Key Takeaways

- Resistance at $38,000: Bitcoin faces significant resistance around $38,000, stalling its recent surge. Yet, this hurdle doesn’t necessarily mark the end of its upward trend, hinting at potential further movement.

- Consolidation Nuances: While breaching $38,000 proves tough, shallow declines during this phase suggest consistent demand for “buying the dip,” forming an ascending triangle pattern, indicating a potential breakout.

- Ascending Triangle Formation: Technical experts identify this pattern as often leading to bullish breakouts, occurring roughly 77% of the time, potentially extending the Bitcoin price uptrend, although false breakouts remain possible.

- Market Sentiments and Predictions: Anticipation builds around a breakout, echoed by experts projecting Bitcoin to surpass $40,000 and possibly aim for $45,000 post-breakout.

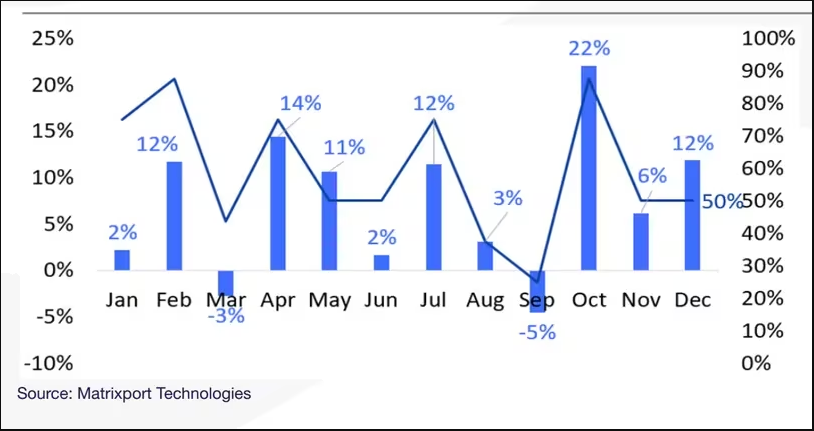

- Seasonal Trends and Technical Analysis: Historical data suggesting strong December performances, averaging a 12% gain over eight years, and other technical indicators hint at fresh buying.

Bitcoin, the pioneer of cryptos, has encountered a significant hurdle in its recent surge, facing resistance around the $38,000 mark. However, this apparent stall in its upward momentum might not signify an end to the ongoing uptrend.

Examining the price action during this consolidation phase provides a more nuanced perspective. While breaching the $38,000 level has proven challenging, subsequent declines have been shallow and short-lived. This unique behavior hints at a consistent demand to “buy the dip” within the consolidation, shaping what experts identify as an ascending triangle formation on the price chart.

Read More: Bitcoin Price Prediction

Alex Kuptsikevich, a senior market analyst at FxPro, pointed out,

“Bitcoin bounces around in an ascending channel, hitting its three-week upper resistance of $37.8K on Wednesday evening. An intensifying sell-off thwarts attempts to heat the price, but the pullbacks have become less deep over the past three weeks, suggesting the building up of bullish sentiment.”

This ascending triangle formation often culminates in a bullish breakout, extending the preceding uptrend. According to technical analysis experts, upward breakouts happen roughly 77% of the time, indicating a high likelihood of Bitcoin price continuing its ascent. However, caution is warranted, as false breakouts, where prices momentarily breach resistance before retracting, are also possible.

Market sentiments resonate with the possibility of a breakout, with experts like Markus Thielen, head of research and strategy at Matrixport, envisioning Bitcoin price surpassing $40,000 and potentially aiming for $45,000 post-breakout.

Market data showcases a notable shift in sentiment, with short positions unwinding and a renewed interest in bullish bets. This transition often exerts upward pressure on prices, hinting at a potential breach of the long-held resistance at $38,000.

Furthermore, seasonal trends in the crypto market offer an additional optimistic outlook. Historical data reveals that Bitcoin price tends to perform robustly in December, boasting an average gain of 12% over the past eight years. Matrixport’s data supports this, suggesting a possible push towards $42,000 based on this seasonal metric alone.

From an overall technical perspective, things look pretty optimistic for the king coin. In 2023, Bitcoin price underwent a remarkable journey, experiencing a surge of over 125% and reinforcing its standing as the digital gold standard. The chart depicts a consistent and impressive upward trajectory, showcasing a notable 126% surge from the year’s start, capturing the interest of crypto enthusiasts.

A significant milestone emerged recently: a bullish golden crossover, where the 50-day moving average surpassed the 200-day moving average, signaling optimism regarding Bitcoin’s future price. Rebounding above its 50-day and 200-day moving averages, the Bitcoin price is currently trading above a steadfast upward trendline held for a year, indicating potential support around $35,500. To witness a surge in fresh buying, BTC price needs a clear breakthrough and sustained trading above the $38,000 threshold!

Thus, Bitcoin price’s recent consolidation under the $38,000 mark may not signify the end of its bullish trajectory. The evolving market dynamics and seasonal trends paint a promising picture of Bitcoin’s potential upward movement in the near term.

As Bitcoin price continues to navigate these critical levels, market participants eagerly anticipate a potential breakout, watching closely for signals that could pave the way for the next significant move in the crypto’s price.

Additional Read: How High Can Bitcoin Price go in 2024?

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more