Table of Contents

ToggleKey Takeaways:

- The Ethereum price surges extremely high, displaying a reverse trend post the Shanghai upgrade and surpassing the crucial resistance levels

- The bullish momentum accumulates which may maintain a healthy upswing for the second-largest crypto in the long-term

- The social sentiments soar high along with a huge drop in the supply of exchanges, flashing massive bullish signals for the crypto

The most awaited moment occurred, the Ethereum Shanghai upgrade which enabled the withdrawals of the staked ETH from the ETH 2.0 Beacon chain. Although huge ETH was withdrawn within just 24 hours of deployment, the price of Ethereum maintains a fine upswing of more than 5% at the same time. Furthermore, the second-largest crypto is manifesting extreme strength climbing above $2000.

No sooner than Shapella upgrades its social engagements soar high with a huge jump in the user activity that has pushed the price beyond the crucial resistance. The explosive move in ETH price was mainly catalyzed by the upgrade and a significant recovery in the star crypto, Bitcoin. The ETH price soared high beyond $2100, and an acute rise in social media activity with more than 395 million mentions on the various social media platforms.

Ethereum (ETH) Technical Overview

Source: Tradingview

- The ETH price is trading along the lower trend line within an ascending triangle and is currently testing one of the pivot resistance levels

- The ADX or the average directional index is maintaining a fine upswing without undergoing massive spikes, indicating the ETH price could soar steadily, with a minimal bearish interference

- The price may hover within the resistance zone for a while and quickly rise beyond the crucial resistance beyond $2400 in the short term

- Although the possibility of the bearish reversal is slightly lower, a breakdown below $1900 may invalidate the bullish thesis

Additional Read: ETH Price Prediction

Ethereum (ETH) On-Chain Overview

Ethereum Supply on Exchanges vs Supply Held by Top Addresses

Source: Santiment

The supply on the exchanges indicates the balance reserves of all the exchanges collectively. It is a usual practice that traders transfer their tokens back to the exchanges when they have to sell or swap the tokens for some other token. This is when the balance on the exchanges increases. However, the levels have dropped heavily which indicates the bullish sentiments prevailing among the market participants as they tend to hold the token for a long time ahead.

Besides, the supply held by the top addresses indicates the balance held by the whales as they usually hold more than 1% of the circulating supply. The supply held by these addresses increases when the whales constantly accumulate the tokens and drop at the times when they either stop accumulating or liquidate them which may create FUD within the market.

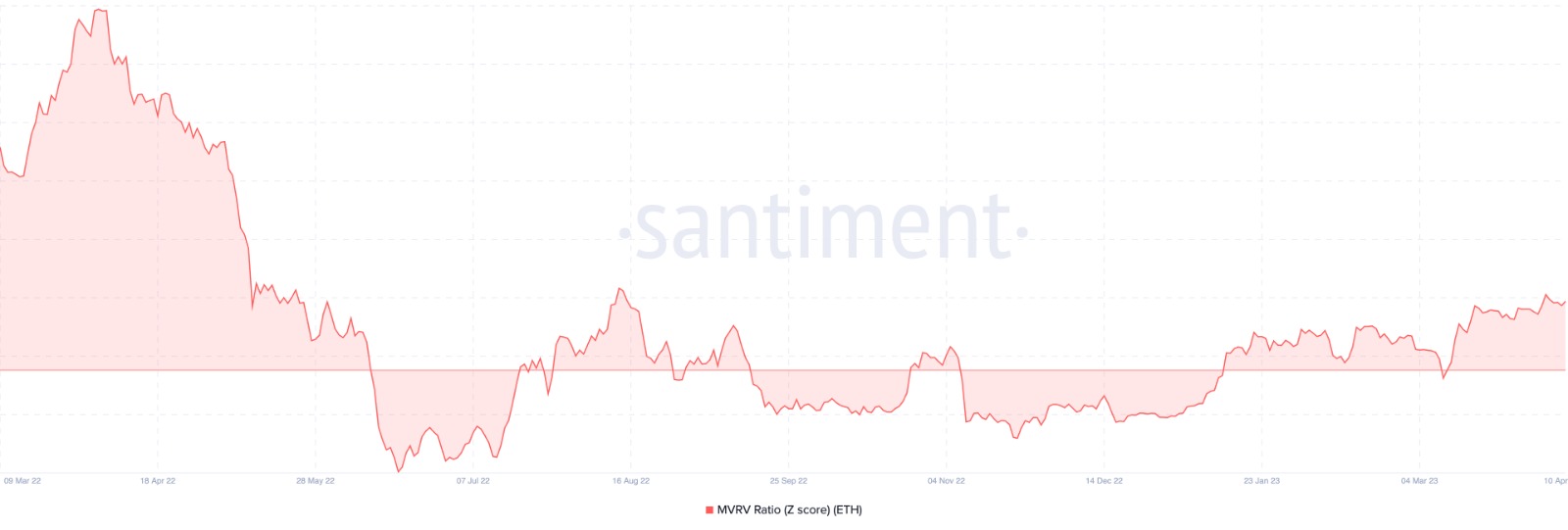

Ethereum MVRV-Z Score

Source: Santiment

The MVRV-Z score is the difference between the total market capitalization and the realized market capitalization which is divided by the standard deviation of the market capitalization. The Z-score is used to determine whether the current price is undervalued or overvalued. If the current levels are below the Z-score, the token is considered as undervalued.

In the present case, the MVRV-Z score has surged and hovered within the bullish regions indicating the price is gaining value and soon may hover within the overvalued regions. Here, the token could be prone to attract the bears who may extract the profit and slash the prices lower.

Read on: Ethereum Merge, Explained

Concluding Thought

Ethereum Shanghai upgrade proved to be the major catalyst in rising the ETH price beyond $2000 levels. Although the social sentiments for the second-largest token have soared extremely high, the minor jump in the MVRV-Z score may raise concerns. However, the chart movements indicate that the price could be primed for a massive breakout very soon.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more