Table of Contents

ToggleSynopsis

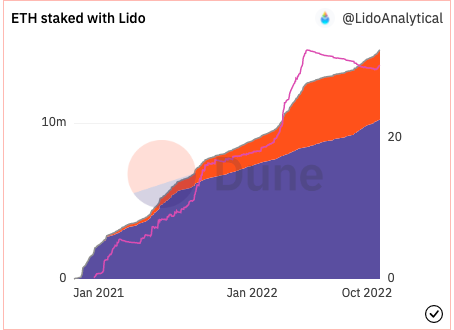

- Post Ethereum’s historic merge the TVL of Lido (LDO) has catapulted to $7.61 billion

- Lido DAO allows investors to stake their ETH holdings without any minimum amount and infrastructure expenses.

Launched in December 2020 after the Beacon chain went live, Lido DAO extended its staking mechanism to networks like Solana (SOL), Moonbeam (GLMR), Terra Classic (LUNC) and Ethereum (ETH). At the time of launch LDO’s value was $ 1.8 and was trading at $1.53 at the time of writing. The TVL of Lido DAO soared from $6.03 billion to $7.6 billion.

Source: Defi Lama

LDO happens to be the backbone for Ethereum staking. On-chain staking requires an individual to stake 32 ETH to be able to participate on the blockchain. Lido allows retail investors to stake any amount of ETH and accrue stETH as a staking reward. This way Lido opens a channel for others to participate in Ethereum staking in a secure way.

Additional Read: Lido DAO Price Prediction

The Staking Pulse

Ethereum, Ethereum Classic, and Lido Staked Ether have surged more than 10% in the last 24 hours. According to data from Coinglass, investors have shorted their ETH holdings to add liquidity to staking pools like Lido DAO.

According to a whale crypto investment tracker, WhaleStats, more than 100 ETH whales have invested heavily in LDO in the last 24 hours. These investors also hold stETH in their portfolio.

JUST IN: $LDO @lidofinance now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs 🐳

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#LDO #whalestats #babywhale #BBW pic.twitter.com/ghoXpCdfws

— WhaleStats (tracking crypto whales) (@WhaleStats) October 29, 2022

Total Lido staked with ETH over the last few months have accounted to 449,440.

Lido DAO records new highs

According to DefiLama, Lido DAO (LDO) has recorded a revenue of $120,000 and the fee accumulated was $120,000 in the last one week. In addition, the number of LDO holder addresses have increased in the last few weeks.

Despite the great performance of the token, the volumes have dipped and the value of Lido has depreciated from its previously recorded highs.

More about Lido DAO

Lido DAO has a market cap of $475,785,292 and has 312,951,153.96 LDO in circulating supply. Besides offering access to DeFi solutions LDO token holders have governance rights, authority to set fee structures and govern the node operators on the platform.

Bottomline

The upside of Ethereum, Ethereum Classic and Lido DAO is driving positive sentiment amongst investors after a long crypto slaughter. Ethereum Classic surged as a result of ETH miners moving to the Ethereum Classic chain – the forked version of Ethereum.

Source: AMBCrypto

Staked ETH’s performance

Lido’s investors have closely monitored the performance of the asset over the months. The value of stETH combines the value of Ethereum and the rewards that an investor accrues by offering ETH liquidity. Staked Ethereum is sent to the liquidity providers after they send ETH to the liquidity pool. Staked Ethereum stETH has recorded new highs in the last one week.

Source: Coinmarketcap

Additional Read: What is Lido DAO Token (LDO)?

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more