shift towards shorter-term holding strategies. This change hinted at traders’ willingness to capitalize on shorter market cycles and adapt their strategies to evolving market conditions.

However, amidst the positive indicators, the average price experienced fluctuations, witnessing a 42% drop since October and settling around $150. These fluctuations added complexity layers to the NFT market’s valuation dynamics. They prompted a closer examination of the factors influencing NFT valuations, emphasizing the need for a deeper understanding of market trends and investor sentiment to navigate the intricacies of pricing dynamics.

Whale Activity and Market Influence

Due to their significant holdings, whales, often influential figures within the NFT market, played a pivotal role in shaping market trends. Their trading behaviors and strategic moves had a discernible impact on market dynamics. Observing whale activity provided insights into potential market trends and sentiment shifts. Understanding their actions and positions became crucial for smaller traders and investors to gauge potential market directions and make informed decisions in response to whale-driven movements.

Learn More: Generative AI and NFTs

Future of the NFT Market Going Forward into 2024

The future of the NFT market holds promise as more and more maturity is coming into the market as a whole. There was a lot of hype around the space, especially during the highs back at the end of 2021 to the start of 2022. But ever since the beginning of the bear market, the sector of the crypto market has taken a beating, and while valuations have been lost, there have been a lot of learnings for the future. Let’s look at some of them:

- Transition to Utility-Driven NFTs: The NFT market is poised for a transformative journey as it enters 2024, transitioning from a focus on collectibles to utility-driven digital assets. The shift towards utility-driven NFTs represents a pivotal evolution, where these tokens move beyond mere collectibles and find applications in real-world scenarios. This paradigm shift will likely see virtual real estate trading, powered by platforms like Decentraland and The Sandbox, gaining further traction. These utility-driven assets are set to bridge the gap between the digital and physical worlds, offering tangible value beyond artistic representation.

- Cross-Platform Interoperability and Seamless Integration: Cross-platform interoperability emerges as a game-changer in the NFT landscape. Protocols like Polkadot and Cosmos, engineering interoperable frameworks, are on the verge of transforming how NFTs traverse across diverse blockchains seamlessly. This development fosters a more integrated digital asset ecosystem and expands opportunities for creators and collectors. The ability to move assets fluidly across various platforms signifies a new era of accessibility and fluidity within the NFT market, enhancing digital assets’ overall utility and value.

- Integration with DeFi: The Financial Frontier: One of the most exciting prospects is the convergence of Non-Fungible Tokens with Decentralized Finance (DeFi) platforms. This groundbreaking integration allows tokenizing real-world assets as NFTs, effectively bridging traditional finance and the crypto world. Utilizing NFTs as collateral for loans or earning interest through DeFi platforms marks a significant step toward financial inclusion and asset monetization. This integration will unlock many financial possibilities, enabling individuals to leverage their digital assets.

- Regulation and Maturation: As the NFT market matures, regulatory frameworks continue to evolve. Governments and regulatory bodies are working towards establishing guidelines to ensure consumer protection, prevent money laundering, and verify the authenticity of digital assets. This enhanced regulatory environment aims to create a secure and transparent ecosystem for NFT participants, fostering trust and stability within the market. Establishing clearer regulations echoes the maturation of the NFT market, providing a more secure landscape for creators, traders, and investors.

- Market Infrastructure Evolution and Diverse Offerings: The infrastructure supporting the NFT market is evolving significantly to cater to diverse needs and preferences. New marketplaces equipped with user-friendly interfaces and robust auction mechanisms are emerging. These developments aim to enhance user experiences and accommodate a broader range of digital assets, transforming the NFT market into a dynamic and inclusive ecosystem. The evolution of market infrastructure reflects a market primed to meet the demands of a diverse clientele, fostering a vibrant marketplace where innovation and creativity thrive.

Conclusion

As the NFT market propels into 2024, it stands at the cusp of transformative evolution. From utility-driven assets to cross-platform integration and the convergence with DeFi, this dynamic landscape promises a future of innovation and inclusivity. With maturing regulations and evolving infrastructure, the NFT market embraces a promising horizon, inviting pioneers to shape its vibrant and diverse ecosystem!

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more