Table of Contents

ToggleBitcoin price action all through the year of 2022 has been well below average. Let’s take an account of things that did happen. Bitcoin dominance fell from over 45% before the year to touch near 35% levels before recovering now to around 40%. Along with that, Bitcoin’s market capitalisation has eroded nearly 58% as of writing, from the beginning of the year and even touched lows of almost 62% at one point.

However, Bitcoin price, like most other assets has been observed to be cyclical in nature. In fact, data suggests that Bitcoin has been profitable in October 77% of the time while over the past nine years, Bitcoin has seen seven Septembers ending in losses, with an average return of -6%. This has held true so well that there are infamous terms like ‘Rektember’ and ‘Uptober’ which happen to be quite popular in the crypto community.

But with the beginning of October 2022, Bitcoin price so far has been lacklustre. It has given no signs of any strong recovery that is going to take place apart from the fact that it is performing slightly better than its closest competitor, Ethereum. But things could very quickly turn. Popular Twitter personality in the crypto space and the creator of the stock-to-flow model for Bitcoin – the pseudonymous PlanB has tweeted on 3 October that he is buying up Bitcoin at the $20,000 level.

S2F model suggests positivity

My first bitcoin investment was in 2015 at ~$400 (yellow circle). Most people said bitcoin was dead.

My 2nd investment was in 2018 at ~$4000 when I published the S2F model. Most people said bitcoin was dead.

My 3rd investment is now at ~$20,000. Most people say bitcoin is dead. pic.twitter.com/oUWppoJgxo

— PlanB (@100trillionUSD) October 2, 2022

His stock-to-flow model for Bitcoin is basically a long term indicator that depicts when the asset is heavily oversold and when it is heavily overbought or it is at par with its value. Currently, according to his chart, Bitcoin is well below both the original 2019 S2F model and the refitted S2F model with 2019-2022 data priced in. This presents a very optimistic picture for the king coin’s future as PlanB’s model has been pretty much on-point most of the times, as is evident from his chart.

Bitcoin SOPR hints towards positivity

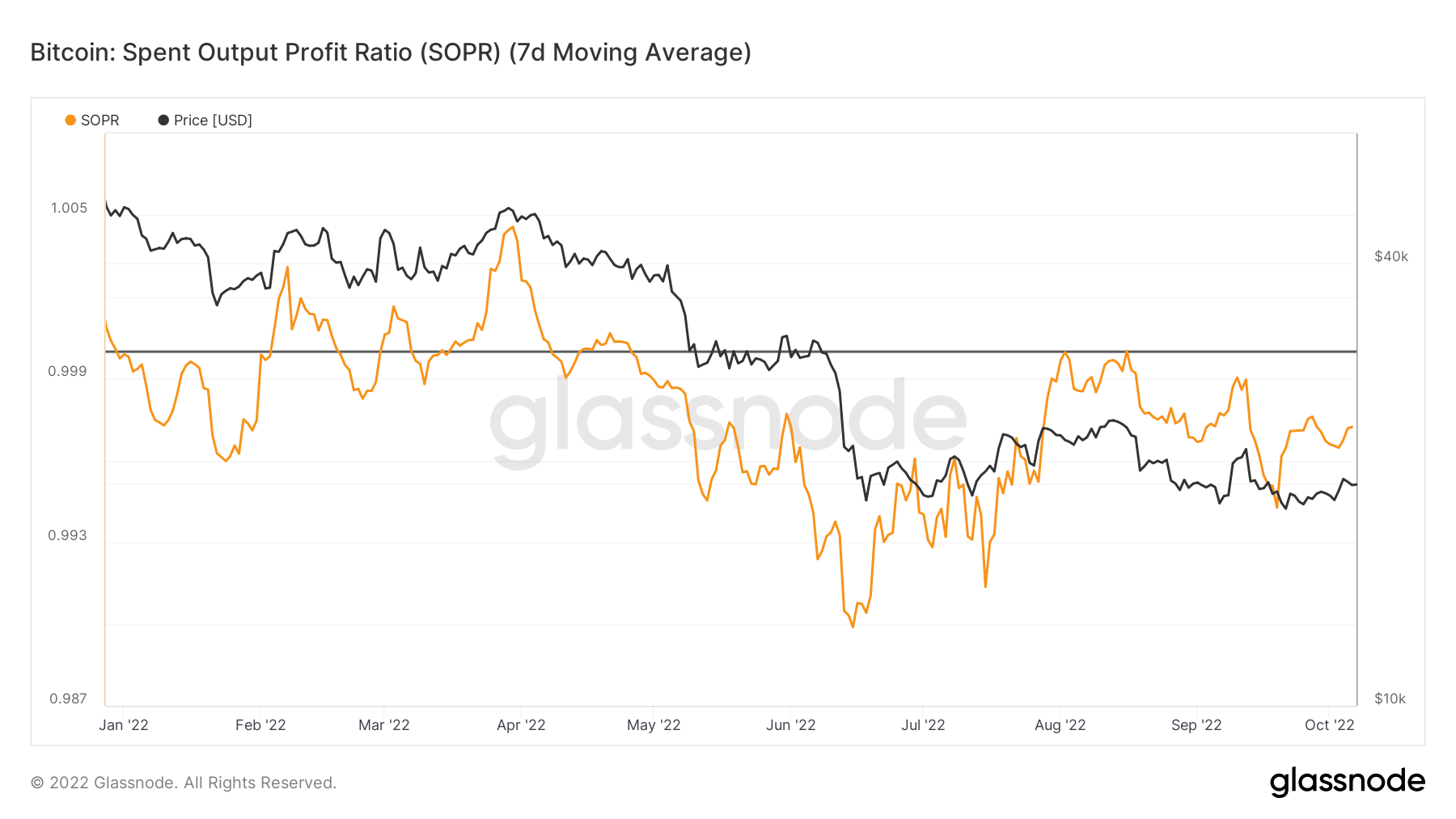

Another factor to consider here is Bitcoin’s SOPR, or spent output profit ratio has been in the negative territory for quite some time now. Below attached is a chart that depicts the 7 day moving average of Bitcoin SOPR, take a look.

SOPR, created by a person named Renato Shirakashi, is a very simple indicator that is calculated by dividing the relaised value (in USD) by the value at creation (in USD) of the output. Or simply put – price sold/price paid. Hence whenever SOPR is greater than 1, it means that the owners of the spent outputs are in profit at the time of the transaction and on the flip side if SOPR < 1, then it means that the the spent outputs are in loss at that time.

Keeping that understanding in mind, from the chart above we can clearly see that Bitcoin SOPR has been below 1 for quite some time now, almost since the beginning of May. This indicates that a lot of people have been selling at a loss while data indicates that Bitcoin long term ‘HODLer’ supply has reached a new all time high, according to a research report by Ark Invest.

What that means is that the weaker hands have been pushed out of the market, who couldn’t take the volatility and decided to exit the market at a loss. Historically it has been observed that it is at this point that HODLers generally tend to buy into the dip and push prices upwards. SOPR cannot stay below 1 in the oversold territory for too long a while and a recovery is typically commonplace.

Conclusion

Hence it seems Bitcoin could possibly be able to stay true to its promise of an ‘Uptober’ after a devastating ‘Rektember’ that went by. However, it is extremely important for investors and traders in the crypto market to do their own research before investing as crypto assets are highly volatile and only invest what you can afford to lose. These data points only indicate what might have with a certain degree of confidence.

Additional Read: Bitcoin Price Prediction 2023

Prices as of 7th October 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more