Table of Contents

ToggleKey Takeaways:

- MATIC price has been shedding huge gains in the past few days as the market sentiments go pretty bearish

- A bullish trend may be expected after the brief consolidation, consuming a little more time than required

- Technicals and On-chain flash bearish signals and hence the consolidation may prevail for some more time ahead

Polygon (MATIC) price recently soared high to mark interim highs above $1.55. While a minor pullback was speculated, the markets turned out to be bearish shedding more than 23% from their highs. Moreover, the sentiments continue to be bearish and hence the descending trend is feared to prevail for a long time, slashing the price below $1.2 in a short while from now. What went wrong, what fueled the price crash?

Read More: Polygon Price Prediction

The crypto winters do not appear to have ceased as the layoffs have now knocked on the Polygon’s door as well. In the latest update, Polygon has announced a layoff of 20% that’s 100 employees, citing an internal consolidation process. However, the official blog notes that the move is not because of the financial difficulties but merely an internal restructuring move aiming to ‘crystallize’ its strategy for the coming years.

Polygon has grown exponentially.

To continue on this path of stupendous growth we have crystallized our strategy for the next 5 yrs to drive mass adoption of web3 by scaling Ethereum.

Our treasury remains healthy with a balance of over $250 million and over 1.9 billion MATIC

— Sandeep | Polygon 💜 Top 3 by impact (@sandeepnailwal) February 21, 2023

Affected employees will be compensated with three months of pay. As per the platform’s internal restructuring plan, the Polygon Studios will be discontinued, the Polygon Foundation will own the newly minted Polygon Labs and mainly former Youtube Head of Gaming Ryan Watt will be the new President.

Polygon Token Technical Overview

Source: Tradingview

- The current trade set-up indicates the formation of a head and shoulder pattern which is largely considered a bearish

- The price is currently testing the neckline of the consolidation and if fails to defend the support levels may plunge hard close to $1

- The descending trend appears likely as the RSI is plunging and on its way to entering the oversold region that may attract liquidity to the platform

- However, the levels around $1.188 could act as a strong base to offer a rebound and nullify the impact of the pattern formed, but despite a rebound, the price is believed to remain consolidated along these levels for a while or until market sentiments do not turn bullish

Polygon Token On-Chain Analysis

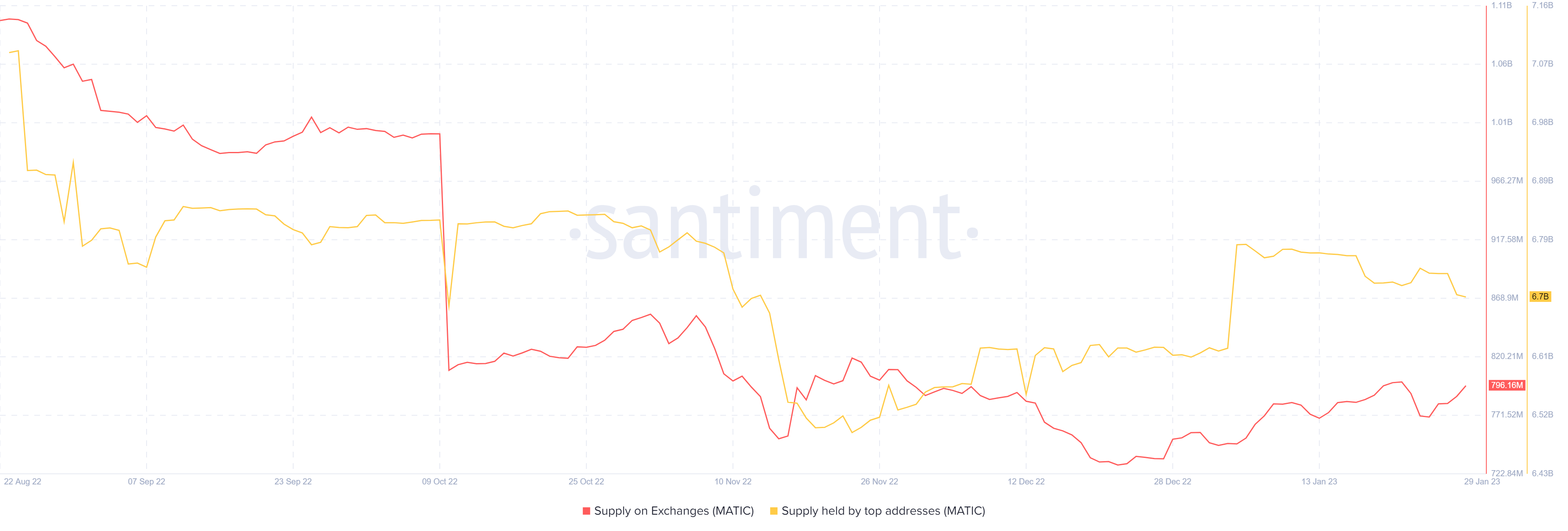

Polygon Supply on Exchanges vs Supply on Top Addresses

Source: Santiment

The supply on various platforms indicates an impending trend for the token. The supply on exchanges that illustrates the balance reserve if drops are considered as bullish but if it surges, it indicates the traders preparing to sell or swap MATIC for another token. Besides, the supply at the top addresses, which can be considered whale addresses, is considered one of the important metrics, as most of the traders tend to follow the pattern that whales follow.

Presently, both metrics have plunged significantly, but the supply on the exchanges is slowly rising while the supply on top addresses is depleting. This indicates the bearish sentiments mounting as the whales are liquidating and traders are transferring their holdings to the exchanges to liquidate. This may hurt the price ahead.

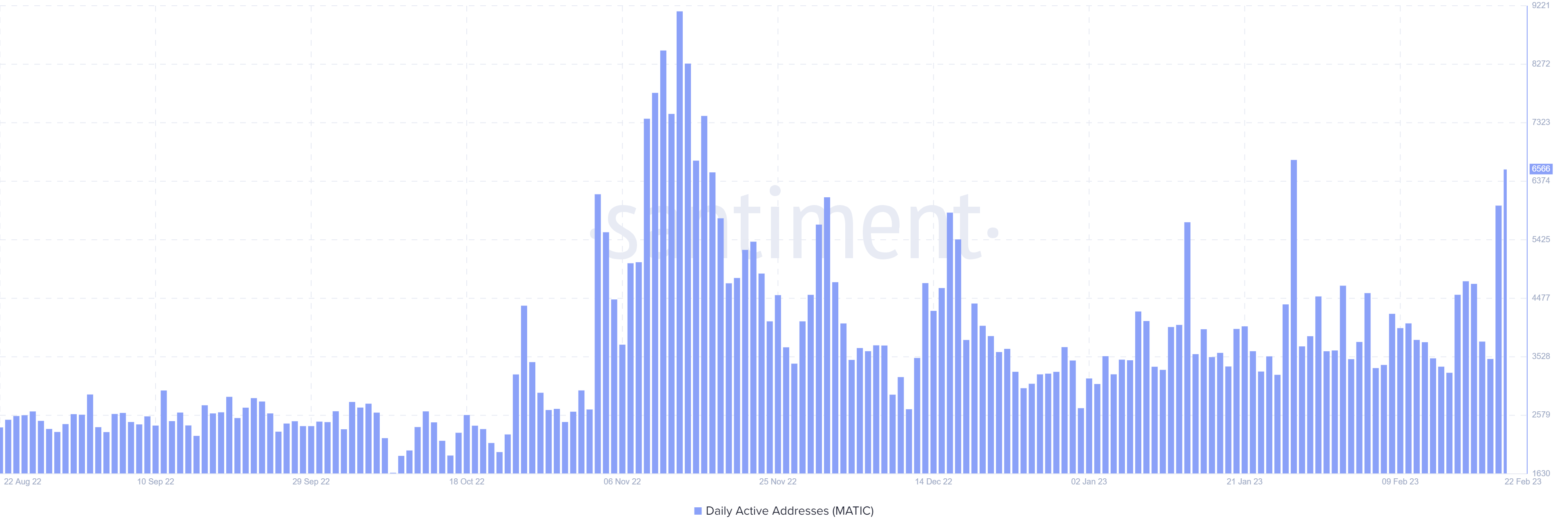

Polygon Daily Active Address

Source: Santiment

The demand for or popularity of the platform is dependent on how active it is. This may be further determined by the trader’s activity on the platform. The daily active address is the count of active addresses that interact with the platform to perform a trade. Each address is considered only once, regardless of whether it is a buy address, a selling address, or a swap address.

The DAA of Polygon has been significantly high in the past few months, indicating the huge activity of the market participants. While the price is consolidating towards the south, it can be assumed that the selling addresses have dominated the market at the moment.

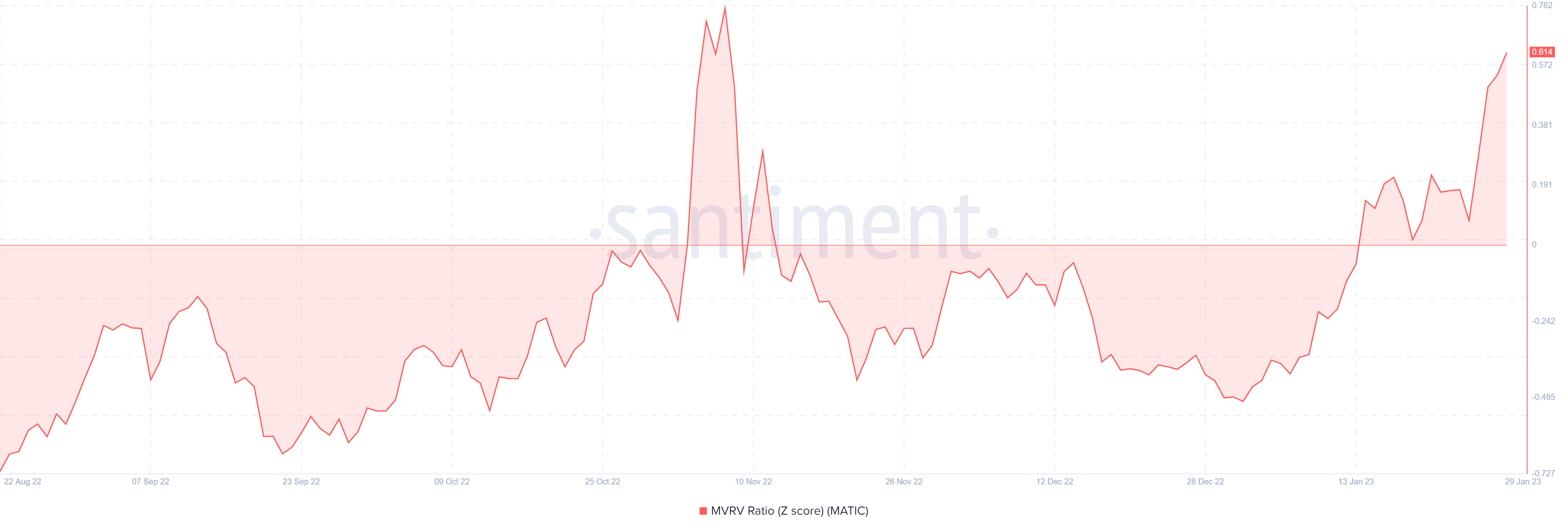

Polygon MVRV-Z Score

Source: Santiment

The MVRV ratio is the comparison between the market value and the realized value of the token to determine the fair value of the token. MVRV-Z score is a helpful metric that sheds light on the real value of the token. It is a slight modification of MVRV that adds the concept of Z, which measures the number of deviations that go above and below the fair value. It is the difference between the current price and the all-time moving average price.

Presently, the MVRV-Z score is soaring high in positive regions, which indicates that the price is overvalued. Once the price reaches these regions, it is likely to shed huge gains as the traders may be preparing to extract their profits. Besides, the pullback could be short-lived that could be revoked quickly.

Read More: Can Polygon Outperform Solana in 2023

Concluding Thought!

After undergoing a magnificent run, Polygon’s (MATIC) price appears to have entered a correction phase. The price is believed to have experienced an ongoing downward trend for an extended period as the metrics flashed bearish signals. The depleting supply raised the MVRV-Z score, etc, indicating the price may test its interim support very soon.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more