Table of Contents

ToggleKey Takeaways:

- BTC Success, BTG Struggle: While Bitcoin had a strong 2023, Bitcoin Gold (BTG) struggled to gain traction.

- Downward Trajectory: BTG’s price remained on a downward trajectory for most of the year, with sporadic bullish movements.

- Breakout Levels: For a potential turnaround, BTG needs to break the $14 mark, followed by the $16 to $18 range.

- Bullish Scenario: A breakout above $18 could pave the way for a substantial rally, with $35 as a potential target.

- Support at $10: Conversely, if BTG dips below its year-to-date low of $10, it could usher in further bearish sentiment.

Bitcoin Gold Price Technical Overview

- While its bigger cousin, the original crypto – Bitcoin, has had a fairly strong and bullish 2023 so far – Bitcoin Gold price has not had that success.

- BTG price has been on a downward trajectory for most of the year, with a few bullish blips here and there – the biggest one being at the start of 2023. The grey parallel channel on the chart depicts the broader selling pressure on the token.

- Bitcoin Gold price has seen a nearly 5% jump in the past 24 hours – but in the broader picture, as we can observe in the chart above, that jump means little as of writing this article.

- BTG price needs to break out beyond the downward trajectory the token is currently in. Thus, the immediate level for the BTG price to break would be roughly $14 and then eventually the $16 to $18 range.

- A breakout beyond the $18 mark can potentially result in a gradual pull-back rally all the way up to $35, scripting a near 100% rally going forward.

- On the downside, the year-to-date low of $10 would serve as a region of support, breaking down below, which would bring in further bearishness in the token.

Read More: Bitcoin Price Prediction

Bitcoin Gold On-chain Overview

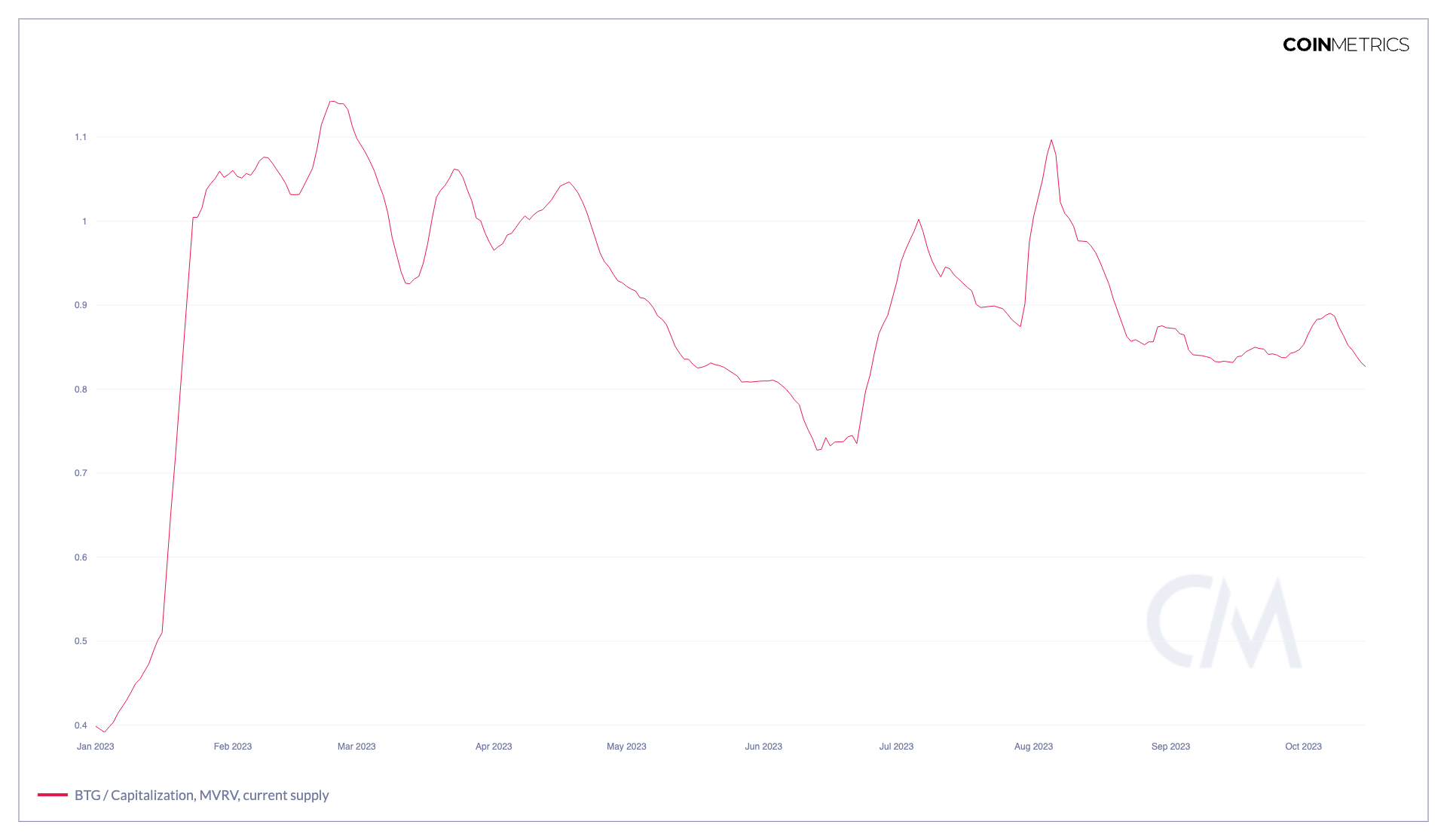

BTG MVRV Ratio Remains Rangebound

The MVRV (Market-Value-to-Realized-Value) ratio for Bitcoin Gold has displayed a rather stable trend for most of the year, with values hovering around 0.8 to 1.1. However, a notable rally occurred at the start of 2023 when the ratio surged from 0.39 to above 1.

The MVRV ratio’s rally in January 2023 suggests a brief period of heightened interest and market activity for Bitcoin Gold. However, the subsequent oscillation between 0.8 and 1.1 could indicate a return to a more balanced and less speculative market sentiment. Investors may have become more cautious, contributing to this range-bound behavior. It’s essential to keep monitoring this ratio for any significant shifts, as it can provide insights into the overall health and stability of the Bitcoin Gold market.

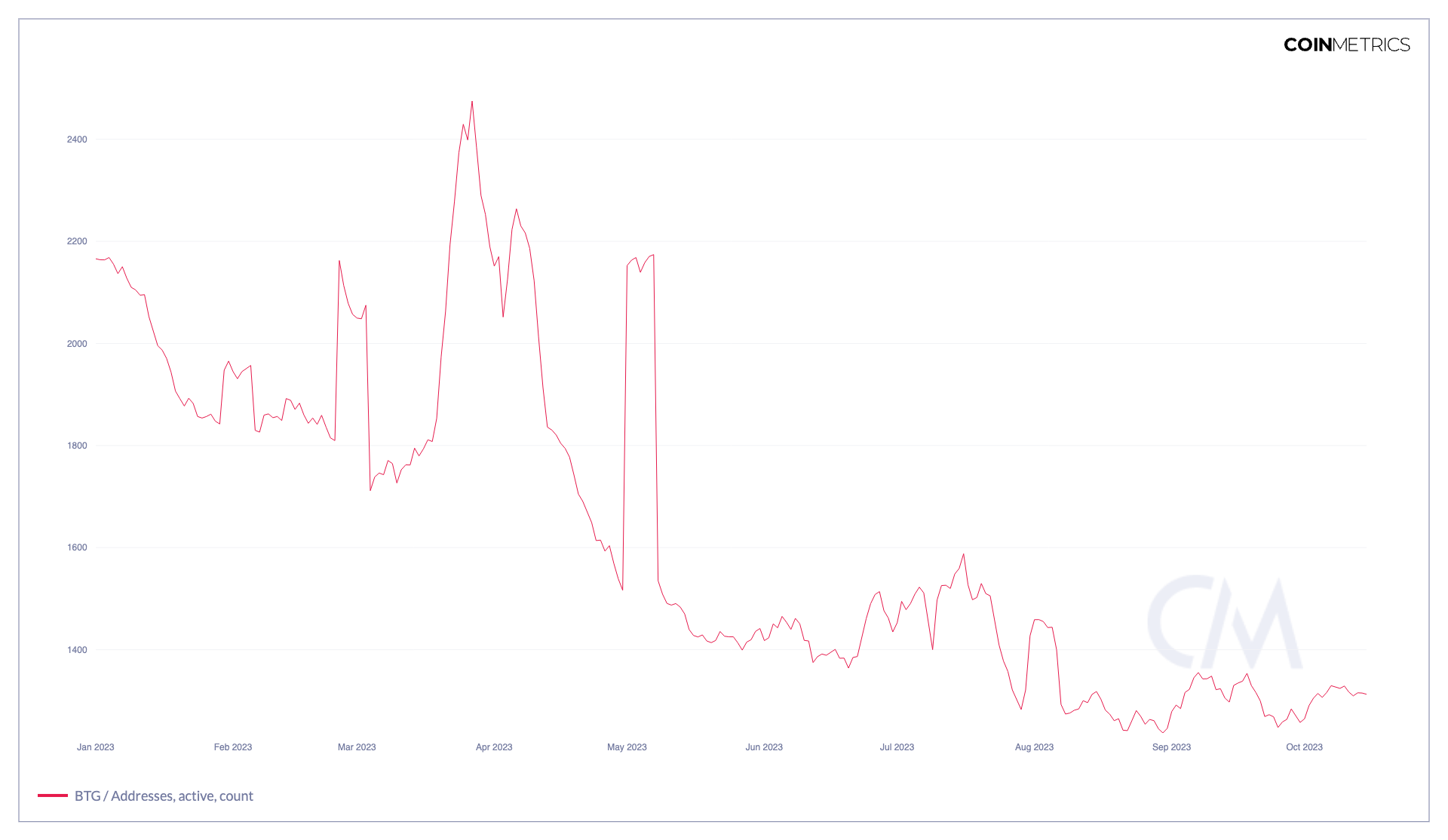

BTG Active Address Count Slides in 2023

The active address count for Bitcoin Gold has experienced a consistent decline throughout the year 2023. At the beginning of the year, in January, BTG had around 2,163 active addresses. It briefly spiked to roughly 2,470 in March. However, it is currently down to under 1,400 active addresses as of the latest data.

The declining trend in Bitcoin Gold’s active address count throughout 2023 suggests a diminishing level of user activity and engagement with the crypto. The peak in March may have been a temporary surge in interest, but it wasn’t sustained. This decline could indicate waning interest or reduced utility for BTG, and it’s a metric to watch for any potential signs of a revival in the coin’s adoption and usage.

Learn More: Bitcoin Cash Price Prediction

Conclusion

Bitcoin Gold’s price faced persistent downward pressure throughout the year, with limited bullish spikes. Breaking the $14 barrier is crucial for potential bullish momentum, with the $18 mark as a significant target. The stability of BTG’s MVRV ratio and declining active address count in 2023 suggest a cautious and less speculative market environment. Monitoring these metrics will provide insights into Bitcoin Gold’s market health and potential for revival.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more