Table of Contents

ToggleKey takeaways:

- Uniswap has recovered over 20% in the past two weeks, in line with the broader crypto market.

- It also raised $165 million in its Series B funding round and is expected to utilize the funds to expand the platforms.

Recent Updates:

- Uniswap recently announced $165 million in Series B funding to expand the platform across the world

1/ We’re proud to announce that we’ve raised $165 million in Series B funding to bring the powerful simplicity of Uniswap to even more people across the world 🦄🍾https://t.co/ChilydWOEO

— Uniswap Labs 🦄 (@Uniswap) October 13, 2022

- The UNI blockchain is active on 5 different chains with 2 more incoming

Uniswap v3 is now live on 5 different chains with 2 more coming. It has better fees for LPs & deeper liquidity than all CEXs we researched. What made all these upgrades possible?

Join Office Hours today to find out more about the history of Uniswap v3!https://t.co/j6CxCrAK2G

— Uniswap Labs 🦄 (@Uniswap) October 7, 2022

Technical Analysis of Uniswap(UNI)

- For a long time, the Uniswap price has been trading within a symmetrical triangle and is nearing the apex of the consolidation.

- As a result, the UNI price is expected to rise slightly, reaching $7.75 and testing the pattern’s upper resistance.

- Furthermore, a minor pullback could drag the price back below $6.4, causing a catapult action to propel the price high, breaking the pattern and reaching above $8.7.

- Meanwhile, if the bulls fail to lift the price, it may fall to the lower support level of $5.7, sparking a rebound towards the upper target.

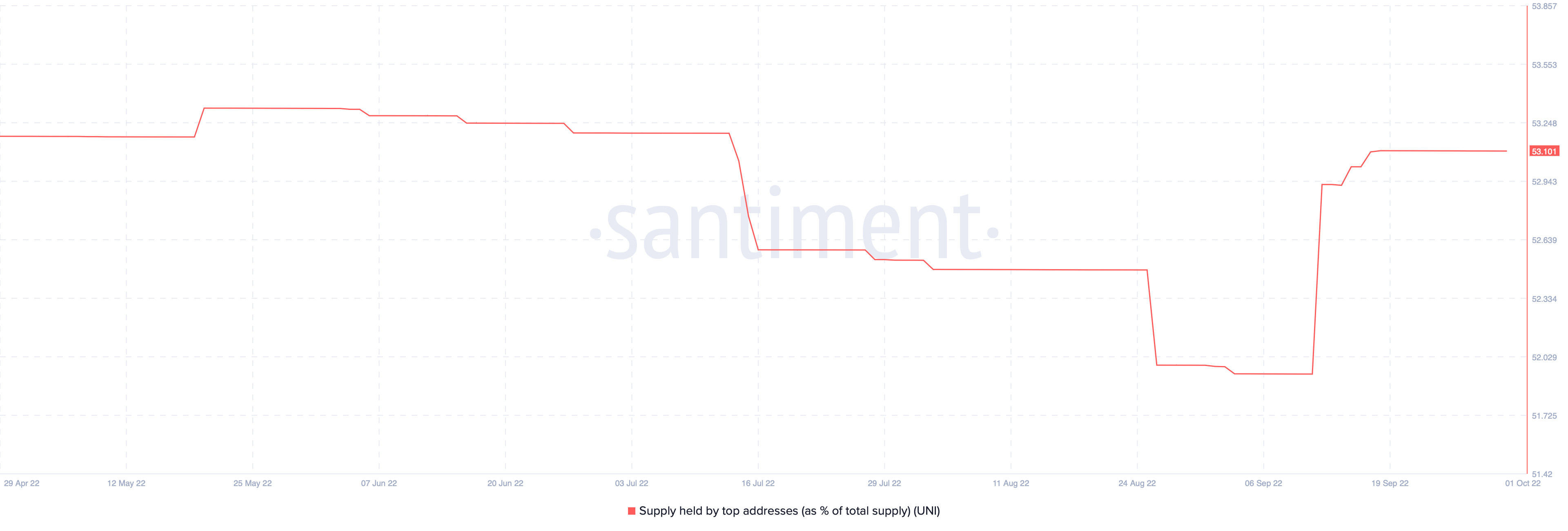

Spike in UNI’s supply held by the top sddresses

The supply in the top addresses usually signifies the state of the market participants, specifically the whales within the ongoing market trend. A rise in the holdings usually fuels the token’s price, while a drop may create certain FUD within the space. Therefore, the top addresses holdings are closely monitored, as a specific change in the holdings may indicate the upcoming trend of the particular crypto asset.

The percentage of the supply held in top addresses had slashed hard in July and further reached its lows during the month of September. However, the supply held by top addresses rose significantly in the past month and has now risen above 50% at the moment. Therefore indicating the possible shift in the market sentiments in the coming days.

Read more: Uniswap Price Prediction

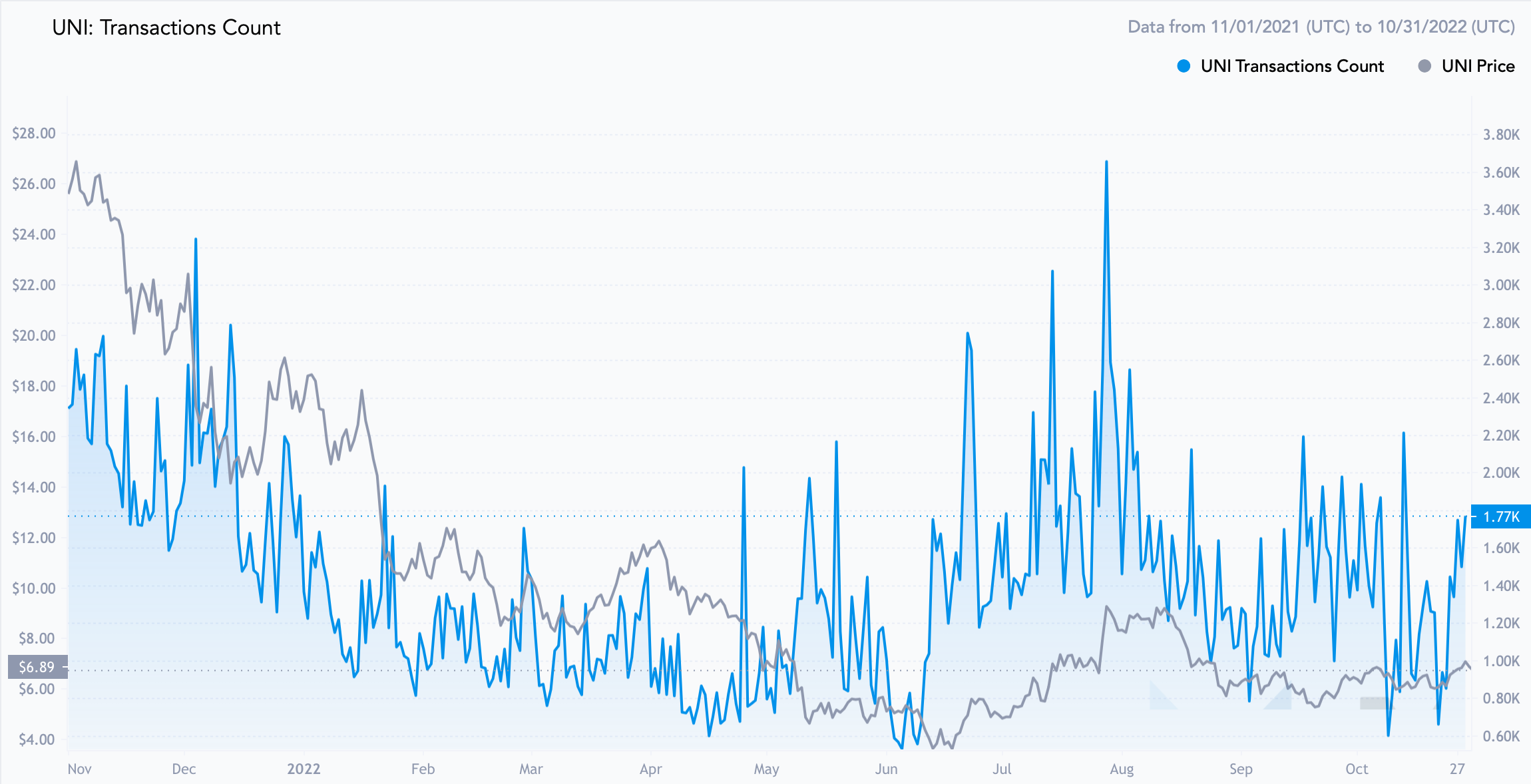

Transactions count is however trading flat to downward

Since the start of the yearly trade, Uniswap has maintained a healthy transaction count, indicating rising market participants’ interest in the asset. The transaction count influences both buying and selling volumes, and an increase in the number keeps the platform active. The increase in the number of transactions may have little effect on the price because the selling volume may have outperformed significantly.

However, since the beginning of the month, the transaction count per day has been restricted to below 2000, with lows of around 600. As a result of the decreased transaction count, which had previously reached highs above 3600, market participants’ attention has shifted to the price, which has remained largely bearish.

Read more: Uniswap Technical Analysis

Conclusion

The Uniswap price is attempting to pull a significant leg up in order to reach critical levels around $8. Meanwhile, the bears maintain their dominance and limit the rally. Despite the fact that the top addresses continue to accumulate, the transaction count is largely depleted. As a result, the retail traders appear to have kept their distance as the whales all play it well.

Prices as on 31 October, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more