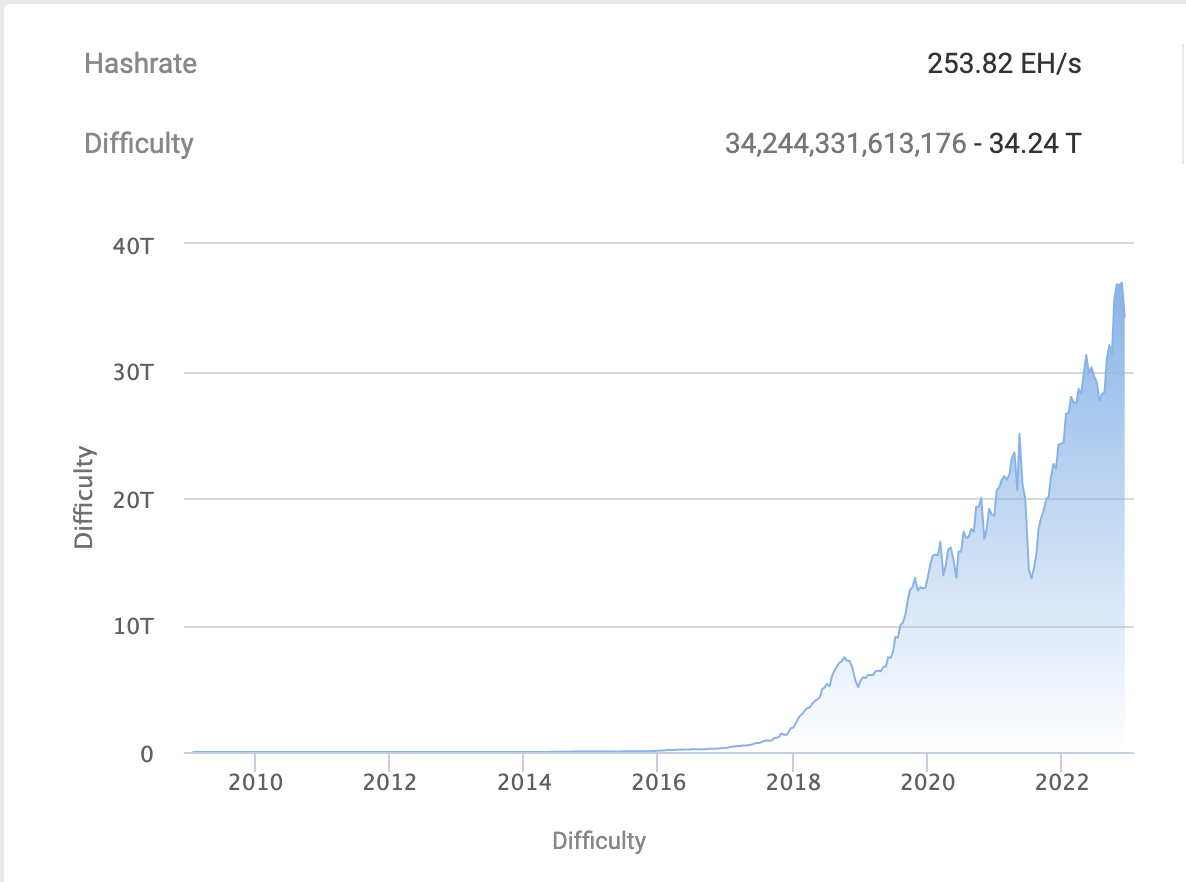

In a recent turn of events, just a few weeks after Bitcoin’s hashrate touched a new all time high, its mining difficulty recorded the biggest drop since the month of July 2021. According to data sourced from BTC.com – Bitcoin’s mining difficulty recorded a 7.3% dip in the value – which is only second to the largest dip ever that happened back in July 2021 – when Bitcoin’s mining difficulty dipped from 25 TH/s down to 14 TH/s – which was a 44% dip back then.

This is kind of contrary to the usual pattern that has been observed so far. Before we get to that, let’s understand why its a unique situation. In a network that runs on the proof-of-work consensus mechanism, mining difficulty is something that automatically adjusts itself according to the hashrate or the total computing power that runs network and keeps it secure. This is done so as to ensure that the time taken to mine a Bitcoin or add a block to the blockchain remains roughly stable. Hence, more the miners, more the hashrate and thus more should be the mining difficulty.

Read more: Top Proof of Stake Tokens

The dip in mining difficulty that was observed back in July 2021 was concurrent with China’s ban on all mining activities in the country. With these Chinese miners switching off their mining rigs to comply with the national ban – we saw the 44% dip in the mining difficulty happening almost overnight.

Additional read: Bitcoin Hashrate Weekly

However, this time around things are slightly different than they were before. According to a report by CoinDesk, this is happening primarily due to the Bitcoin miners choosing to shut down some of their mining rigs in order to cut costs and preserve profitability in a market that is overrun by bearishness and the price of Bitcoin which has stubbornly remained below $20,000 for a large chunk of the year.

This argument further gains weight when we look at other Bitcoin mining pools shutting down too. According to CoinDesk, major producers like Core Scientific (CORZ) and Argo Blockchain (ARBK) are dealing with liquidity crunches, while Compute North filed for Chapter 11 bankruptcy.

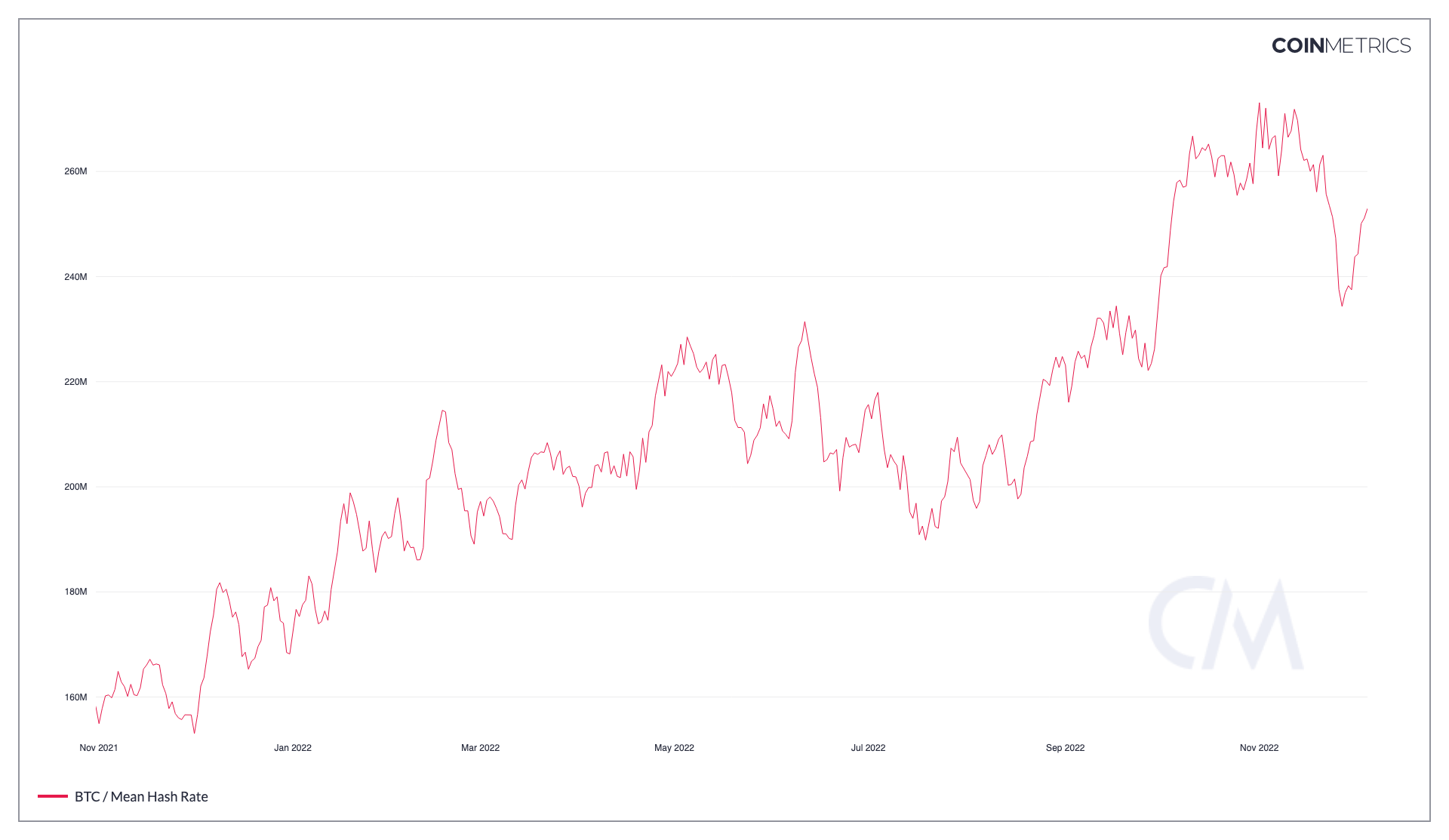

The chart above is indicative of the hashprice index – hashprice is nothing but the value that a miner can expect from each hash of computing power the miner provides to the network. Thus, as indicated by the chart above, the cost of each hash of computing power that is provided by the miners in Bitcoin’s network has been steadily declining ever since the beginning of the year.

This has also made it very difficult for Bitcoin miners to continue to run their mining rigs, especially in a world of raging inflation where cost of all other necessities for this business, primarily electricity, is going through the roof. As a result, it is becoming more and more uneconomical for miners to continue mining, especially as the crypto market as a whole is weighed under by the bear run. Thus miners are essentially caught between rising costs to mine Bitcoin while at the same time, the lower price of Bitcoin itself in the market.

Read more: Bitcoin Price Prediction

Sourced from CoinDesk.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more