NFT and its exploration has seen a huge surge since 2021. With Metaverse and its various applications being worked upon, interest in NFTs has seen an interesting journey. With the spike in Ethereum NFT sales volume for the past couple of months, the NFT trade has seen a rapid acceleration as well in the past week. During January, DappRadar data shows registration of more than 9.5 million NFT sales, which is the largest recorded tally in nearly a year, ever since February 2022. The amount comes to about 42% increase from December’s total of about 6.7 million NFTs sells.

Read More: Top NFT Projects In 2023

The whole NFT trade scenario is caused because of the evolving market, where data shows that upstart marketplace Blur has overtaken the biggest NFT marketplace OpenSea where traders are rapidly flipping valuable NFTs, behaviour similar to how they usually treat DeFi tokens.

As per the data seen on DappRadar, the upstart marketplace Blur has generated about $460 million worth of Ethereum NFT trades over the past seven days. The amount is close to a 361% increase over the previous time span. Meanwhile, OpenSea saw a 12% increase in trading volume, which amounted to $107 million during that same period. Following the two leaders, the third place for NFT marketplace, X2Y2, tallied its amount to a $11 million in trades, also during that similar timeframe.

The surge in volume has been registered to come soon after Blur went ahead and airdropped its BLUR governance token to the NFT traders who have earned rewards through the marketplace. The tokens have also been shared to traders who were trading elsewhere ahead of Blur’s own launch last fall. Data from CryptoSlam shows a 155% week-over-week increase in Ethereum NFT trading volume.

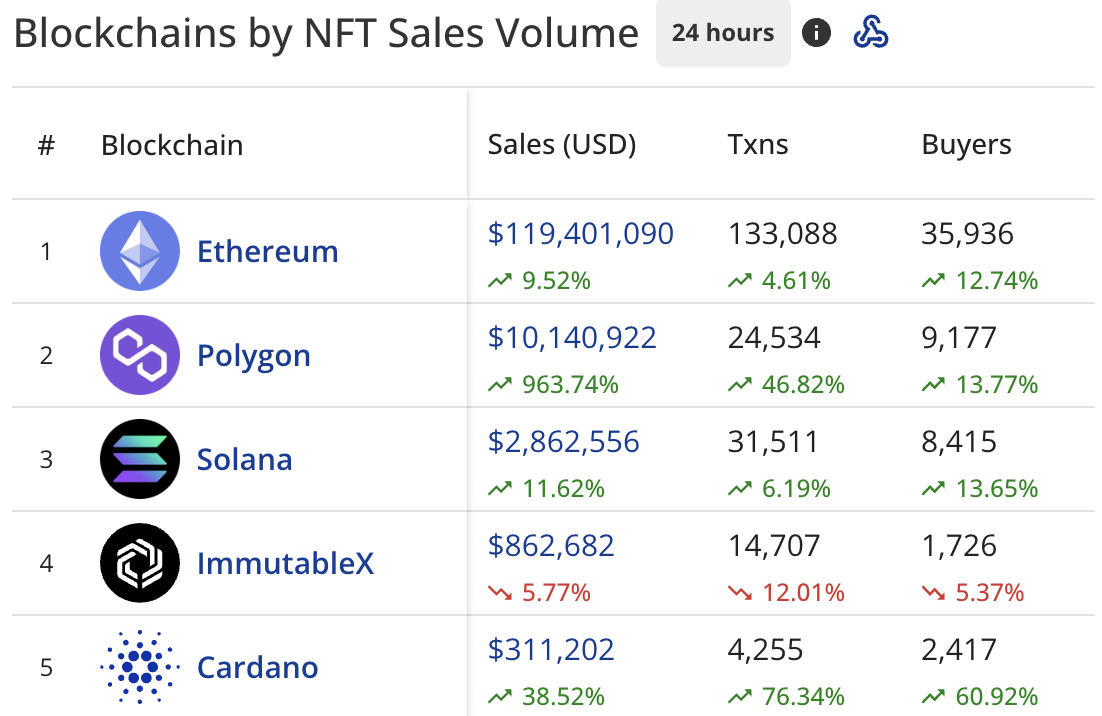

Source: CryptoSlam

According to the Decrypt report, this surge has not only come from traders of BLUR tokens, but also from whales traders who have significant NFT holdings. The whales appear to have been flipping their NFTs with even faster frequency than before. It maybe in an effort to give a boost to the potential future token reward allocations.

DeFi and NFTs are merging. Ape and ape hard.

— Machi Big Brother (@machibigbrother) February 18, 2023

The largest trader during this time period has been noted to be the well-known pseudonymous NFT trader. He was also the person who was involved with nearly 1,300 Otherside NFT trades that ended up yielding $4.3 million worth of sales in the process.

Additional Read: Top Metaverse Projects In 2023

Source: OpenSea

The account that shows a constant flood of inbound and outbound trades, has been facilitated by Blur’s unique marketplace model, which specifically rewards traders for using bidding pools that enable bulk trading for NFTs; as per the report from Decrypt.

Blur Bidding Pools have reached a new ATH of $132.65M TVL, or, around 2.4x Aptos TVL and 0.5x Solana TVL.

Blur also became the #1 protocol on Ethereum by gas usage as well, surpassing both Uniswap and Seaport.

🚨TURN NOTIFICATIONS ON🚨 for details about Season 2, coming soon! https://t.co/89DONJ6K8z pic.twitter.com/GCqGHDQBcq

— Blur (@blur_io) February 20, 2023

Even though OpenSea still has more unique wallets than Blur, the competitor has gone up in terms of the number of transactions, along with the widening gap in its trading volume. However, according to some traders, it is mostly the whales traders who are trading among themselves.

we aren’t growing the pie. It’s the same folks circulating assets + eth around and around

— Naveen 🦅 (🖖🏾,🖖🏾) (@NaveenSpark) February 18, 2023

Source: Decrypt

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more