Table of Contents

ToggleKEY TAKEAWAYS:

- FTX crypto exchange has been in the news in the last couple of days. From claiming the company was solvent all the way to asking for Binance’s Changpeng Zhao signing the LOI to acquire the FTX exchange.

- FTX crypto exchange native token, FTT price has suffered a market cap erosion of over 83% in the past couple of days.

FTX crypto exchange has been popular for a very long time. FTX’s founder, Sam Bankman-Fried is one of the most popular names in the crypto world and thanks to building the FTX exchange, he had become one of the youngest billionaires in the world, at one point having a net worth of nearly $17 billion.

After completing a degree in physics at the Massachusetts Institute of Technology, he perfected the crypto arbitrage techniques to make his initial wealth before founding several crypto products, ranging all the way from the well known crypto exchange, FTX to Alameda, a prop trading desk.

But of late, after weeks of spat between the founders of two of the largest crypto exchanges, Binance and FTX – it has finally concluded with Binance’s CZ stating his intention to acquire one of its biggest competitor in the market.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

While all that is well and good, let’s take a look at how this move could affect the exchange’s crypto token, FTT.

FTT TECHNICAL OVERVIEW

It is clearly evident from the chart above that FTT price has taken a major hit in the past couple of days. Its price had been sliding all through the bear market but that was pretty much in tandem with the broader crypto market. However, now ever since the news regarding the overleveraged FTT tokens broke, its tokens have suffered nothing short of a freefall. It fell all the way from around $25 to well below $5 as of writing, suffering the biggest hit yesterday, soon after the acquisition news came to the fore.

5) I know that there have been rumors in media of conflict between our two exchanges, however Binance has shown time and again that they are committed to a more decentralized global economy while working to improve industry relations with regulators. We are in the best of hands.

— SBF (@SBF_FTX) November 8, 2022

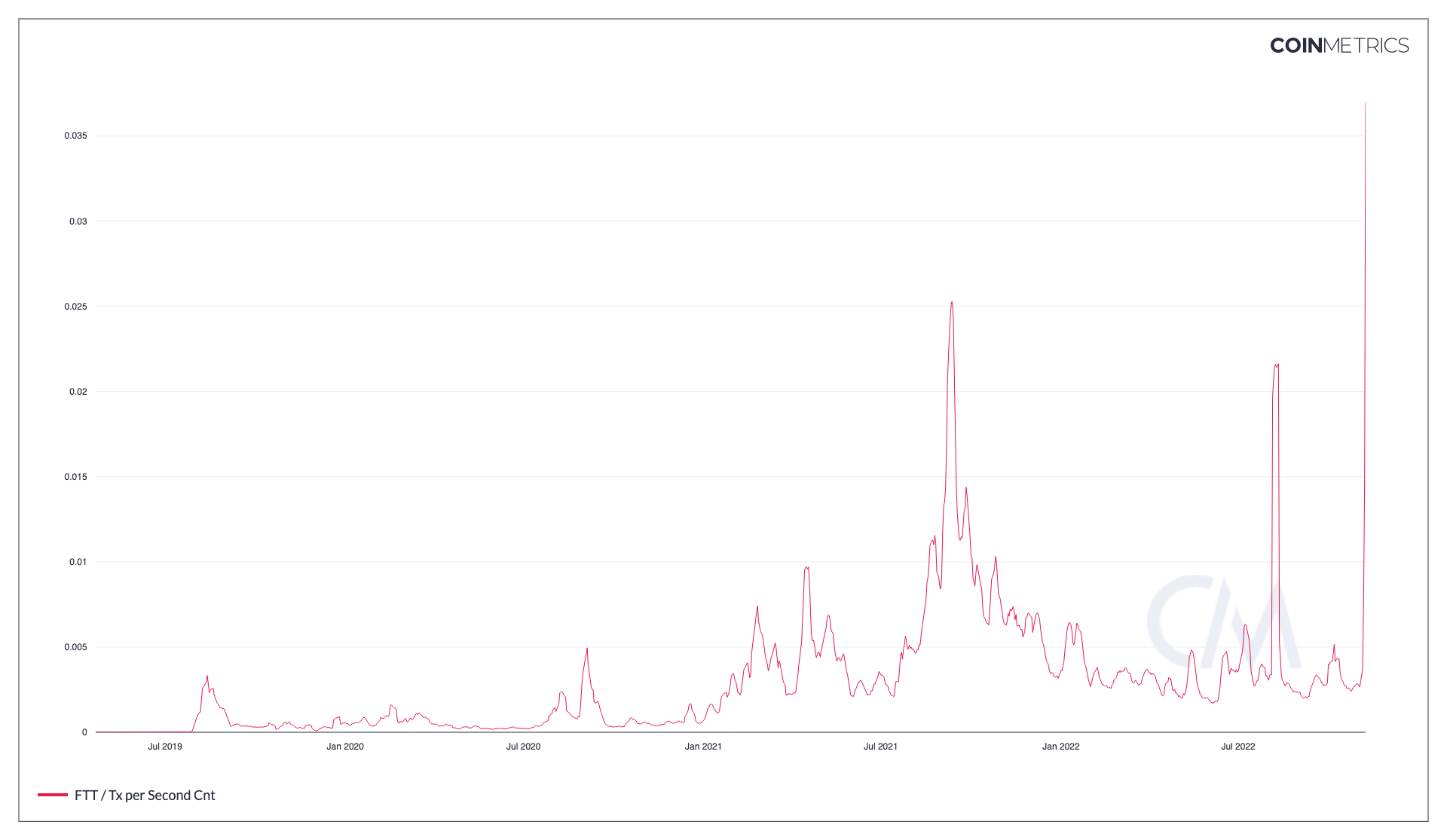

FTT’S TRANSACTION COUNT HITS AN ALL-TIME-HIGH

After the recent debacle, FTT’s transaction count per second has hit a fresh new all-time-high, breaking past all records made before. While this usually presents positive scenario for a crypto token suggesting increased on-chain activity, it is fair to assume that in FTT’s case that is probably not the case. Rather, correlating it with the FTT price crash, the more likely scenario in this case is long term HODLers and investors are probably pulling out their funds from the crypto.

The news of the acquisition could go one of both ways for the FTT token – one the acquisition would definitely benefit those who are already invested through the FTX exchange, while the creation of a behemoth after the Binance-FTX acquisition could hint towards the creation of a monopoly in the business. Hence the FUD around it could be the concern for investors and traders.

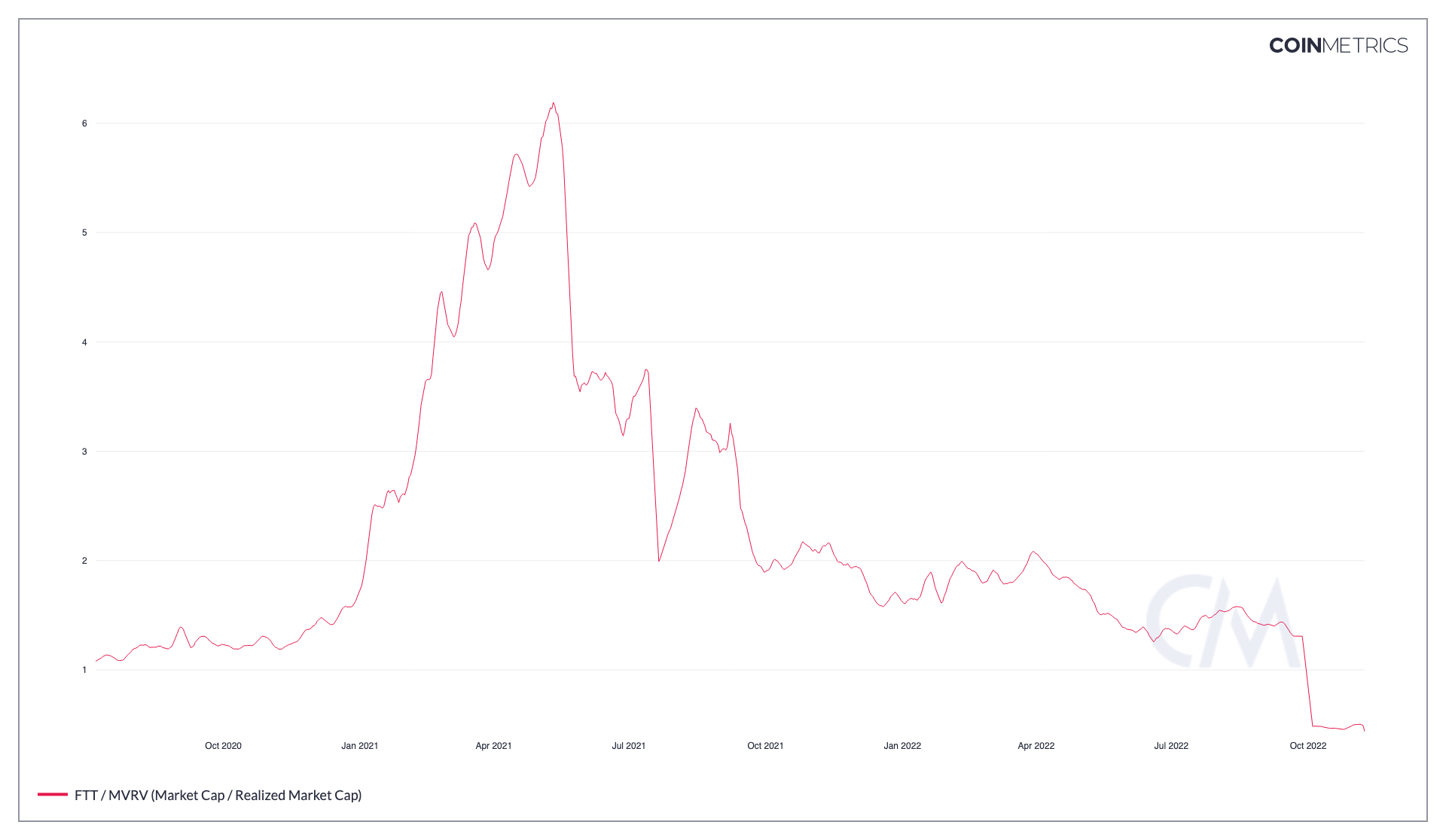

FTT MVRV RATIO AT ALL-TIME-LOWS!

However, on the flip side, amid the crash in the value of the FTT token, its MVRV Ratio values have reached one of the lowest points of all times. Typically, an analysis on the basis of historical records has proved that a generally low level of MVRV Ratio, especially if is under the value of 1 indicates that a large section of the supply is being held at break-even or even at a loss. These low values have historically identified market bottoms and late stage bear accumulations. This is because the market value of the token supply is decreasing when compared to its realized market cap.

CONCLUSION

FTT token has been very popular in the crypto space, especially thanks to the popularity of the man himself, Sam Bankman-Fried – who pioneered the FTX crypto exchange. So with the due diligence for the acquisition is yet to be completed on the part of Binance, CZ has promised that it is fully committed in its intent to acquire FTX and help users to ride over the exchange’s liquidity crunch. While that is yet to actually play out in the market, observations from above, as of now, indicate that weaker hands have been pushed out of the market – some late stage accumulation may still play out and a recovery could happen later on.

Prices as on 9 November, 2022.

Read more: Top Crypto News

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more