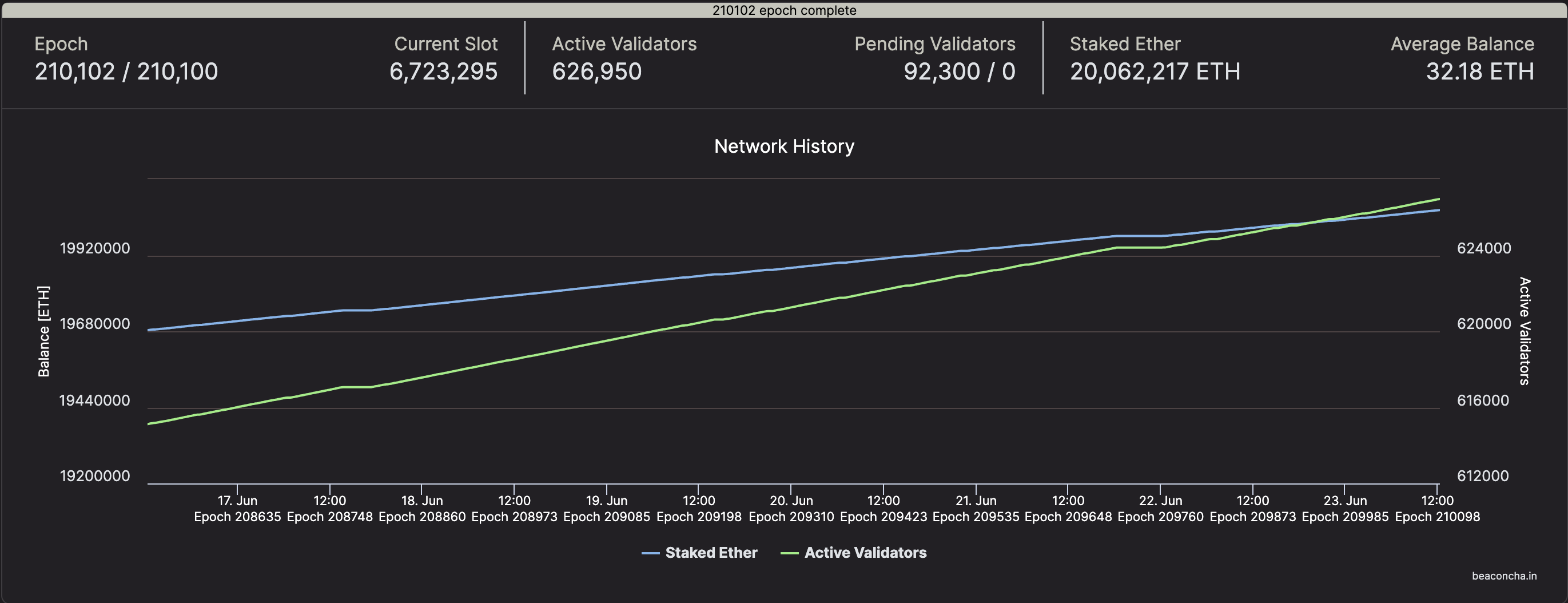

In a significant milestone for the Ethereum network, the total value of staked Ether has reached 20 million ETH. This means that currently, with ETH priced at $1,880, over $38 billion worth of ETH tokens have been staked to secure the largest altcoin network by market cap.

This achievement showcases the growing demand for Ethereum staking, highlighting the increasing confidence and participation of holders in the network’s proof-of-stake (PoS) consensus mechanism. As Ethereum continues its transition to Ethereum 2.0, staking plays a vital role in securing the network and offers attractive rewards for participants.

Additionally, The popularity of staking ETH among validators experienced a significant surge following the Shapella upgrade, despite the opportunity to stake ETH being available since the Ethereum Merge in September last year. This is because with the Shapella upgrade, we finally saw withdrawals being enabled, and thus, the network saw renewed interest.

Read More: Ethereum Price Prediction

The milestone of 20 million ETH staked underscores the rising popularity of Ethereum staking as an investment strategy. Staking involves locking up ETH as collateral to support the network’s operations and validate transactions. In return, stakers receive rewards in the form of additional ETH. With the Ethereum 2.0 upgrade, staking has become crucial in ensuring the network’s security and scalability.

Total Staked Ether | Source: beaconcha.in

Crunching some more numbers – at present, the circulating supply of ETH stands at 120.2 million ETH, with staked ETH accounting for approximately 19.4% of the total ETH on-chain. This percentage roughly corresponds to about 6.4% of Bitcoin’s market capitalization being fully staked in Ethereum.

Thus, the 20 million staked ETH mark represents a significant increase in the amount of ETH being staked. This milestone signals growing confidence among Ethereum holders in the network’s future prospects and the benefits of participating in staking. As more individuals and institutions recognize the potential rewards and long-term value of staking, the amount of staked ETH is expected to continue its upward trajectory.

Ethereum staking is an integral part of the network’s transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. PoS consensus is designed to address some of the limitations of PoW, such as high energy consumption and scalability issues. By staking ETH, participants contribute to the security and efficiency of the network, validating transactions and maintaining the blockchain.

Staking offers several advantages to participants. First, stakers earn additional ETH as rewards for their contribution to the network. These rewards provide a passive income stream and can be particularly appealing in a low-interest-rate environment. Second, staking allows participants to actively engage with the Ethereum ecosystem and play a role in shaping its future. Lastly, stakers contribute to the decentralization of the network, reducing the concentration of power and enhancing its overall security.

This major milestone in staked ETH reflects the increasing interest and participation in Ethereum staking. Ethereum holders are recognizing the potential long-term benefits of staking their ETH, including the opportunity to earn rewards and support the network’s growth. This growing interest can be attributed to several factors.

First, Ethereum 2.0 represents a significant upgrade for the network, addressing scalability concerns and introducing innovative features. As the transition progresses, staking becomes a crucial component of Ethereum’s infrastructure, making it an attractive option for ETH holders.

Second, staking offers a more environmentally friendly alternative to traditional mining. Proof-of-stake mechanisms consume significantly less energy compared to the energy-intensive PoW consensus. As environmental concerns become increasingly important, staking provides a sustainable way for individuals and institutions to engage with the Ethereum network.

Learn More About Ethereum Cancun Upgrade

Furthermore, the potential for capital appreciation adds to the appeal of staking. As Ethereum’s price continues to show positive momentum, participants benefit from both staking rewards and potential price appreciation, further enhancing the overall return on investment.

Looking ahead, the future of Ethereum staking appears promising. As the Ethereum 2.0 upgrade progresses, more ETH holders are expected to participate in staking, leading to a further increase in the amount of staked ETH. This trend could contribute to a positive feedback loop, where a larger staked ETH supply enhances network security and stability, attracting more participants.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more