Key Takeaways:

- Spot bitcoin ETFs have been on a tear in recent months, driving billions of dollars in new demand for the crypto asset.

- There are a number of reasons for the surge in popularity of spot ETFs, including their direct exposure to the price of Bitcoin, their liquidity, and their regulation.

- The surge in spot ETFs’ popularity has positively impacted the crypto market, increasing its visibility and legitimacy.

Spot Bitcoin ETFs have been on a tear in recent months, driving billions of dollars in new demand for the OG crypto asset. In fact, according to a recent report by NYDIG, spot ETFs have accounted for over $30 billion in new demand for crypto since their inception.

There are a number of reasons for the surge in popularity of spot ETFs. First, spot ETFs offer investors a more direct way to gain exposure to the price of Bitcoin. This is in contrast to futures ETFs, which track the price of Bitcoin futures contracts. Futures contracts are derivatives, meaning they are not directly correlated with the underlying asset’s price.

Second, spot ETFs are more liquid than other ways to invest in Bitcoin, such as through crypto exchanges. This is because spot ETFs are traded on major stock exchanges, providing a deep liquidity pool.

Third, spot ETFs are regulated by the SEC, providing investors with greater comfort. This is in contrast to crypto exchanges, which are often unregulated.

The surge in popularity of spot ETFs has had a positive impact on the crypto market. It has increased the visibility and legitimacy of Bitcoin and made it easier for investors to gain exposure to the crypto asset.

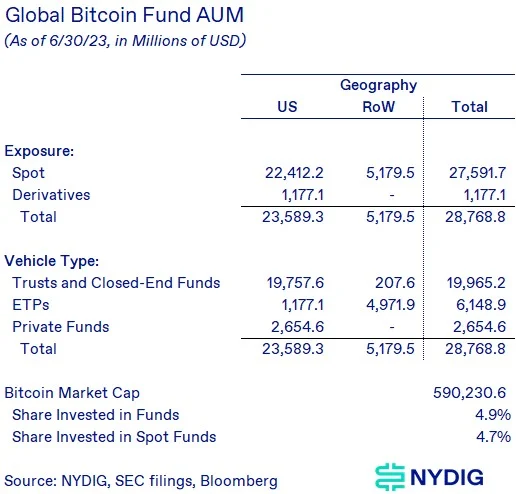

According to NYDIG’s latest data, the total assets under management for Bitcoin amount to $28.8 billion, with $27.6 billion allocated to spot-like products.

Bitcoin, often referred to as digital gold, has drawn comparisons to gold ETFs that emerged in the early 2000s. Interestingly, gold ETFs currently hold a mere 1.6% of the global gold supply, in stark contrast to the 17.1% held by central banks. In comparison, Bitcoin funds hold 4.9% of the total Bitcoin supply.

The data reveals a significant demand disparity between digital and analog versions of assets within funds. While gold funds have amassed over $210 billion in investments, Bitcoin funds trail behind with $28.8 billion, mainly due to the crypto asset’s inherent high volatility.

Additionally, according to the research report by NYDIG, the true potential of a Bitcoin ETF is influenced by a convergence of several factors. These factors include the successful launch of an ETF, a weakening US dollar, the Federal Reserve’s shift towards quantitative easing, and a generational transfer of assets to younger individuals who display a higher inclination towards investing in cryptos.

In a surprising development on July 19, the US Securities and Exchange Commission (SEC) accepted applications from six companies, including BlackRock (BLK.N), for the creation of a spot Bitcoin exchange-traded fund. This marks the initial step in the SEC’s evaluation process to determine whether these latest proposals should be approved.

Additionally, the SEC has officially recognized Bitwise, VanEck, WisdomTree (WT.N), Fidelity, and Invesco (IVZ.N) applications for similar spot Bitcoin ETFs. These proposals have been listed in the Federal Register over the past week.

Read More: Bitcoin Price Prediction

Conclusion

Spot ETFs are a relatively new investment product that has quickly gained popularity among investors. They offer a number of benefits over other ways to invest in crypto, such as direct exposure to the price of bitcoin, liquidity, and regulation. The surge in spot ETFs’ popularity has positively impacted the crypto market, increasing its visibility and legitimacy.

Source: Coincu

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more