Table of Contents

ToggleIntroduction

In the realm of digital assets, a fascinating phenomenon has been observed – the connection between Bitcoin’s scarcity and its potential for a remarkable post-halving rally. The intricacies lie in the halving events that substantially impact the production of new Bitcoins. An analysis of historical trends unveils the role of these halvings in shaping the crypto landscape, elucidating the concept of scarcity and ultimately influencing market dynamics.

Key Takeaways

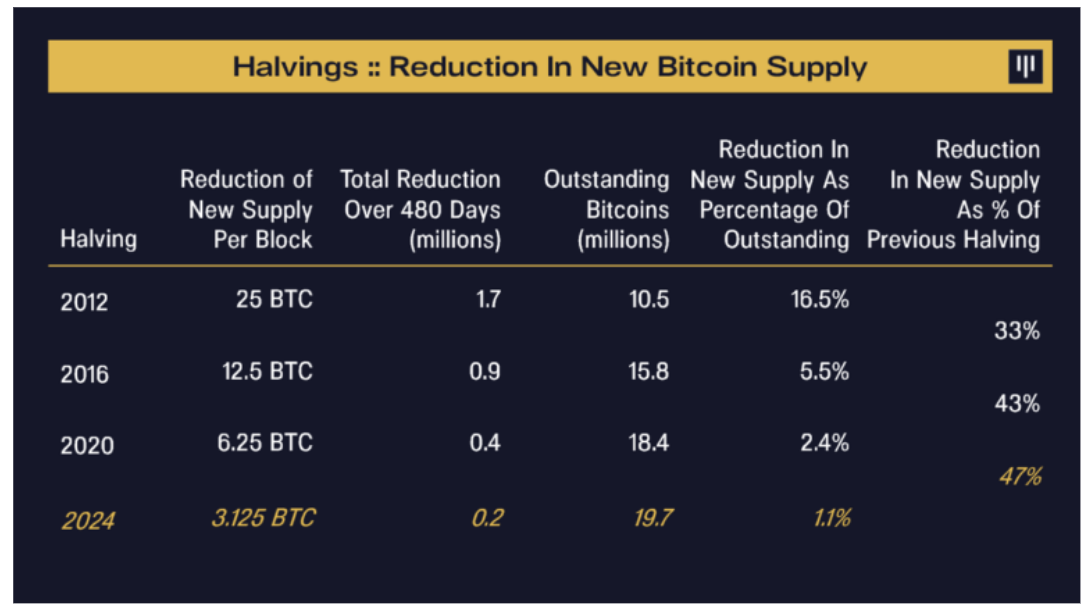

- Halving’s Fundamental Impact: Bitcoin’s halving events are pivotal and transformative in the crypto ecosystem. These events result in a substantial reduction in the rate at which new Bitcoins are introduced into circulation, setting off a series of interconnected changes that reshape the way Bitcoin is perceived and valued.

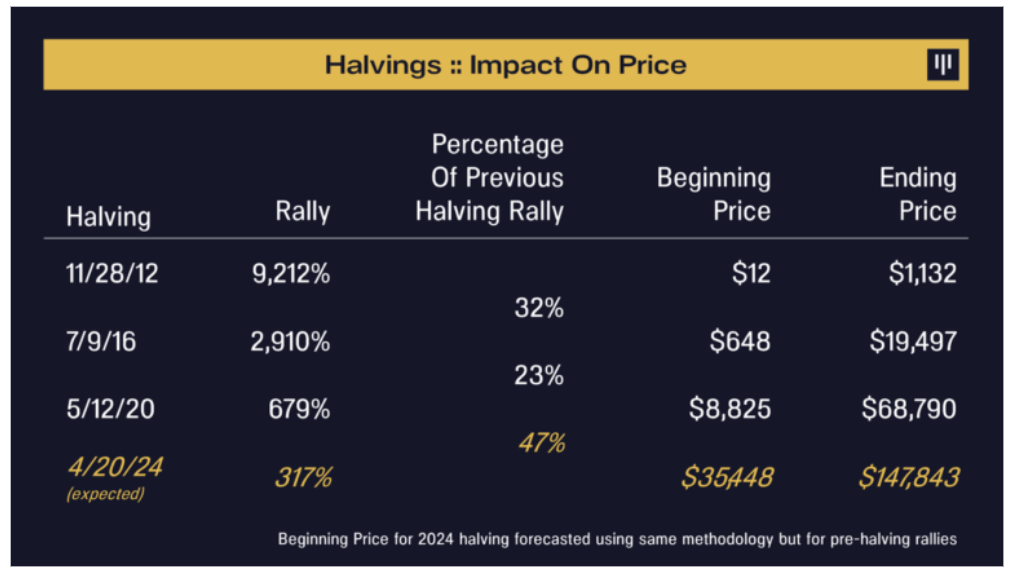

Source: Pantera

- Amplification of Deflationary Traits: The cyclical nature of halvings, occurring at regular intervals, serves to amplify one of Bitcoin’s core attributes – its deflationary nature. With each subsequent halving, the scarcity of available Bitcoins becomes more pronounced. This scarcity, in turn, becomes a defining factor that bolsters Bitcoin’s value proposition in the eyes of investors and users alike.

- Historical Patterns as Indicators: A detailed examination of past halving events through historical analysis uncovers a consistent and notable trend. Specifically, these analyses reveal a marked increase in the magnitude of price rallies following each halving. This historical pattern underscores the potential for a significant surge in the value of Bitcoin in the periods following halving events.

- Projected Growth: Respected within the crypto research domain, Pantera offers an insightful analysis. According to Pantera’s assessment, the dynamics driven by Bitcoin’s inherent scarcity are projected to persist. This persistence is likely to contribute to a substantial price surge of approximately 47% as the 2024 halving approaches. Such projections underscore the anticipation of continued growth based on the principles set in motion by halving events.

Read More: Bitcoin Price Prediction

Source: Pantera

Implications and Conclusion

Bitcoin’s scarcity-driven nature has long been a fundamental aspect of its allure. The halving events, which curtail the influx of new supply, play a pivotal role in emphasizing this scarcity. This intrinsic feature intertwines with the historical trends of the crypto, fostering the potential for significant market rallies following halving events. As the reduction rate approaches the 50% mark – as projected for the 2024 halving – the implications for Bitcoin’s price dynamics are substantial. The intricate balance between limited supply and growing demand sets the stage for a unique market trajectory.

Source: Cryptoslate

Additional Read: Bitcoin Price’s Crucial Support at $25,400

FAQs

What is a Bitcoin halving event?

Bitcoin halving is a programmed event that occurs every 210,000 blocks, reducing the reward miners receive for validating transactions. This process aims to control the issuance of new Bitcoins, ultimately leading to a finite supply.

How do halvings impact Bitcoin's scarcity?

Halvings cut down the rate of new Bitcoin issuance, increasing scarcity. With each halving, the rewards earned by miners decrease, putting a cap on the total supply of Bitcoins over time.

Why does scarcity matter for Bitcoin's value?

Scarcity is a key driver of value in both traditional and digital assets. Limited supply combined with growing demand tends to push prices higher. In the case of Bitcoin, its fixed supply of 21 million coins contributes to its scarcity-driven value proposition.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more