While the beginning of the month of April 2023 had been a strong one across the crypto market, with Bitcoin taking leaps and bounds in terms of market cap and dominance – Ethereum too had been catching up pretty quickly. Especially post the Ethereum Shanghai Upgrade that went live successfully on April 12, ETH prices managed to gain strength and rallied rapidly to reach 11-month highs of $2100.

But over the course of the past week, the crypto market has seen some struggle on the upside with Bitcoin hitting a stiff resistance at the $30,000 mark while at the same time, Ethereum too facing strong supply at $2100. Now, ETH price has retreated to $1850 in line with the overall crypto market cap, amid news of increasing inflation numbers from the UK and regulatory woes.

As of writing this article, ETH price is at about $1830 and could break down below this at any point in time and there is increasing fear regarding a further price correction. There is reason to question the potential upside from current levels as the past 6 days have seen over 13.5% correction in ETH price and at the same time over $150 million worth of leveraged ETH Futures long positions have been liquidated between April 19 to as of writing.

Read more: Crypto Market Slumps as BTC Price & ETH Price Falls

Ethereum Witnessing Dip in Total-Value-Locked (TVL) in DeFi

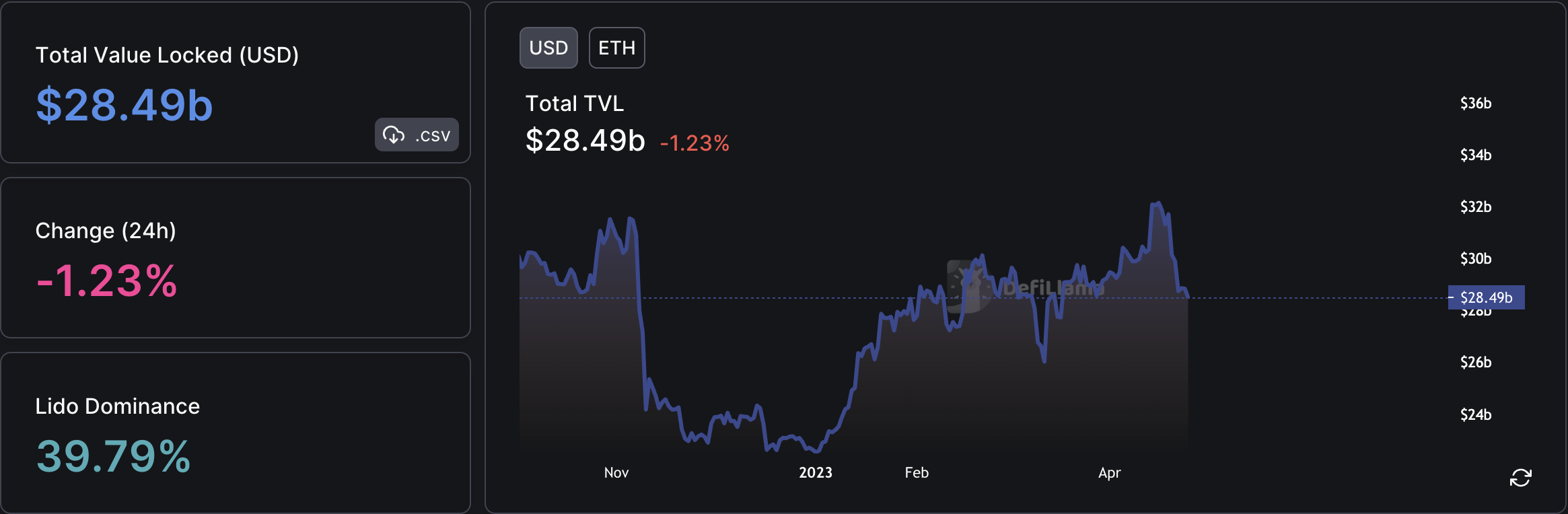

Alongside the correction in the price of Ethereum’s native token, ETH, the largest smart contract platform by market cap also saw a dip in the total-value-locked (TVL) in DeFi – falling from around $32 billion around April 16 to now around $28.5 billion. This indicates a potential situation where there is a decreasing interest in the use of Ethereum’s tokens for the time being as more and more people are looking to withdraw their funds.

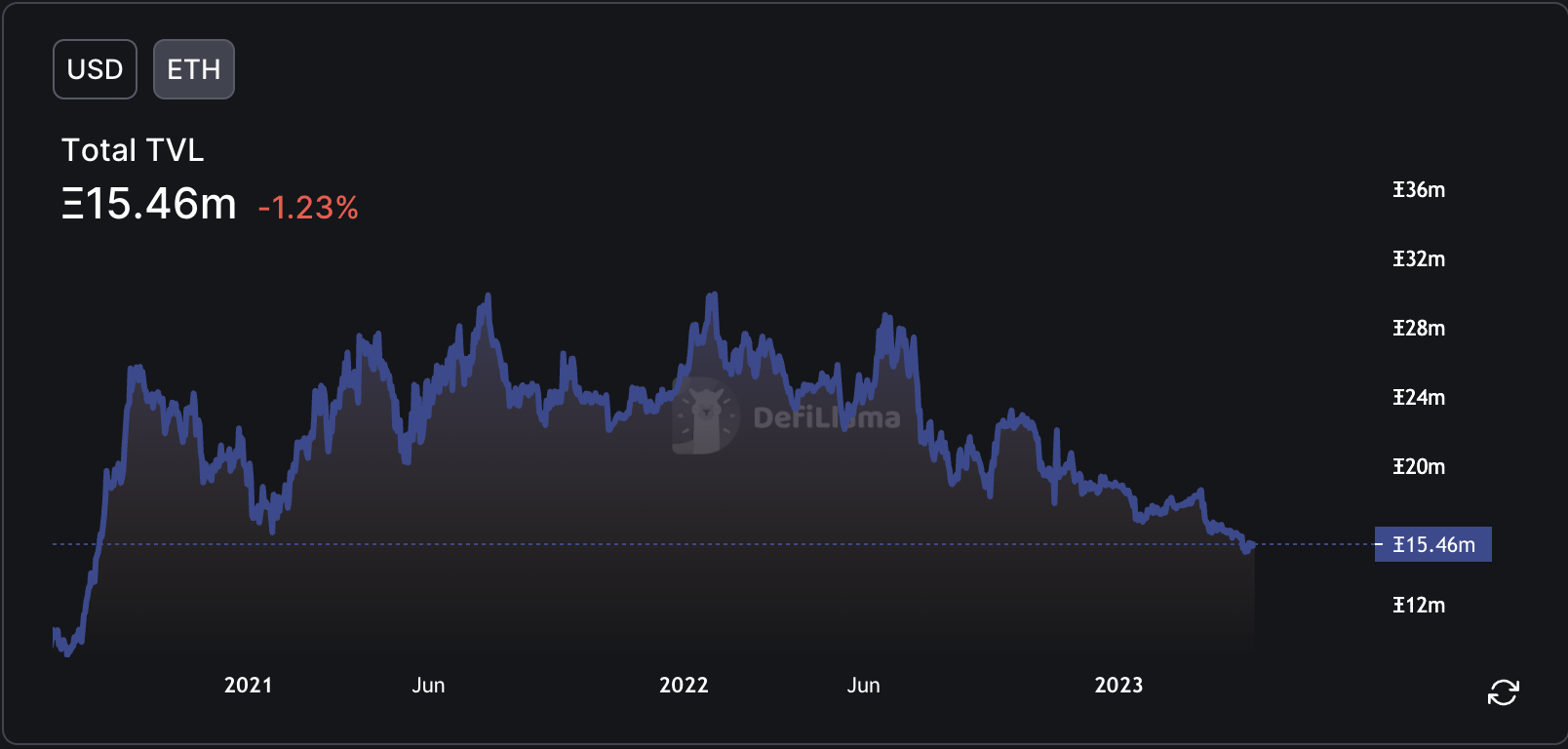

Additionally, total deposits on Ethereum’s smart contracts on Ethereum has also plunged to their lowest point since August 2020! This excludes the effects of native Ethereum staking, which recently unlocked withdrawals – but rather only looks at value staked on dApps built on Ethereum. According to data from DefiLlama, this value has fallen from around 28 million ETH back in June 2022 to around 15.5 million ETH as of writing this article.

Additional read: Ethereum Price Prediction

Futures & Options Traders are Hinting at Bearishness

Professional and more seasoned traders from the crypto derivative markets, especially the futures and options markets are also hinting at an overall bearish video. One good indicator to look at is the put-to-call ratio, which attempts to decipher the underlying sentiment of the options traders in the market.

Traders use put options to either take a bearish position by buying a put option or have a neutral to bullish outlook by selling a put option. On the other hand, traders use call options to either take a bullish position by buying a call option or have a neutral to bearish outlook by selling a call option. There are various strategies that indicate the overall sentiments from the options market, thanks to the nature of the derivatives market itself.

According to data from The Block, the current put-to-call ratio is at about 0.47, and that has been on a rising trajectory since the beginning of the year. ETH’s put/call ratio (marked in red) was at about 0.24 at the beginning of 2023 but is now around 0.47 at the time of writing this article, which indicates a sharp increase in the put OI in the market and also a potential drop in the call OI for ETH option contracts.

Thus overall, things look to be moving towards a slightly bearish scenario from the options point of view too and thus a more careful approach to the crypto markets can be a wise idea.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more