Table of Contents

ToggleKey takeaways:

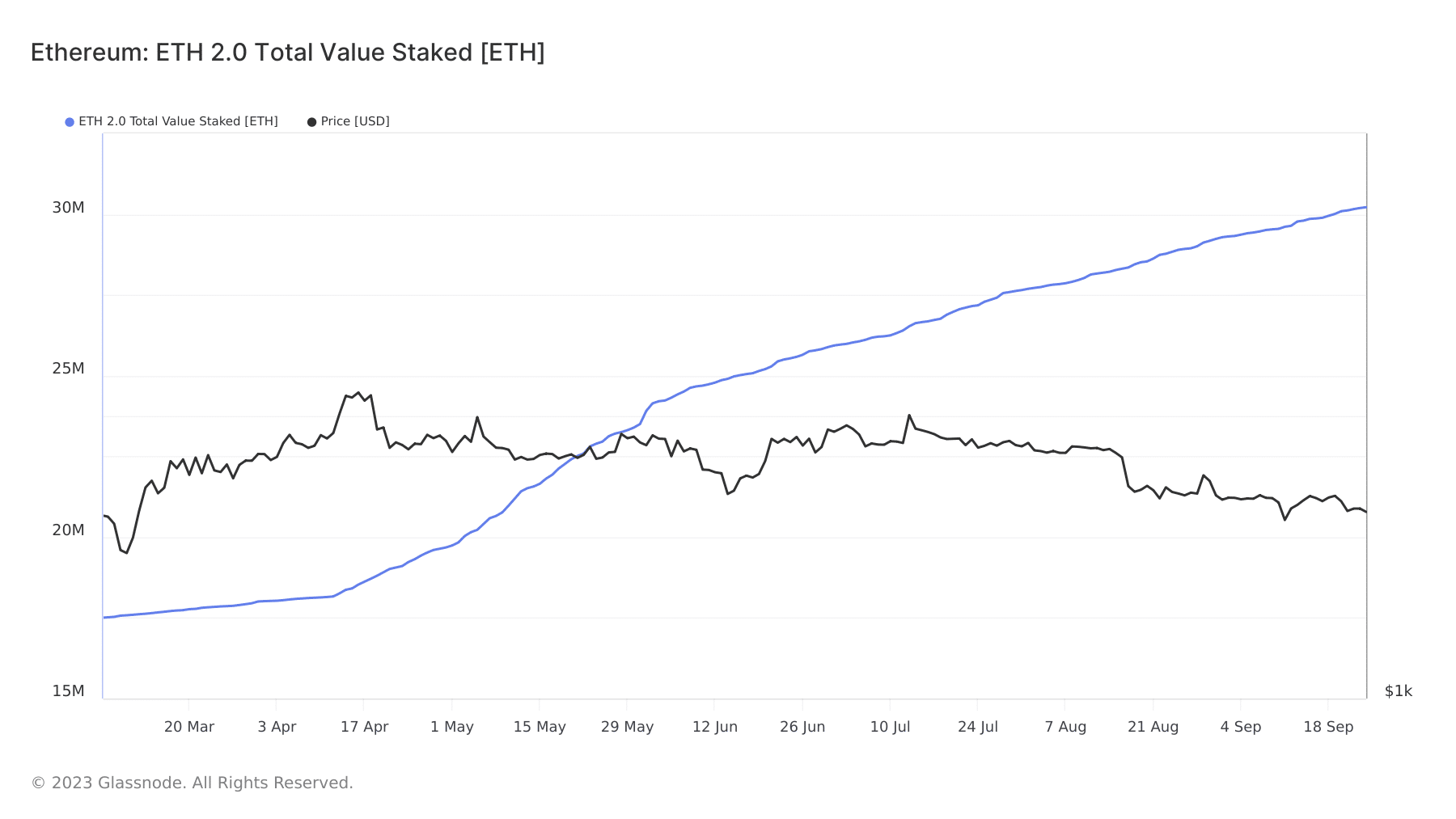

- Ethereum staking has reached an all-time high of over 30 million ETH.

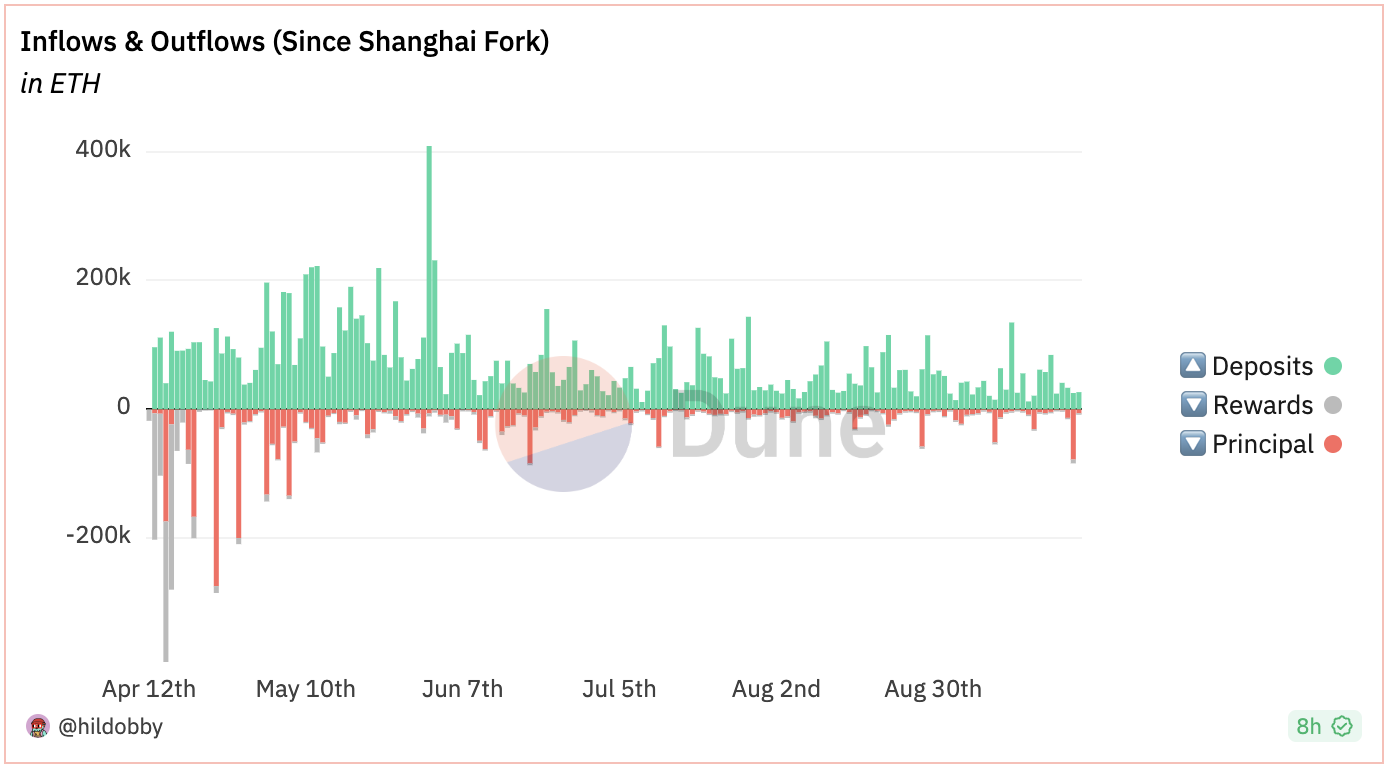

- Exchange inflows have declined as staking activity has increased.

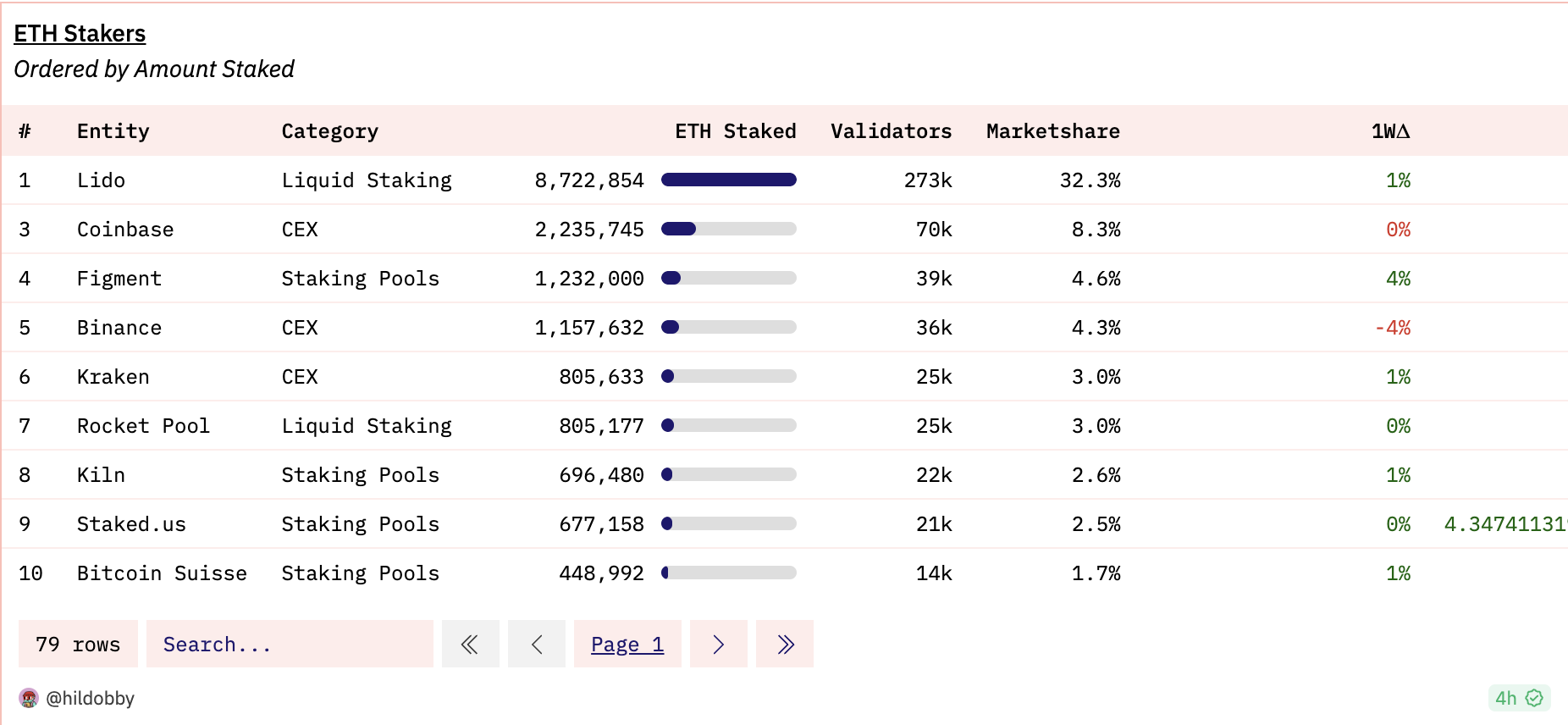

- Lido Finance has emerged as a dominant player in the ETH staking ecosystem, with over 32% market share.

- Lido’s dominance has sparked concerns about security and centralization in the Ethereum ecosystem.

Introduction:

The total amount of Ethereum staked has reached a record high, surpassing 30 million ETH. This is a testament to the growing popularity of staking as a way to earn rewards and support the Ethereum network. At the same time, exchange inflows have declined as staking activity has increased. This suggests that more Ethereum holders are choosing to stake their ETH instead of selling it on exchanges.

Ethereum Staking Hits Unprecedented Levels:

Recent data from Glassnode highlights Ethereum’s staking contract’s continuous growth, reaching an astounding milestone of approximately 30 million ETH staked. This achievement is no stranger to Ethereum, as the staking contract has consistently reached remarkable heights since its inception. At the moment, the stakes have surged beyond 30 million ETH, underlining the enduring appeal of staking in the Ethereum ecosystem.

Noteworthy is the consistent influx of new ETH stakes, showcasing the resilience of this staking trend, even though daily staking activity has witnessed a slight dip recently.

Source: AMBCrypto l Glassnode

Read More: Ethereum Price Prediction

Decline in Ethereum Flow on Exchanges:

In tandem with Ethereum’s staking surge, an observable trend emerges – a decrease in the flow of ETH to exchanges. While a chart from Dune Analytics reveals sporadic ETH inflows to exchanges, these have been outweighed by significant outflows. At the time of writing, the exchange netflow metric showed a positive balance of over 7,000 ETH, but the preceding days witnessed prominent outflows.

Source: Dune Analytics

Currently, the supply on exchanges hovers around 10.7 million ETH, a level not witnessed in nearly half a decade.

Lido Finance’s Dominance:

Lido Finance has emerged as a dominant player in the Ethereum staking ecosystem, with over 32% market share. Lido’s popularity is likely due to its low staking minimums and ease of use. However, its dominance has raised concerns about security and centralization in the Ethereum ecosystem.

Source: Dune Analytics

Additional Read: Will Ethereum Price Ever Reach $10,000?

Conclusion:

Ethereum’s staking ecosystem is undergoing a seismic shift, with records being broken and Lido Finance’s meteoric rise dominating the conversation. The decline in exchange inflows indicates a growing interest in staking as a preferred method of participation in the Ethereum network. However, it also raises questions about the decentralization and security of the ecosystem in the face of Lido Finance’s dominance.

Source: AMBCrypto

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more