Crypto Market turns bullish as the US Bank turmoil intensifies, Surge in Bitcoin & Ethereum Prices

As the US banking sector faces increasing turmoil, the crypto market is rising to unprecedented heights. Interest is being driven to new highs as investors seek out alternatives to traditional banking. With the US banking system facing numerous challenges, the crypto market offers the potential for high returns with lower risks. Get the latest on the crypto market and its potential to weather the storm of US banking turbulence.

Table of Contents

ToggleKey Takeaways:

- Bitcoin price and Ethereum price have underwent a massive price action in the past few days gaining more than 30% each and marking their respective yearly highs

- With the recent upswing the global crypto market cap has now approached a step ahead to hit $1.2 trillion as it stands at $1.18 trillion

Crypto Market Today at a Glance

| Global Crypto Market Cap | $1.18T |

| Rise/Fall in Crypto Market Cap | +1.42% |

| Total Crypto Market Volume | $55.89 billion |

| Total DeFi Volume | $4.45 billion |

| Bitcoin Price | $28,119.28 |

| Bitcoin Dominance | 46.3% |

| Ethereum Price | $1,792.10 |

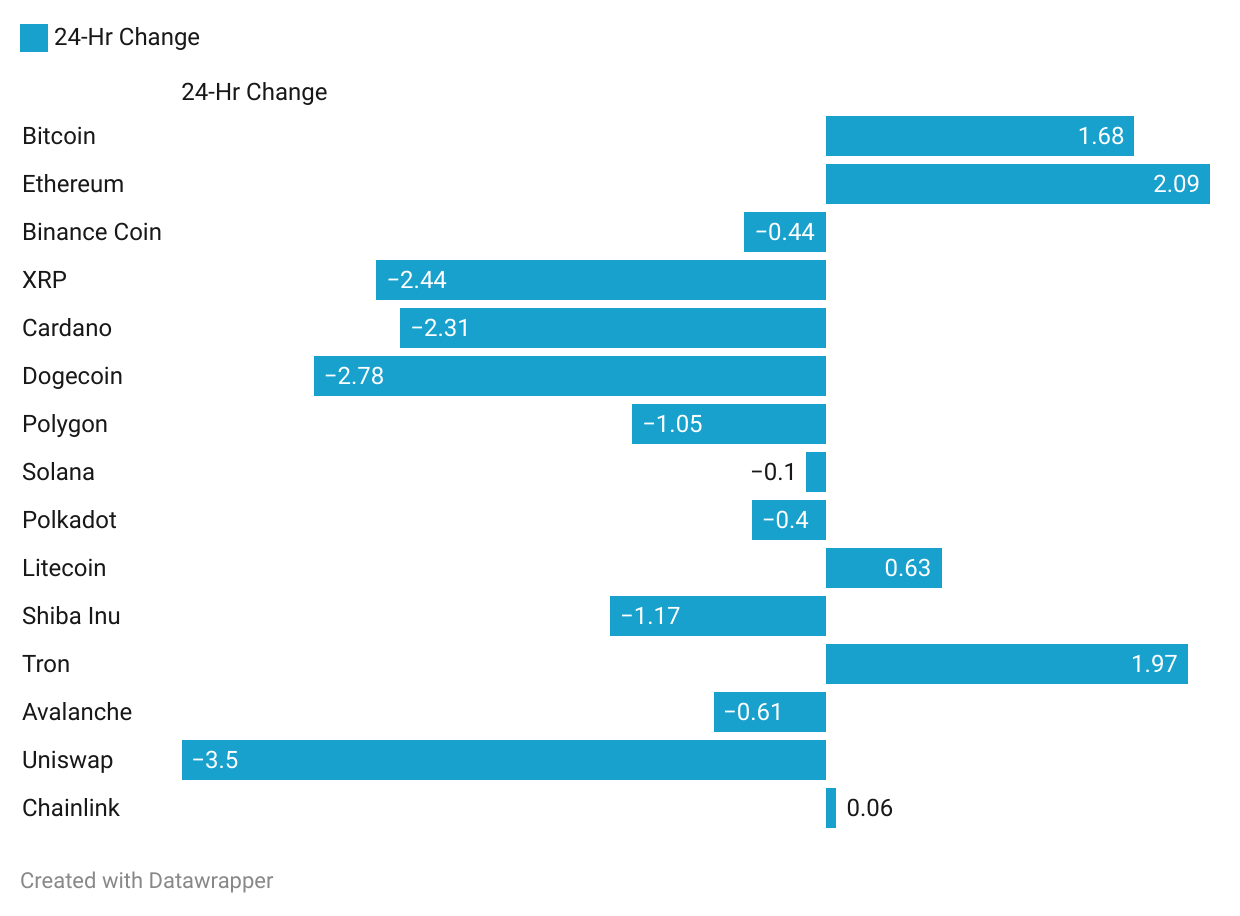

Top Cryptos Today by Market Cap

Source: Datawrapper

After experiencing massive bearish pressure, the crypto space now appears to have ignited a notable recovery as the top cryptos have begun to flip from their respective support levels. The global crypto market cap which had dropped close to $1.13 trillion rebounded well and surged high to reach beyond $1.19 trillion and before reaching $1.2 trillion is facing a slight pullback which currently appears to be a short-lived one.

The main reason for the stability in the Bitcoin and Ethereum prices are said to be the recent hike in the interest rates of 25 basis points and also the ongoing concerns on the US banking system’s monetary policy. Bitcoin price is trading at around $28,102 with a jump of nearly 2% while Ethereum price stands at $1,790 with a surge of 2.2% in the past 24 hours.

“The recent crypto rally has been fueled by bank runs that have led many to become sceptical with traditional banking, given all the vulnerabilities with deposits flights,” says Edward Moya, a senior market analyst at foreign exchange market maker Onda.

Other than this, the other cryptos which printed green candles are Litecoin and Tron. Litecoin appears to have come under bullish influence as the hype surrounding its upcoming halving event scheduled in August 2023 have made huge rounds. Besides, the other major cryptos continue to trade carrying minor losses which may be recovered in a short while from now.

Additional Read: USDC Stablecoin Depeg after SVB Collapse

Bitcoin Price Today

Source: Tradingview

Bitcoin price appears to have inoculated enormous price action since the beginning of 2023 as the price has maintained a massive upswing. Despite the month of February being somewhat bearish, the rally revamped with a massive bullish upswing since the beginning of March. The recent turmoil within the traditional banking system has impacted the Bitcoin price positively that leapt long to hit the levels above $28,000 at the moment.

The price currently appears to have gathered enormous strength and hence is believed to surge high to hit $30,000 income days ahead. However, the price is trading within a rising wedge pattern which is largely considered bearish. Hence, the possibilities of the price undergoing a minor pullback or a rejection after hitting the edge of the rising wedge looms.

In case of a bearish breakout, the lower support region between $24,450 and $24,700 may offer a strong base to spark a rebound. Therefore, with a rebound, the price may further begin a notable upswing to reclaim the levels above $28,000 initially and head back to hit $30,000. This time, the bear may remain inactive as the bulls may be determined to rise the levels beyond $32,000

Read More: Bitcoin Price Prediction

Ethereum Price Today

Source: Tradingview

The Ethereum price is displaying a slightly more diverse action than the Bitcoin price trend. While the BTC price appears poised to mark the highs at the earliest, the ETH price at the same time appears to be more calculative to prevent steep drops and losses. Hence, it remained within a predetermined resistance and support levels for quite a long time, before attempting a bullish breakout beyond the major resistance.

Fortunately, the volume has risen a bit which is largely dominated by the bulls and hence it may keep up the momentum of the rally towards the north. Presently, the price has soared beyond the crucial resistance at $1737 and is again accumulating gains before beginning the next bullish wave. The interim target for the ETH price could be reaching beyond $2000 but needs to rise beyond a crucial resistance at $1800 before.

Overall, the market sentiments continue to remain bullish despite the price facing minor turbulence with the top 2 cryptos. The crypto space is believed to remain bullish and undergo frequent bullish waves post to which a minor pullback may be imminent

Read On: Ethereum Price Prediction

Top Gainers & Losers

| Top Gainers | Top Losers |

| Mask Network (Mask) +16.03% | Arbitrum (ARB) -87.18% |

| NEO (NEO) +6.93% | Conflux (CFX) -9.22% |

| Mina (MINA) +6.50% | Optimism (OP) -7.41% |

| Dash (DASH) +5.72% | GMX (GMX) -6.38% |

| Zcash(ZEC) +5.27% | Toncoin (TON) -6.18% |

Have Bitcoin and Ethereum Parted their Ways? Decode the Truth Here!

- Ethereum price appears to have become independent as the trend is becoming more and more diverse than that of Bitcoin

- The decoupling is believed to have a larger impact on the entire crypto space as the altcoins may soon jump into action, sidelining Bitcoin

The crypto market sentiments have been largely influenced by various other factors like variations in the traditional finance system, whale transfers, influencer mention, etc and many more. However, in the wider perspective, it is believed that the entire crypto space, including the Ethereum price, follows the star crypto Bitcoin. Woefully, it does not appear to be the same presently, as the tight correlation has decoupled periodically over the weeks.

In the recent past, the traditional financial markets were hard hit by numerous turmoils which benefited the crypto markets specially the value of Bitcoin to a large extent. Moreover, the recent interest rate hike by the US FED also helped the top cryptos to maintain the same strength. In the meantime, the performance of the second largest crypto, Ethereum remained low-key at the same time.

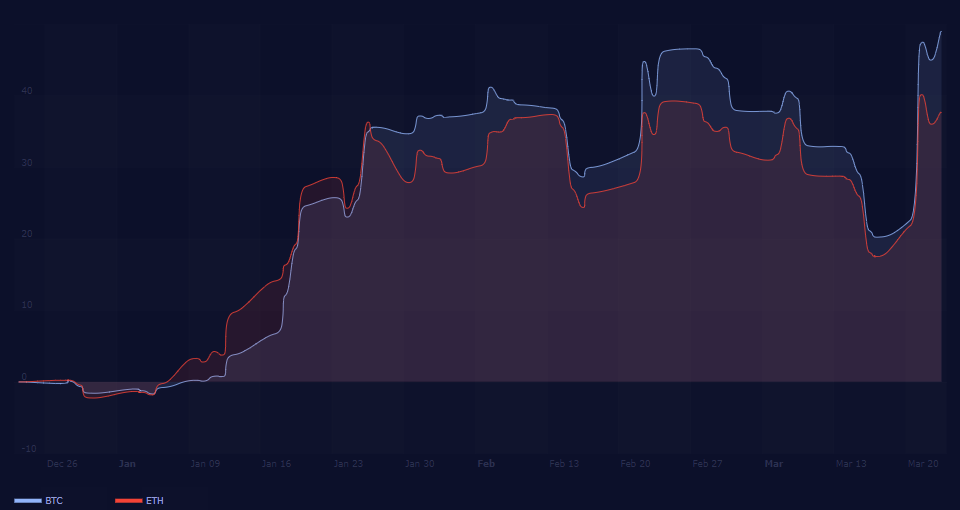

Source: macroaxis.com

The above chart illustrates the performance of both the top 2 cryptos since the beginning of the year 2023. It clearly points out the second-largest crypto following Bitcoin with equal jumps and rejections too. However, in the past few weeks, the ETH price has been maintaining a low-key performance compared to that of Bitcoin.

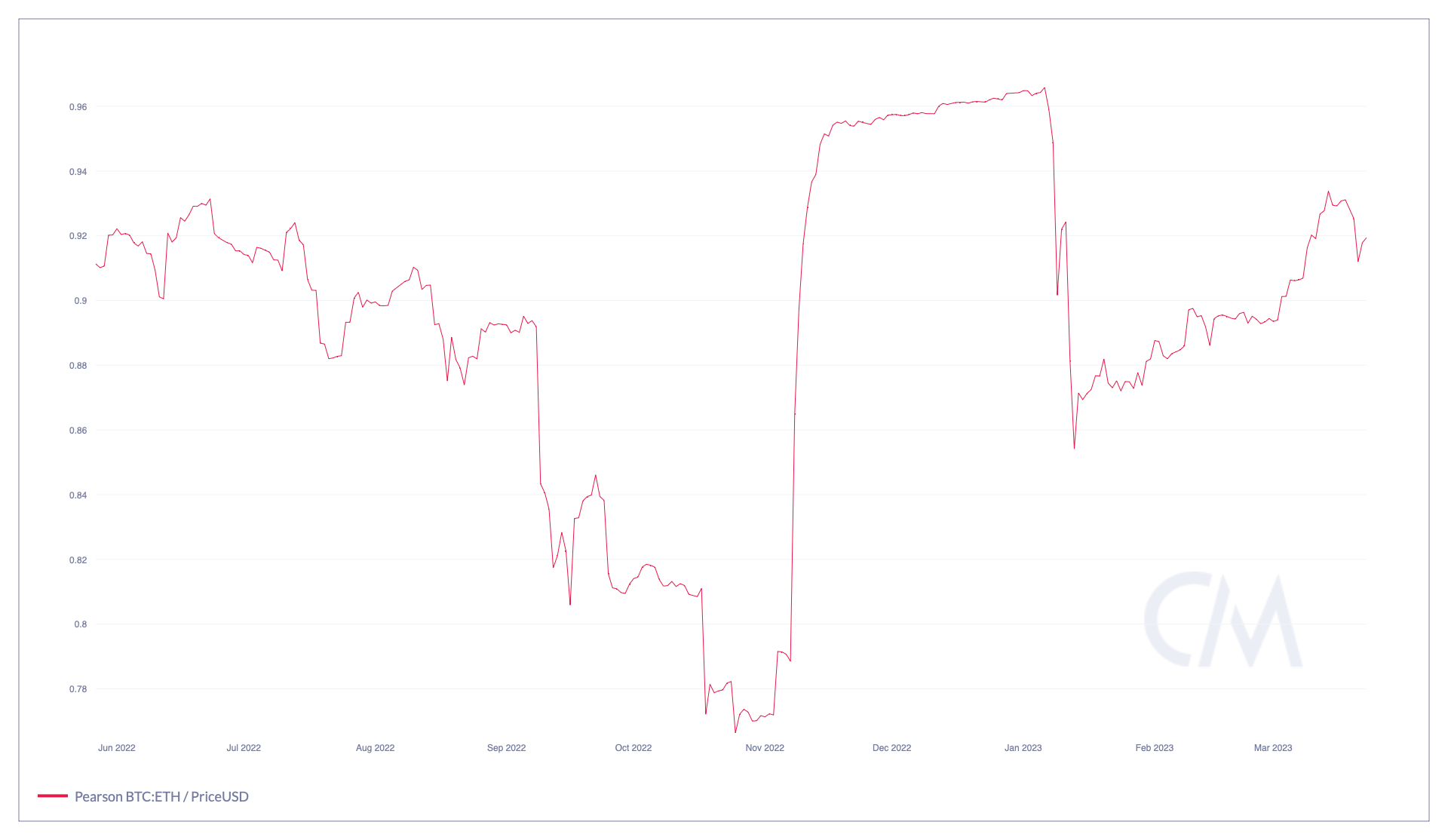

Besides, the correlation chart displays both of them being heavily correlated since 2018. However, the levels have been varying , which indicates less dependency on ETH over BTC. The correlation has remained strong but has dropped to 0.39 in recent times.

Source: Coinmetrics

Considering the price movements, the ETH/BTC pair has heavily declined by more than 17% in the past few days. The price surge of both the top cryptos has also varied to date, Bitcoin surged by nearly 65% while Ethereum 45%. The difference in the upswing indicates that one among them may maintain its calm while the other may offer a good opportunity.

In the past few days, Bitcoin’s volume witnessed a plunge of nearly 3% with Ethereum also dropping by 4% but the trading volume increased beyond its 20-day average by more than 20%. However, the reason is directly linked to the recent turmoil faced by the popular banks in the state of the US.

The bank collapse did induce a sense of safety within the crypto space, specifically Bitcoin which revived the argument of it being an alternative to the fiat currency. Moreover, the reserves of the banks remained a huge concern for the customers until the Fed stepped in and injected billions.

Overall, Bitcoin compared to that of Ethereum is looked a step higher as the investors see value in the token out of the banking landscape. Moreover, BTC’s correlation with the DXY Index also may be a reason for its supremacy.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more