Table of Contents

ToggleKey Takeaways:

- BTC Price: A Tug of War: Bitcoin price action around the $40,000 mark indicates a battleground for bulls and bears. Despite reaching $38,000 and higher spikes, a micro-range has confined BTC price movement, leaving market participants guessing about the next major move.

- Monthly Close Dilemma: As the month concludes, Bitcoin price faces a critical juncture. The range-bound behavior around $37,000-$38,000, untested liquidity levels, and the allure of $40,000 shape a contentious scenario, creating anticipation for the monthly close’s impact.

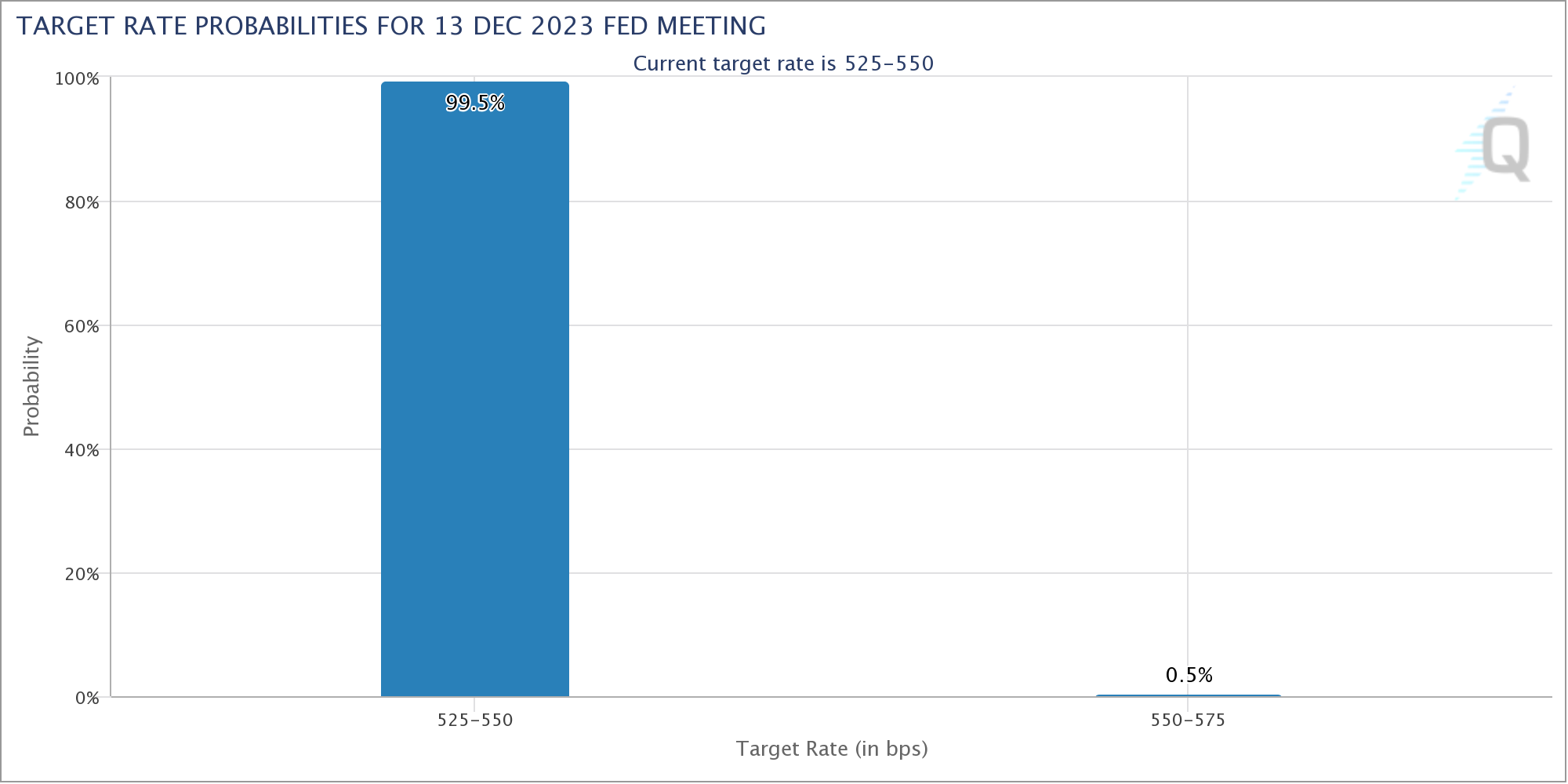

- Macroeconomic Triggers: The upcoming Federal Reserve data on inflation, GDP, and interest rate policy plays a substantial role. These indicators promise potential volatility in Bitcoin and traditional markets, hinting at significant price shifts based on economic revelations.

- Institutional Perspective: The Grayscale Bitcoin Trust (GBTC) nears price parity with BTC, marking an institutional shift and ETF anticipation. The convergence suggests growing optimism for an ETF approval, potentially transforming institutional Bitcoin interest.

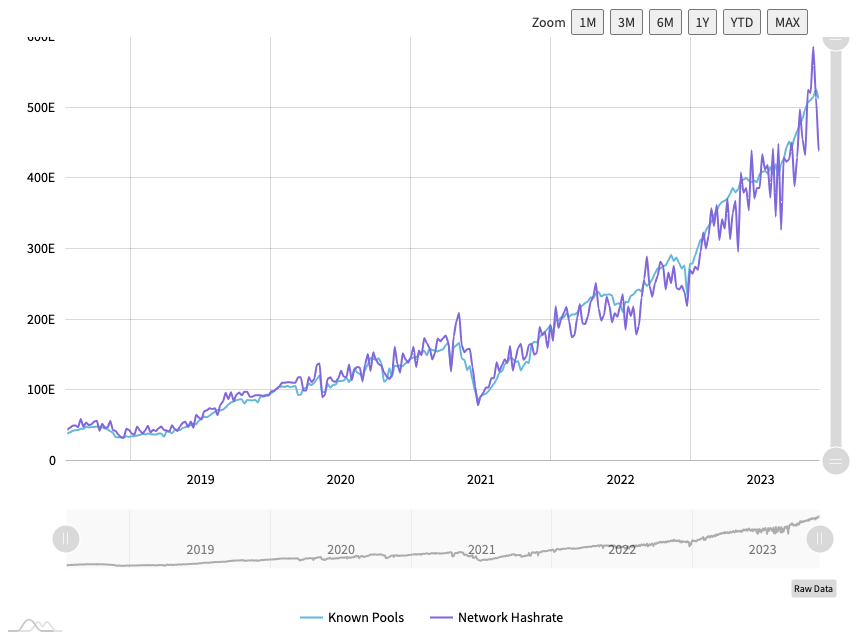

- Mining Dynamics and Exchange Balances: Record-breaking hash rates signal miners’ confidence, emphasizing long-term profitability. Concurrently, dwindling Bitcoin balances on exchanges amidst regulatory shake-ups hint at a shift in market dynamics and potential scarcity.

Bitcoin price action continues to draw attention as it displays signs of potential upward momentum. This week holds pivotal moments for the short-term trajectory of BTC price as multiple factors converge to influence its price dynamics.

Monthly Close and Trading Dynamics

The recent action in Bitcoin price has highlighted a battle between bulls and bears, with both camps ensnared within a tight trading range. The monthly close is a significant milestone as untested liquidity levels surrounding $40,000 persist amid stubborn resistance. Traders are grappling with the challenge of breaking free from this narrowing corridor, indicating a heightened sense of uncertainty in the market.\

Read More: Bitcoin Price Prediction

Market Sentiments and Liquidity Levels

Analysts closely monitor liquidity blocks positioned above and below the current spot price. Key liquidity levels at $37,000 and $38,000 are crucial in determining market sentiment. The evolving sentiment hinges on the behavior of spot takers—whether they continue to offload their positions or prompt momentum toward higher price levels. Liquidity levels and market dynamics are important in deciphering Bitcoin price trajectory.

Impact of Fed’s Macro Data

The U.S. Federal Reserve’s impending release of crucial economic indicators, notably the third-quarter Gross Domestic Product (GDP) and October’s Personal Consumption Expenditures (PCE) figures, has drawn significant attention from Bitcoin traders and traditional market participants alike. These figures are barometers of the country’s economic health and are integral to shaping the Federal Reserve’s future interest rate policies.

The data release holds substantial weight, as it is expected to provide key insights into the pace of economic recovery, inflationary pressures, and consumer spending trends. Historically, these figures have wielded considerable influence over financial markets, impacting traditional assets and cryptos like Bitcoin. Any surprises or deviations from market expectations in these metrics could trigger considerable volatility, potentially translating into significant price movements for Bitcoin.

GBTC Institutional Interest

The Grayscale Bitcoin Trust (GBTC) notably reflects institutional interest in the crypto space. Its journey toward price parity with Bitcoin presents a significant narrative shift. Previously, GBTC traded at a considerable discount compared to its net asset value (NAV), sometimes nearly 50% lower. However, the recent shift toward an 8% discount to NAV showcases a changing perspective within institutional investors. This shift in price suggests growing confidence and a changing narrative surrounding Bitcoin’s institutional investment landscape.

One of the pivotal reasons behind this shift revolves around anticipating a US-approved Bitcoin exchange-traded fund (ETF). The current market sentiment implies an expectation for the imminent approval of an ETF, reflected in the dwindling discount in GBTC. This ETF approval signifies a substantial milestone for Bitcoin’s broader acceptance and integration into traditional financial systems.

Additionally, the approaching transformation of GBTC into a spot ETF adds weight to this narrative. While specific dates for this transformation may be after the new year, the potential approval aligns strategically with significant milestones in the crypto space.

Additional Read: Can Bitcoin Halving Initiate a Bull Run in 2024?

Bitcoin Hash Rate and Exchange Balances

Bitcoin hashrate has surged to record highs, reflecting miners’ unwavering confidence despite the price being 50% lower than its peak. Concurrently, known miner wallet outflows to exchanges are at their lowest in seven years, indicating reduced selling pressure. Moreover, declining BTC balances on exchanges, nearing levels last seen in April 2018, hint at a shift in trader sentiment and behavior.

These developments paint a vivid picture of Bitcoin’s current landscape, offering insights into the intricate elements shaping its price movements. The current Bitcoin price direction remains ambiguous as the market anticipates potential catalysts and macroeconomic data. However, these key insights provide valuable clues into the factors that could significantly impact its price trajectory in the near term.

Conclusion

In conclusion, the struggle around the $40,000 mark holds immense significance for the Bitcoin price trajectory this week. Traders navigate through a landscape of uncertainty, analyzing various indicators and market dynamics for insights into potential movements in BTC price. The convergence of these factors defines the evolving narrative around Bitcoin, underscoring the critical nature of this juncture in the crypto market.

This comprehensive analysis provides invaluable insights into the factors shaping Bitcoin’s price journey, catering to traders and enthusiasts navigating the complexities of the current market landscape.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more