Key Takeaways:

- Institutional Confidence: The surge in Bitcoin futures on the Chicago Mercantile Exchange (CME) indicates strong institutional confidence in Bitcoin price surpassing the $40,000 mark soon.

- Spot ETF Anticipation: The substantial growth in CME’s Bitcoin futures open interest, correlating with Bitcoin price previous all-time high, suggests heightened anticipation for a potential approval of a spot Bitcoin ETF.

- Diversified Investment Approaches: Institutional investors are exploring alternatives like CME Bitcoin options and regulated ETFs in various global regions, seeking leveraged exposure while avoiding the high costs associated with futures contracts.

- Derivatives Metrics Analysis: Although CME Bitcoin futures’ substantial growth indicates bullish sentiments, metrics such as the basis rate and BTC options delta skew don’t reflect excessive short-term optimism, casting doubts on immediate ETF approval expectations.

The recent surge in Bitcoin futures traded on the Chicago Mercantile Exchange (CME) indicates a compelling bet by investors on Bitcoin price reaching the $40,000 price threshold. The annualized premium for Bitcoin futures catapulted to 34% on November 28, triggering speculation among analysts about the imminent approval of a spot BTC ETF.

Institutional investors have showcased a keen interest in Bitcoin. The shift became evident on November 10 when CME Bitcoin futures outpaced Binance’s BTC futures markets in size. Bitcoin derivatives metrics suggest that these investors exhibit robust confidence in Bitcoin’s potential to surge beyond $40,000 shortly.

Read More: Bitcoin Price Prediction

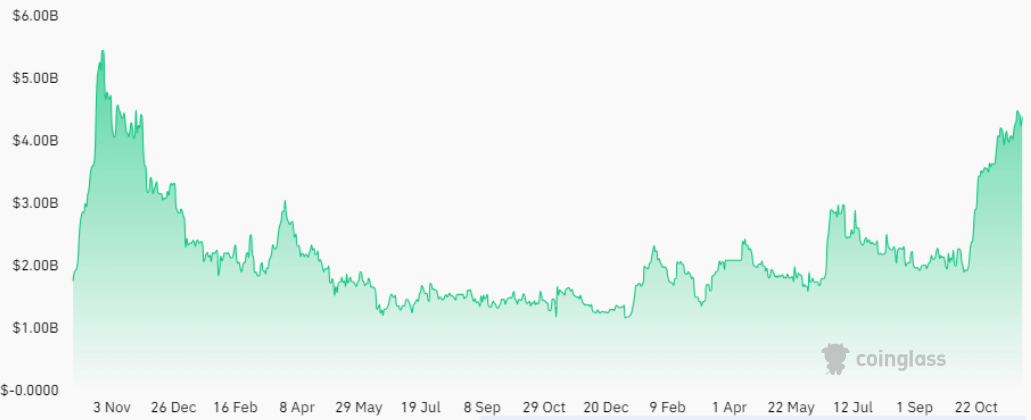

CME’s current Bitcoin futures open interest has surged to $4.35 billion, marking the highest level since November 2021, coinciding with the previous all-time high of $69,000 for Bitcoin price. This substantial growth hints at heightened institutional interest. However, the surge prompts questions about whether it substantiates further price gains.

The remarkable growth in CME’s BTC futures open interest, a staggering 125% increase from $1.93 billion in mid-October, is largely linked to the anticipation surrounding the approval of a spot Bitcoin exchange-traded fund (ETF). Yet, it’s crucial to note that this movement doesn’t necessarily correlate directly with market makers’ or issuers’ actions. Crypto analyst JJcycles highlighted this hypothesis in a social media post on November 26.

Institutional investors looking to avoid the high costs of futures contracts have diversified options. They might opt for CME Bitcoin options, which require less capital but offer similar leveraged long exposure. Additionally, regulated ETF and exchange-traded notes (ETN) trading in regions like Canada, Brazil, and Europe provide viable alternatives.

While it might seem somewhat risky to assume that major asset managers are making bold moves using derivatives contracts pending a decision from the US Securities and Exchange Commission (SEC), expected in mid-January, the remarkable surge in CME Bitcoin futures open interest is clear evidence of institutional investors setting their sights on the crypto.

The surge in CME’s Bitcoin futures activity has been steady, but the most remarkable development is the spike in the contracts’ annualized premium (basis rate) on November 28. Typically, monthly futures contracts in neutral markets trade with a 5% to 10% basis rate to account for longer settlement times, a phenomenon known as contango. However, that day, the annualized premium surged from 15% to 34%, stabilizing at 23%. A basis rate above 20% signifies substantial optimism, indicating a strong willingness from buyers to pay a considerable premium to establish leveraged long positions.

During these eight hours on November 28, Bitcoin price rose from $37,100 to $38,200. However, determining whether the spot market or futures contracts influenced this surge is challenging, as arbitrage between the two occurs in milliseconds. Instead, traders should focus on BTC option market data to confirm heightened interest from institutional investors.

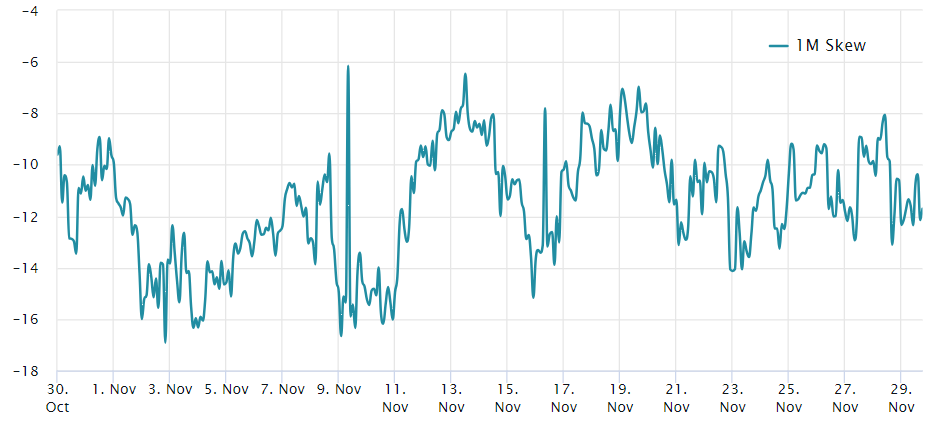

As depicted above, the 30-day BTC options 25% delta skew has remained consistently below the -7 % threshold and stood near 10% on November 28. This data corroborates the bullish sentiment among institutional investors using CME Bitcoin futures, raising doubts about the theory of whales accumulating assets ahead of a potential spot ETF approval. In essence, derivatives metrics do not indicate excessive short-term optimism.

Despite Bitcoin price hovering around $38,000, bullish trends continue challenging resistance levels as long as the hope for a spot ETF approval remains a driving force.

This surge in CME Bitcoin futures activity and the associated bullish sentiment underscores a significant shift in institutional interest in the crypto market. The growing anticipation for a spot Bitcoin exchange-traded fund (ETF) approval propels this trend. However, it’s imperative to consider associated risks and exercise caution amidst changing metrics and volatility.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more