Table of Contents

ToggleKey Takeaways

- The MATIC price dropped below $0.6 for the first time in 2023 and formed the new bottom at $0.51

- Although the price is recovering, the bearish influence continues to hover over the Polygon price

- The development activity slashes while the supply on exchanges rises, flashing bearish flags over the crypto

Polygon price is currently trading in a challenging situation despite the price regaining value above $0.6. The bulls managed to accumulate some bullish pressure during the previous trading day, but the bears continued to maintain their dominance. Presently, the volatility has slashed heavily as the volume has dried up massively. Therefore, an extended bearish trend may prevail over the MATIC price for longer than expected.

Recently, the regulatory crackdown has heavily impacted the crypto space, with more altcoins facing the heat. Polygon, being one of them, is now way behind in achieving the speculated target of $1. However, the technicals suggest greener days are on the horizon as the bulls are trying to accumulate strength to revive a bullish trend shortly.

Polygon (MATIC) Price Technical Overview

Source: Tradingview

- The MATIC price is trading within a decisive symmetrical triangle and trading very close to the apex of the consolidation

- The price is expected to breakout in the direction of the volume induced which is in the bull’s favor at the moment

- The RSI in the short term has risen from the lowest levels and heading towards the overbought levels, indicating a positive momentum for the MATIC price

- Besides, the ADX determines the strength of the rally is plunging that may keep a lowered pace and volatility until the volume infuses in

- Therefore, the MATIC price could remain to hover between $0.6 to $0.65 for an extended period.

Read More: Polygon Price Prediction

Polygon (MATIC) On-Chain Overview

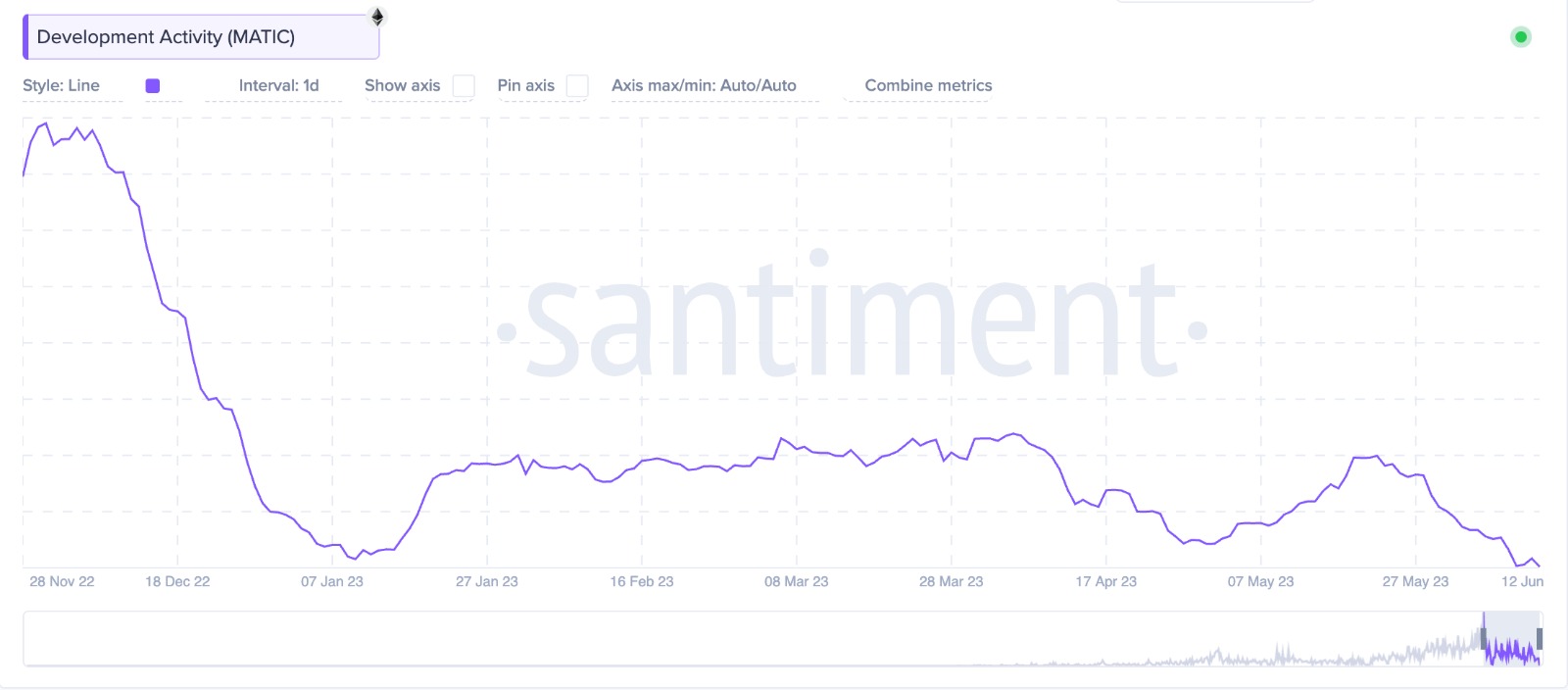

Polygon Development Activity

Source: Santiment

Source: Santiment

Development activity is considered one of the most important metrics that may impact market sentiment in the long term. The activity is recorded on the GitHub repositories in terms of the number of commits submitted. These commits could be the number of queries submitted or responses. It may even hold the number of new features or upgrades submitted to the platform.

The development activity has plunged to ground level at the moment, which indicates the team behind the project is not very attentive to offering a decentralized, workable product. With the drop in the price, the activity also appears to have dropped heavily, which may flash bearish signals for the crypto as the market participants may be less assured of the future prospects.

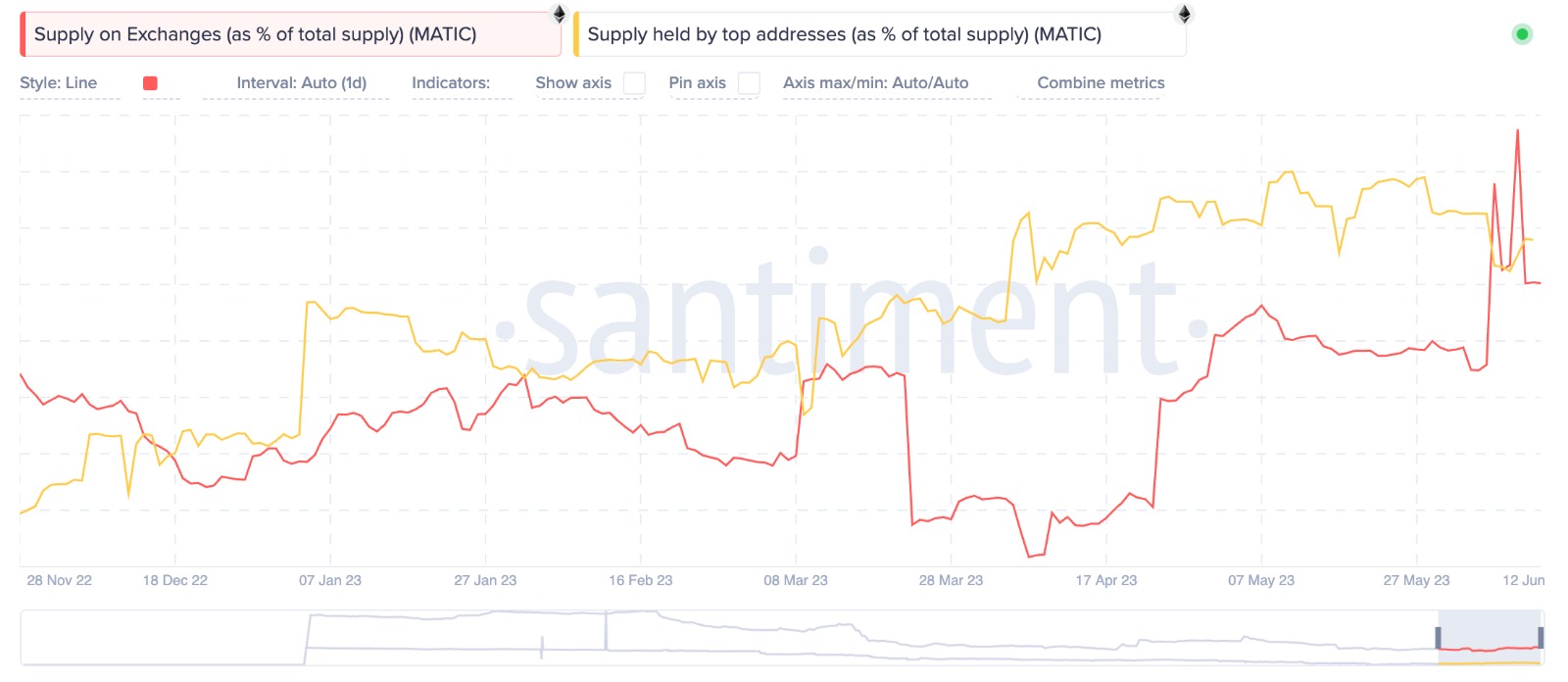

Polygon Supply Held on Exchanges vs Supply Held by Top Addresses

Source: Santimnet

The balances on the exchanges held by the top addresses shed light on the sentiments of the whales and the traders. Whenever the traders want to sell or swap their holdings for other tokens, they transfer them back to the exchanges, which raises the supply on exchanges, similar to the present levels. It is a bearish signal for the crypto, as more traders could be ready to sell MATIC, creating huge selling pressure.

Besides, the supply held by top addresses is also surging pretty high, which indicates the top addresses or whale addresses have been accumulating MATIC for a long time. The rise in these levels may amplify bullish sentiments among market participants, which may further impact the price to a large extent.

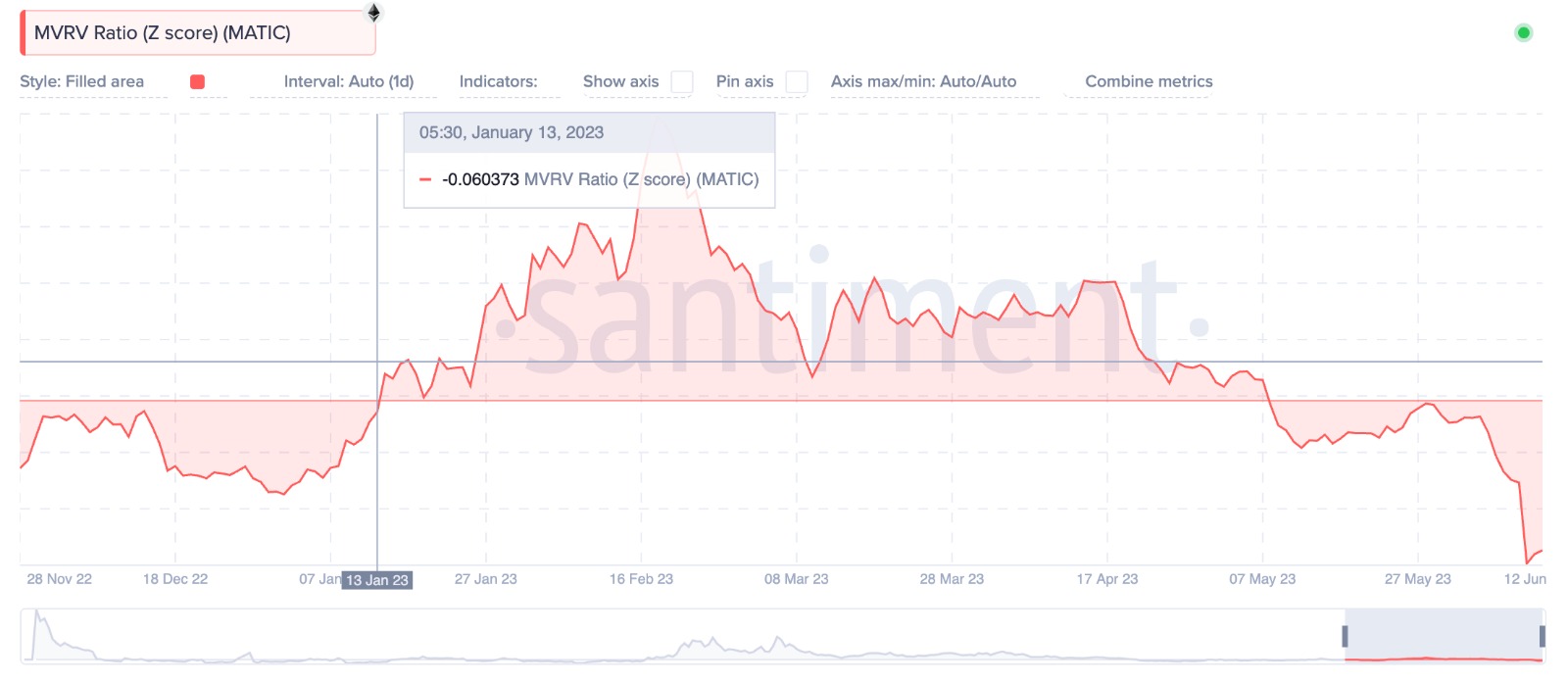

Polygon MVRV-Z score

Source: Santiment

The MVRV-Z score is the ratio between the difference between the market cap and the realized cap and the standard deviation of the market cap. The Z-score tells when the token is trading below its price, which may be a good buy, and when the price is entering bubble territory, indicating a good sell.

Presently, the MVRV-Z score has plunged heavily to negative levels, indicating the bearish momentum hovering over the MATIC price. The traders may soon fall into a FUD and begin to mount selling pressure very soon. This may drag the MATIC price towards new lows in the coming days.

Additional Read: Arbitrum Price Prediction

Concluding Thought

The Polygon (MATIC) price has been trading under an acute bearish influence after displaying significant strength during the first quarter of the year. With the fresh regulatory crackdown, the crypto space appears to be in dire straits as the prices of the major crypto assets, including MATIC, are consolidating within narrow regions. Unfortunately, the price may continue to remain consolidated for a while until the bullish momentum kicks in.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more