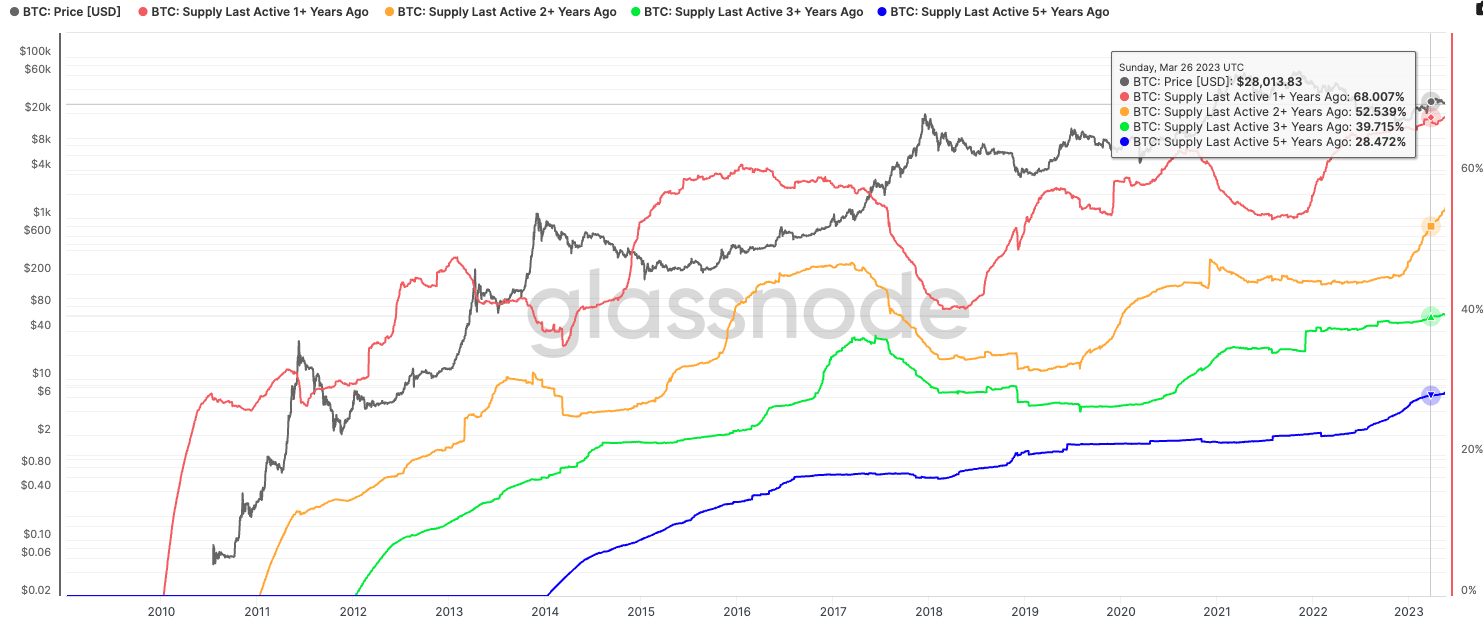

The concept of HODLing, a term derived from a misspelling of “hold” in the crypto community, refers to the practice of holding onto cryptos for an extended period rather than engaging in frequent trading. Recent data from Glassnode reveals an intriguing trend in the Bitcoin market, with a record-breaking 68% of BTC being held for at least one year. This article will explore the significance of this HODLing trend, its implications for the market, and the potential reasons behind it.

The Growing HODLing Trend

Bitcoin investors are demonstrating an increasing preference for long-term holdings, as indicated by the rising proportion of BTC held for extended periods. Glassnode’s data shows that 55% of Bitcoin has been held for at least two years, and an impressive 40% has been held for three years. This shift in behavior suggests that investors are becoming more confident in Bitcoin’s long-term value proposition and are willing to withstand market volatility for potential future gains.

The prevalence of HODLing in the crypto market is generally seen as a bullish signal. When a significant portion of BTC remains dormant, it implies that investors are opting to hold onto their assets rather than sell them. This long-term holding mindset contrasts with the prevailing trend in the U.S. stock market, where investors frequently engage in shorter holding periods. The Bitcoin HODLing trend suggests a belief among investors in the long-term potential and value of Bitcoin, which can contribute to increased price stability.

Read More: Bitcoin Price Prediction

BTC Supply | Source: Glassnode/CoinDesk

Sean Farrell, head of digital assets research at FundStrat, notes that being a long-term holder has become more popular over time. However, there are exceptions during periods of market exuberance. In such cases, investors who purchased Bitcoin during price dips may decide to sell their older coins to capitalize on enthusiastic buyers. This behavior reflects the dynamic nature of market sentiment and the potential impact it can have on the HODLing trend. He mentioned,

“The trend is bullish insofar it means that higher prices are ahead in this cycle and any reticence to sell from current HODLers could result in a mini-supply squeeze”.

Analyzing long-term holder supply metrics may not necessarily provide short-term price signals, as it’s challenging to gauge immediate market movements based solely on HODLing data. However, the current HODLing trend suggests the potential for higher prices in the current market cycle. The reluctance of existing HODLers to sell their BTC holdings could result in a supply squeeze, putting upward pressure on prices. This scenario presents an opportunity for traders and investors to carefully assess market dynamics and anticipate potential price movements.

Glassnode’s report also highlights the Long-Term Holder Supply, which refers to coins held for longer than 155 days. This metric has reached a new all-time high, with approximately 14.46 million Bitcoin falling into this category. The increase in the Long-Term Holder Supply is attributed to coins acquired shortly after the FTX failure, transitioning into long-term holder status. This data further reinforces the growing trend of Bitcoin HODLing and underscores the faith investors have in the crypto’s future prospects.

Thus, the Bitcoin HODLing trend, with a remarkable 68% of BTC held for over a year, demonstrates the increasing confidence and conviction of investors in the long-term potential of Bitcoin. This behavioral shift signifies a departure from frequent trading and a more patient approach to investment in the crypto market. While the HODLing trend does not offer immediate price signals, it suggests a positive sentiment regarding future price appreciation. Traders and investors should consider this trend as one of the factors influencing market dynamics and evaluate the potential implications for their investment strategies. As Bitcoin continues to evolve and gain wider acceptance.

Additional Read: Over 1 Mn Addresses Now Hold 1 BTC Or More!