Table of Contents

ToggleWhat is DeFi Staking?

DeFi staking is a practice that enables a user of a Decentralized Finance (DeFi) Platform to act as a validator for transactions and earn profit for doing it so. DeFi skating has become one of the most trendy topics in the DeFi Market today for enabling crypto asset holders to generate passive income by staking their crypto tokens. To better understand DeFi Staking, a quick look back at what decentralized finance is!

Decentralized Finance, or better known as DeFi, is a new financial terrain where investors from all around the world explore different financial solutions to check the best fit for their financial needs or goals. One of the best known examples of DeFi is the infamous Bitcoin. Bitcoin is a crypto asset built on a decentralized peer-to-peer network to transfer digital payments from one person to another.

Staking has been a concept known to the crypto space for a long while, however, it gained momentum recently. This new financial tool has become increasingly popular because it doesn’t require particular trading or technical skills, and investors’ most significant challenge might be choosing the right and secure platform. When the number of Decentralized finance wallets crossed a whopping 30 Million on the Ethereum network, the concept of staking has been discussed even further. The ultimate purpose of wealth creation has been one of the more common focal points for many crypto service providers and protocols. The process of staking is one lucrative way, above and beyond crypto trading, for DeFi users, to monetize their crypto assets.

Apart from staking being a good option for incurring some passive earnings, the PoW, widely known as the proof-of-work consensus mechanism, was not a very sustainable model for blockchain. Mainly due to its extensive need for energy usage. As a result, most blockchains are shifting to or adopting PoS or proof-of-stake consensus; the best example of it is the Ethereum Merge. With the PoS consensus being the more valuable consensus among the blockchain providers, Defi staking seems to have a sustainable and lucrative future. With this context, let us dive a little deeper and understand the advantages of Defi staking!

Read more on: What is Decentralized Finance?

What are the advantages of DeFi staking?

To quickly scan through the benefits that DeFi brings to the table:

- An easy way of earning a passive income.

- Stakers are normally offered low entry fees.

- It is usually pretty simple to get started.

- With the interest rate in mind, rewards are normally higher than expected.

- Where proper smart contracts are used, stakers are highly secured.

- Increased liquidity.

- An attractive service they get to offer to their users.

- Revenue from stakers and networks.

- Pretty dynamic token market capitalization and liquidity.

- Much lower energy consumption for validating blocks.

- DeFi staking also helps maintain liquidity.

How to earn passive income in DeFi staking?

With the massive adoption that crypto has seen, there are more projects that are being worked on to solve newer problems. Most of these emerging blockchains are built, keeping in mind the energy consumption the network would require. Thus, they are mostly based on the PoS mechanism. Some of the most popular PoS blockchains are, Polkadot, Algorand, Solana, and Cardano, all of which offer rewards to the users, who wishes to put their assets “at stake.”

DeFi coins cannot be mentioned without bringing in a guest mention of the most popular altcoin and the most popular blockchain in DeFi coin; Ethereum, which has also transitioned to a PoS protocol post its Merge upgrade that got completed this year.

Now onto how one can stake crypto assets. To stake one’s crypto asset users have to deposit their crypto funds in a smart contract to perform various required network functions and as a reward for conducting the required functions, they receive staking rewards. The staking rewards incentivize the proper supervision of the network’s security through ownership of the stakers.

Read more: Top DeFi Tokens

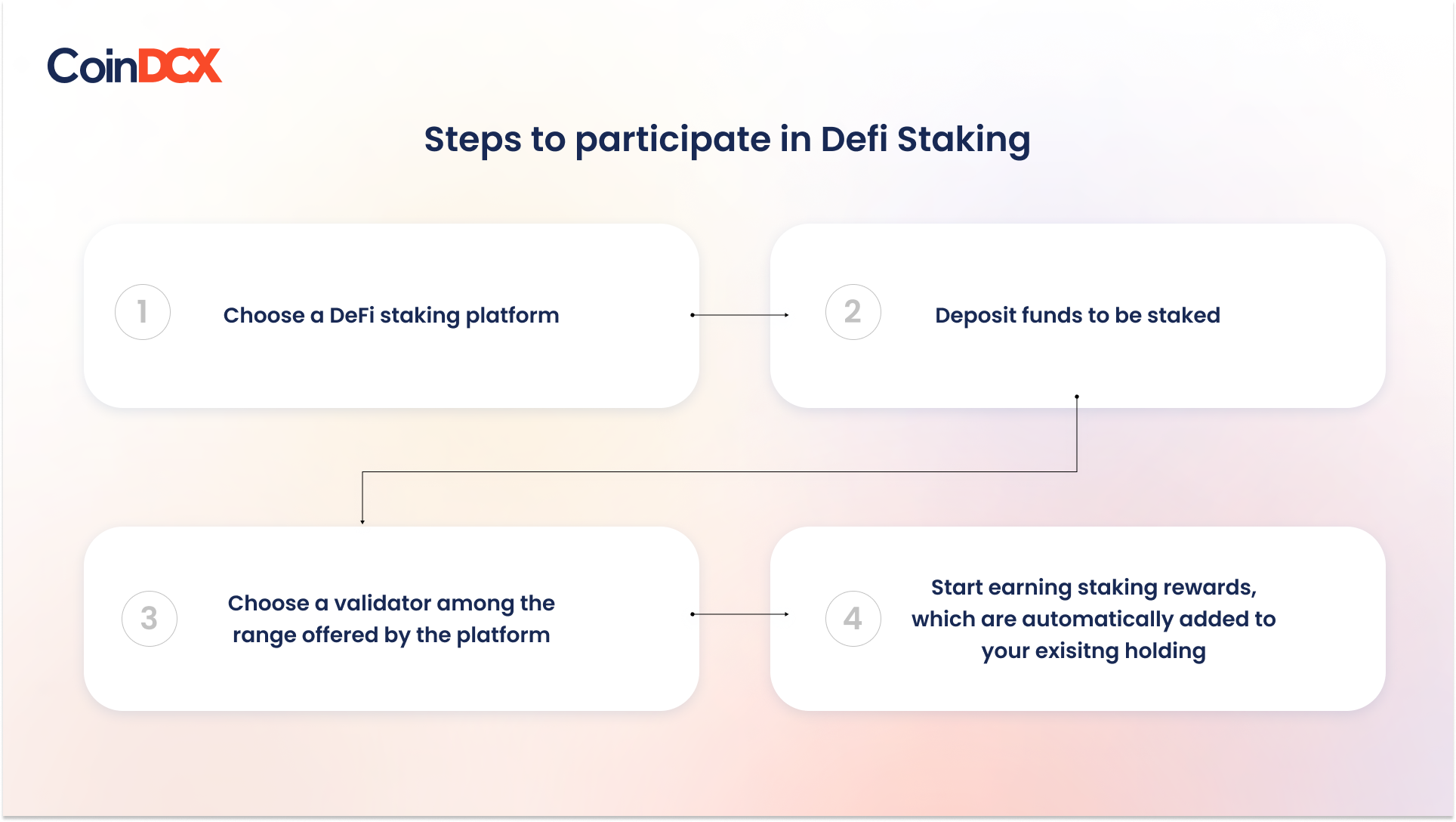

To divide the staking process of taking part in DeFi staking into a few simple steps:

-

Select a DeFi staking platform

-

Deposit the crypto funds that are to be staked

-

Select a validator among the many offered by the platform

-

Start earning staking rewards after completing the necessary staking activities. The rewards are automatically added to the existing holding of the crypto.

What are the disadvantages of DeFi staking?

Besides facing the issues typical of the crypto space, which includes things such as high volatility and network security, DeFi staking presents a few other concerns that are specific to the DeFi sector. While many are tempted to participate in the DeFi staking, delighted by the prospect of easy gains, what they sometimes easily forget or ignore is the potential risks that lie in wait. Some of the risks or disadvantages of DeFi staking are mentioned below; to better assess if staking is something one is up for and how to implement it.

-

Gas Prices

The scalability problems of Ethereum may result in extreme spikes in gas prices, which may end up in making DeFi transactions rather expensive to execute. As the Ethereum network remains the most popular DeFi platform, the possible increase in gas prices may significantly slow the sector’s growth.

-

Slashing

Slashing is a risk that PoS blockchains may present. This occurs when the PoS blockchain validators fail to validate the transactions correctly or are fraudulent in their behavior by keeping or inducing a downtime or double signing transactions. If that turns out to be the case; both the validator and the delegators can end up losing a part of their staked tokens or rewards.

With that being said, it is important to keep in mind that DeFi staking is still in its nascent stage. The DeFi staking sector still needs to be further practiced and evolved. While it has already shown great potential and appears as a valuable alternative to traditional financial tools, it is still at the early stage of experimenting with its capabilities; thus presenting many challenges.

Read More: Differences between DeFi vs CeFi

Different types of DeFi staking

Now that we have covered a whole lot about DeFi Staking, it is time to take a closer look at the types of DeFi Staking available for users.

Staking

To recap, DeFi staking involves the staking of crypto assets. The basic staking of crypto assets involves locking a set amount of the crypto assets to become a validator in a Proof-of-Stake (PoS) blockchain network. The other well-known blockchain mechanism, Proof of work (PoW) relies on algorithms where transaction validation requires computation work whereas the Proof-of-Stake (PoS) relies on validators for validating the payment. In other words, the validators have to perform their duties diligently otherwise they are at risk of losing a portion of even the entire of their stake.

Yield Farming

The crypto market was already aware of the lending and borrowing platforms as they were the first strong use case that provided the definitive usage of decentralized finance. However, with the rise of yield farming; the process showcased the true power of DeFi. The term yield farming is referred to the practice of moving multiple crypto assets over DeFi staking platforms in order to churn out the maximum profit by the user. In order to do so, users make their assets available on a lending protocol or a liquidity pool. They earn their passive income in the form of interest and sometimes it is also earned via a portion of the revenue generated by their DeFi staking platform of choice.

Liquidity Mining

One of the subcategories of yield farming is liquidity mining. This process involves depositing crypto assets and tokens to liquidity pools. The liquidity pools are a crucial part fin order to enable trading without any mediators involved in a type of Decentralized Exchange(DEX) known as an Automated Market Maker. A typical liquidity pool consists of two assets that make up a particular trading pair. So the whole system relies on the liquidity providers who make the assets available at the liquidity pool.

Top Platforms for DeFi Staking in India

| DeFi Staking Platform |

|

|

|

|

|

Additional Read: What is Okto?

|

Wallet name |

Features |

| Okto | DeFi earning, wallet, staking & yielding, cross-chain bridges |

| MetaMask | Token swapping, crypto purchases, dApp browser |

| Trust Wallet | Crypto purchases, token swapping, dApp browser, staking |

| Trezor | Cold storage, portfolio management, crypto purchases |

| Ledger | Cold storage, crypto purchases, token swapping, dApp browser, staking |

| Crypto.com DeFi Wallet | Swapping, staking, storing |

Additional Read: Top 6 DeFi Wallets of 2023

The Future of DeFi

Staking represents a great advantage that PoS blockchains have on PoW platforms and vows to become a prominent sector of the crypto space.

Clearly staking in DeFi platforms is a new way to earn passive income and people are getting interested more in it day by day. Staking encourages long-term participation in a blockchain network as validating nodes will have to put a certain amount of assets to verify the blocks. As industry trends indicate the boom of POS blockchains, Defi staking holds a strong future. Development of Defi staking platforms or integration of Defi staking in existing blockchain-based platforms has the potential to pull global crypto users.

The development and opportunities that DeFi conveys are numerous, especially considering different concepts, features, and services that can be combined and interconnected to create a system of limitless movements and transactions. DeFi staking will take advantage of such flexibility and offer investors an increasing plethora of income streams.

Related posts

Top DeFi Lending Platforms of 2023: DeFi Powerhouses

Dive into the realm of DeFi lending platforms and innovation!

Read more

What Are Decentralized Derivatives in Crypto & How Do They Work?

Demystifying DeFi derivatives: Explore blockchain-based financial instruments and innovations!

Read more