The unfolding of the FTX collapse has given rise to a lot of questions and also pointed out a number of things the crypto community can look at for a better transition to the Web3 world we are marching towards. Following multiple incidents within the Aave community, the decentralized lending protocol Compound Finance passed a proposal to levy loan limits on its platform. Compound is also set to introduce new borrowing caps as a conscious attempt to lower the risk rate on its platform.

- insolvencies

- liquidations

- borrow usage

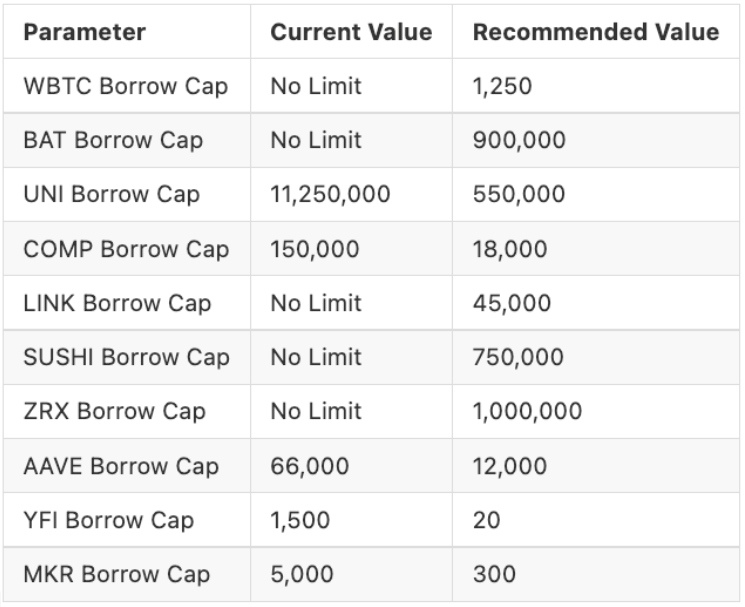

When asked to gather the thought of the community, Compound’s community voted overwhelmingly in favor of introducing or lowering the maximum borrowing amount for 10 crypto assets that included wBTC, LINK, and UNI.

Proposal 135 has passed with quorum. ✅

Proposal 135 sets borrow caps for ten Compound v2 markets.

The proposal will be applied in two days. https://t.co/JvlEPJZrgp

— Compound Governance (@compgovernance) November 28, 2022

A quote from the proposal by Compound said, “Setting borrow caps helps avoid high-risk attack vectors while sacrificing little capital efficiency and allowing for a threshold of organic borrow demand.”

The proposal from Compound was not sudden. The proposal came to action after an alleged exploit attempt was made on a well known a rival lending platform; Aave. The attempt brought to question any potential vulnerabilities that may exist in the decentralized finance (DeFi) protocols’ lending mechanism.

According to CoinDesk reports, the alleged attempt on Aave is an exploiter, who appeared to be the infamous DeFi trader Avi Eisenberg. He had borrowed a large sum of money in the form of illiquid CRV tokens on the Aave platform. He did so as an attempt to create a bad debt on the protocol. Following this, on Monday, November 28, 2022, Aave froze its borrowing services in 17 crypto assets, in order to mitigate the possible risk from potential attacks before its network upgrade.

Did You Know? Avi Eisenberg came to be well known, particularly for his self-described “highly profitable trading strategy”. He exploited a loophole that he found on the Solana-based Mango Markets and drained a massive sum of $114 million from the protocol last month.

Source: CoinDesk

Read more: Bitcoin Price edges towards $17000

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more