Table of Contents

ToggleKey Takeaways

- Tether has recovered billions lost in market cap following the Terra Luna crash of 2022, with its market cap touching an all-time high.

- On Thursday last week, the USDT market cap reached $83.2 billion dollar with a reported Q1 net profit of $1.48 billion.

- Tether has announced the first round of $1 billion investment in Renewable energy sources to support sustainable Bitcoin mining operations in El Salvador and building a 241 MW capacity renewable energy generation park- “Volcano Energy” in Metapán.

How does USDT Tether Work?

USDT, issued by Tether, is a stablecoin pegged to the fiat currency U.S. dollar, at a 1-to-1 ratio. This means for each USDT token in circulation; there is an equal amount of cash reserve backing it. This backing mechanism ensures the stability of USDT value, making it a safe investment as compared to volatile crypto like Bitcoin(BTC), Ethereum(ETH), etc. For this, Tether maintains a reserve of cash, corporate bonds, loans, and investments, allowing users to exchange fiat for USDT tokens. Furthermore, the USDT token total supply is adjusted by minting and burning tokens in correspondence to prevailing market demand.

Why did Terra Luna crash?

On May 12, 2022, the algorithmic stablecoin TerraUSD-UST experienced deviation in its value following the liquidation of $285 million worth of UST tokens on Curve and Binance exchange. Terra maintains the stability of the UST peg through a peg mechanism involving Terra native coin, LUNA. When the UST price falls, UST tokens are burned, and LUNA coins are minted. Conversely, if the value of UST rises up, LUNA coins are burnt, and new UST tokens are minted.

The massive liquidation of Binance and Curve caused a deviation of UST price from $1 to $0.68 and a halt in the Terra Luna blockchain network. These circumstances created panic among investors, resulting in large redemptions, which caused the huge crypto crash of 2022. Following the situation, other stablecoins also broke from their dollar value peg, with USDT market cap declining to $65 billion in two months.

Know More: Terra Luna Crash Explained

Q1 for Tether

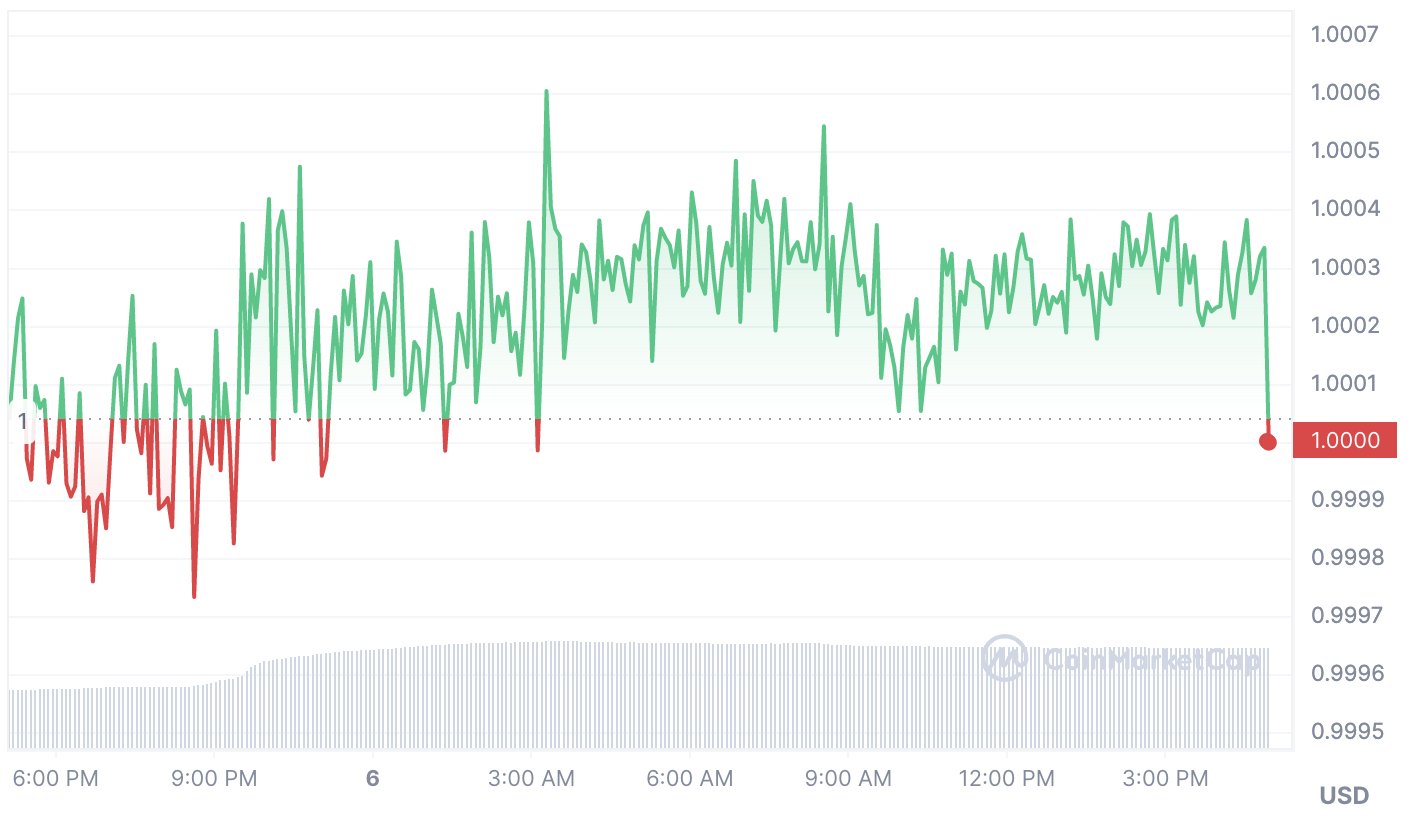

Tether has successfully managed to recover its $20 billion lost market cap in the TerraUSD crash last year. As of June 2023, the Tether USDT market cap is standing at an all-time high of $83.23 billion, surpassing the previous market cap high set in May 2022.

Source: CoinMarketCap

Tether reported a net profit of $1.48 billion in the first quarter of 2023, with an upsurge in its reserve of $ 2.44 billion. Current Tether reserves have 85% of its investment in cash, cash equivalents, and other short-term deposits.

Tether USD₮ Reaches All-Time High, Surpasses Previous Market Cap High of $83.2Bhttps://t.co/Vxs5fbDQ4j pic.twitter.com/YbxWBWjmwd

— Tether (@Tether_to) June 1, 2023

In the last month, Tether announced 15% of its profits would be invested in Bitcoin, which will increase Tether’s Bitcoin holding from the previously reported 2% of the $80 billion total reserve.

Additional Read: USDT vs USDC

Tether recovery post Tether USD crash in 2022

Though USDT Tether has been part of various controversies and criticized for lacking transparency and objection to enough reserves to back its one-to-one peg, Tether displayed significant strength during market turbulence and has re-established its reputation. Its industry-leading transparent practices and continuous resilience in the face of market volatility have proven Tether as a trustworthy platform.

Paolo Ardoino, CTO of Tether, said in a statement, “Today’s numbers demonstrate that people want access to financial freedom, and when given that access, they will make use of it,” Tether has solidified its position as a safe stablecoin with its compliance and transparency mechanism, while other stablecoins are still struggling to recover.

FAQs

Tether remains at a dollar value peg by maintaining its reserve sufficient to back up, circulating USDT with an equivalent value of fiat currency. The Terra community is standing strong and continually working on proposals for ecosystem development and new mechanism design for the coin. All with the goal of reviving the platform from the huge downturn of 2022.How does Tether stay on $1?

How is Terra going to recover?

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more