Table of Contents

ToggleKey Takeaways

- Bitcoin price displayed an iconic rally by surging by more than 12% to mark new highs for 2023 at around $24,905

- The bulls appear to be well in position and are carrying enough strength to combat the bearish interference to keep up the upswing ahead

- Star crypto is believed to maintain the trend as the on-chain metrics are flashing massive ‘buy’ signals

The Bitcoin price recorded the biggest single-day green candle for the first time in the past 8 months by adding more than $1800 to its value. The spike occurred after experiencing an extended consolidation for nearly a week below $22,000. However, the bulls broke above the compression and marked new highs for 2023 at $24,905 in the early trading hours. Several factors account for the shift in bearish market sentiments, some of which are listed below.

The hash rate, which measures the computational power required to accomplish a transaction over the Bitcoin network, is getting closer to its ATH. Meanwhile, nearly $78 million in short liquidations were recorded in the past few hours, spiking prices beyond $24,000. Alongside, the DXY Index, which measures the strength of the USD, is experiencing bearish action after a soaring high in the first few days of February.

Tommy Tuberville, an American politician and a senator representing the state of Alabama, reveals in an interview his plans to reintroduce the “Financial Freedom Act.” The act prohibits the Department of Labor from investing retirement money in cryptos. The senator believes that the law should be changed because Americans can invest their money wherever they see fit.

“Every American should have the right to invest their retirement money how they see it,”

Read More: Ethereum Shanghai Upgrade

Bitcoin Technical Overview

Source: Tradingview

- The Bitcoin price is trading within a rising wedge that carries the possibility of rejection after reaching the peak of the consolidation

- The RSI has bounced from the bearish divergence but it has to be noted that the RSI levels are yet to test the lower support and hence a bearish retracement could be imminent

- With the retracement, the price is believed to drop close to $22,400 to $21,800 and trigger a massive rebound

- The rebound may ignite a notable upswing toward $25,400 and mark a fine upswing ahead

Bitcoin Token On-Chain Analysis

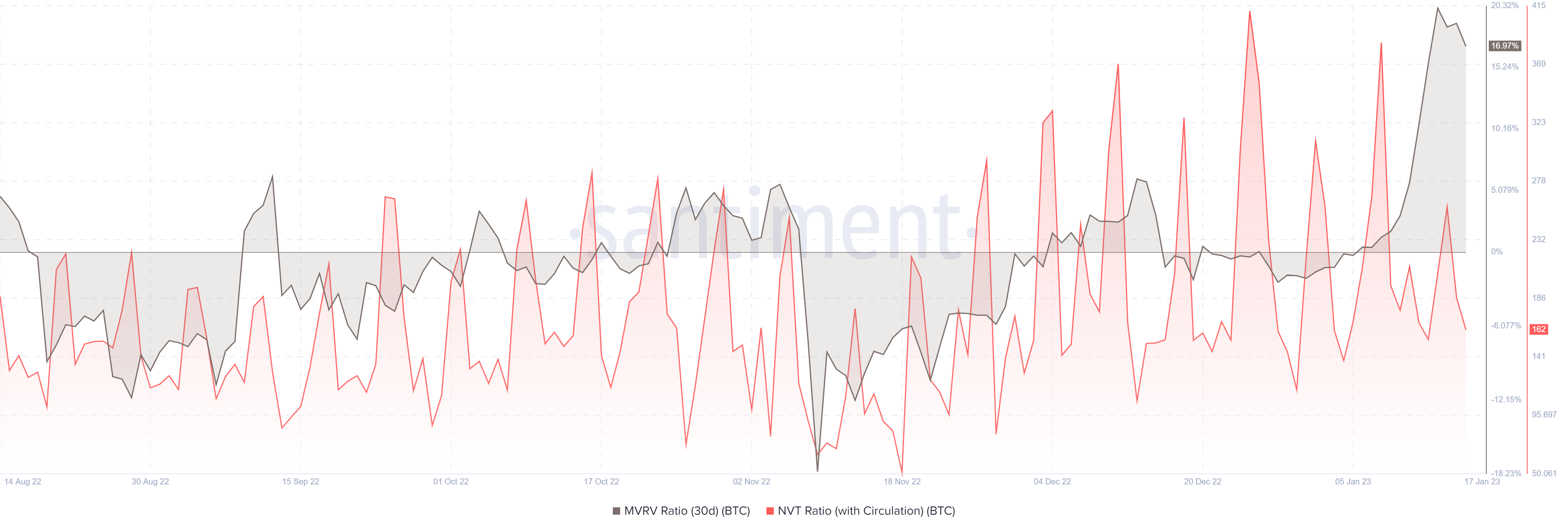

Bitcoin MVRV & NVT Ratio

Source: Santiment

The MVRV ratio is the comparison between the market capitalization and the realized cap to get the fair value of the token. This value determines whether the token is undervalued or overvalued. Besides, the NVT ratio compares the transaction volume with the market cap and indicates the sentiment of the inventors.

The MVRV ratio spiked to levels not recorded in the past 6 to 8 months. This signifies that the BTC price is now overvalued and hence traders may think of extracting the profits any time from now. The NVT ratio has dropped from the positive ranges indicating that the transaction volume is growing faster than the market cap and hence the investor sentiment is bullish.

Additional Read: Bitcoin Hash Rate Up By 50%

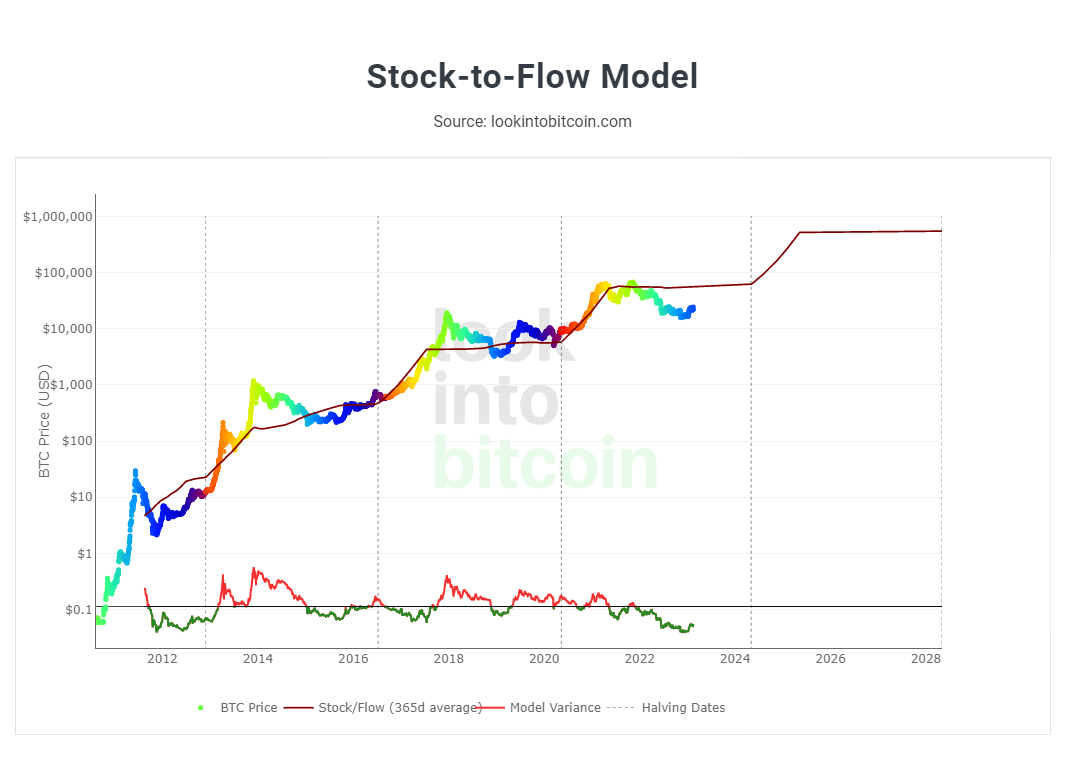

Plan-B’s Stock-to-Flow Model

Source: Buybitcoinworldwide

The BTC stock-to-flow model is a forecasting tool for the BTC price displaying an estimated price level based on the number of tokens available in the market against the number of tokens produced each year. This model treats Bitcoin as being comparable to commodities which are often called a ‘store of value’ as they retain value for a longer time.

In the above chart, the BTC price is overlaid on the top of the stock-2-flow ratio line wherein the price has continued to follow the S2F over time. The colored dots display the no.of days until the next bitcoin halving and the S2F line incorporates a 365-day average to figure out the changes caused due to the halving event.

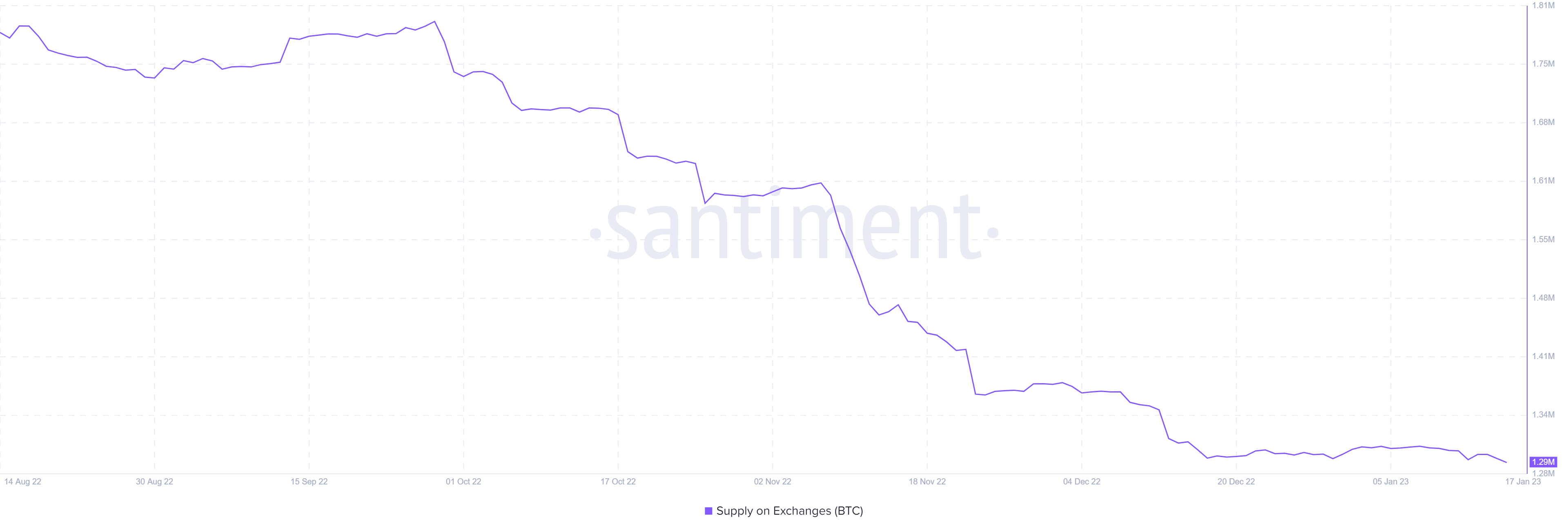

Bitcoin Supply on Exchanges

Source: Santiment

The supply on exchange indicates the number of Bitcoin held by the combined exchange reserve. The levels here determine the sentiment of the investor, whether he is bullish or bearish on the BTC price. Whenever the bearish market kicks off the traders tend to sell their holdings and to do so, transfer their tokens back to the exchanges from their wallets. This is when the supply of exchanges increases.

Conversely, the supply drops when the trader is confident of the impending upswing and hence holds the token for a long time. The metrics also indicate diminishing confidence in the centralized exchanges, as the traders could hold the tokens in their wallet or Decentralized exchanges but not on a CEX.

Concluding Thought

Bitcoin price after experiencing an extended compression has broken above the consolidation. Therefore, it is believed to maintain a firm upswing for the next few days to meet the higher targets. However, the on-chain metrics are also flashing massive ‘buy’ signals due to which the trend may remain bullish for a longer time ahead.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more