Table of Contents

ToggleKey Takeaways:

- The Synthetix price underwent a significant upswing and soared beyond the crucial resistance, flashing necessary bullish signals

- As the fractals have just flipped from the bearish influence the price is believed to maintain a fine upswing in the coming days

- The exchange supply rises flashing bearish signals while the rising network growth indicates the growing adoption of the token

Synthetix, a DeFi liquidity provider, underwent a magnificent recovery in the past few days and sliced through the psychological barrier at $2.7. Despite a bearish close for the first quarter of 2023, the price rose well and rebounded after marking interim lows around $2.25. Now that the price has soared beyond $3, clearing the crucial levels at $3.5 may be the prime target that may occur in a few days.

In a recent update, Synthetix’s platform has launched an incentive program aiming to amplify the trading activity on the Optimism network. The program allocates 200,000 OP tokens as rewards weekly in Synthetix Perps which may continue for 17 weeks after a 3-week ramping period.

1/6 📢 Synthetix Optimism Trading Incentives will be live tomorrow! 🎉

Those using Synthetix Perps integrators can now earn their pro-rata share of 200,000 $OP per week for 17 weeks.

Learn more in this thread or this blog post 👇🧵https://t.co/qFF3Iqe6te

— Synthetix ⚔️ (@synthetix_io) April 17, 2023

The trading rewards will begin at 50,000 OP for the first week, which may rise to 200,000 OP. The eligibility depends on the trading score, which is calculated by considering the total trading fees, excluding the execution fees, which determine how much he may receive from weekly rewards. Besides, Synthetix launched V3 in February on Ethereum Mainnet and Optimism, which will be gradually released in the coming months.

Read more: Synthetix Price Prediction

Synthetix (SNX) Technical Overview

Source: Tradingview

- The SNX price is trading along the lower trend line and recently bounced from the lower support aiming to test the upper resistance

- The RSI is soaring high, while the ADX displayed a bullish divergence. Therefore, the price may flutter within the narrow ranges for a while

- As the price reaches the apex of the ascending triangle a significant upswing may be expected, slicing the major resistance

- However, the bulls are required to maintain some strength, or else a breakdown from the ascending triangle may invalidate the bullish thesis

Synthetix On-Chain Overview

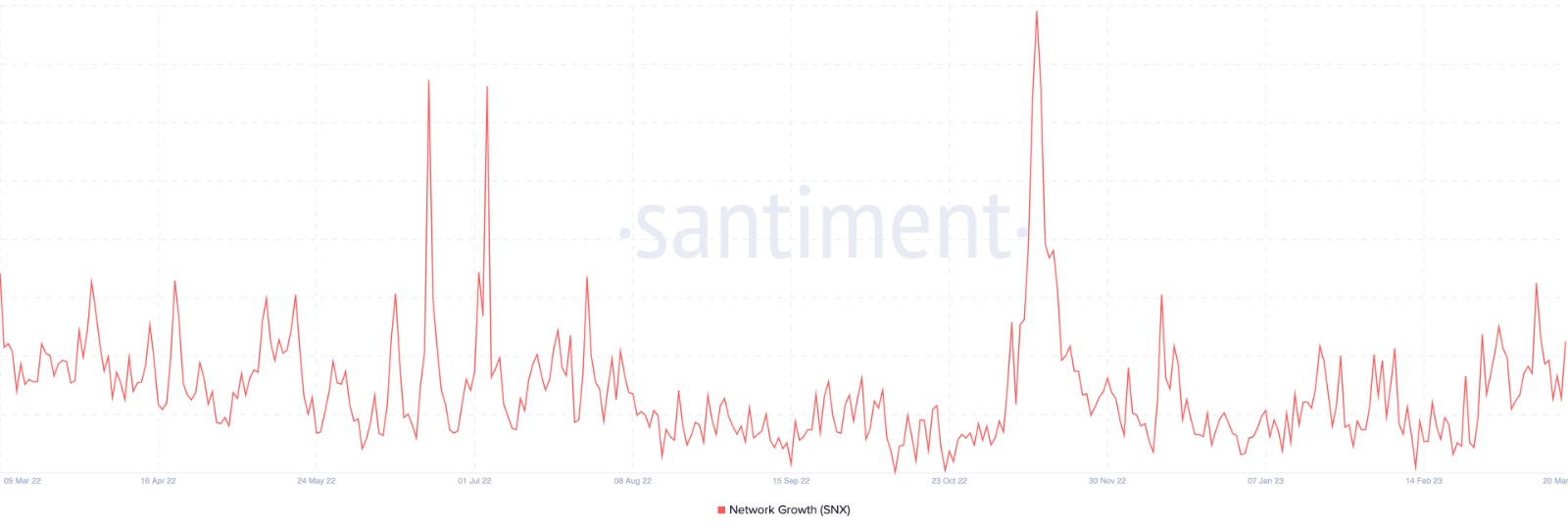

Synthetix Network Growth

Source: Santiment

The network growth is very similar to the daily active address, but only the transactions of the new address are considered. It is the number of new addresses that transacted the token for the first time. It usually indicates user adoption over time, which can be considered to know whether the project is gaining or losing traction over time.

The network growth of Synthetix maintained a lower trend from the beginning but has begun to rise notably in the past few days. It indicates that more new addresses have been formed every day, indicating a rise in the adoption rate that may further impact the price positively.

Synthetix Supply on Exchanges vs Supply on Top Held Addresses

Source: Santiment

The supply on the exchanges is nothing but the collective reserve balance of all the exchanges. This indicates the liquidity present on the exchanges, which may ease the buying & selling process. Besides, the availability of liquidity on the platform may slash demand, which may further drag the price lower. It happens when the balance on the exchanges rises, as the traders usually transfer back their tokens to the exchanges, intending to either sell or swap the token.

Alongside, the supply held by the top addresses can be considered the whale addresses, as they hold more than 1% of the entire circulation. The rise in the levels indicates the bullish sentiment among the whales, which may turn the market bullish as the retail traders tend to follow the whales. Conversely, if the balance drops, it indicates that either the whales have stopped accumulating or have begun to liquidate. This may further circulate bearish sentiments among the participants.

Synthetix MVRV Ratio

Source: Santiment

The MVRV ratio is the comparison between the market capitalization of the token and its realized capitalization to get the fair value of the token. The fair value determines whether the current price is undervalued or overvalued, and depending on this, the next move of the token may be determined.

If the current price is above the fair value, then the price is considered overvalued, which may attract a short-term pullback as the traders tend to extract some profits. Besides, when the price drops below the fair value, it is considered undervalued, which may attract liquidity and create the possibility of a massive rebound.

Additional read: Uniswap Price Prediction

Concluding Thought

Synthetix’s price has been largely bullish since the beginning of 2023 but has manifested extreme price actions in the past few days. Although some of the technical indicators are flashing bearish signals, the bulls appear to have maintained their strength and may push the prices toward higher targets.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more